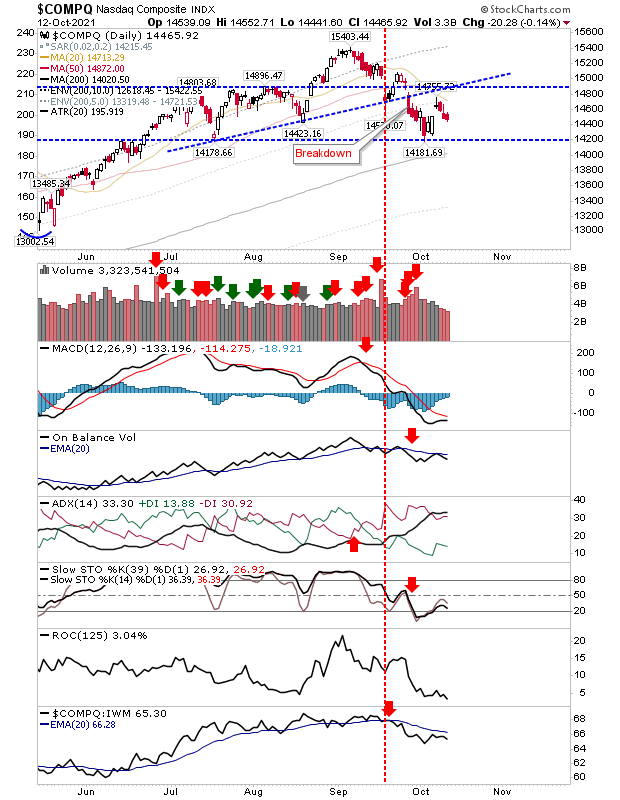

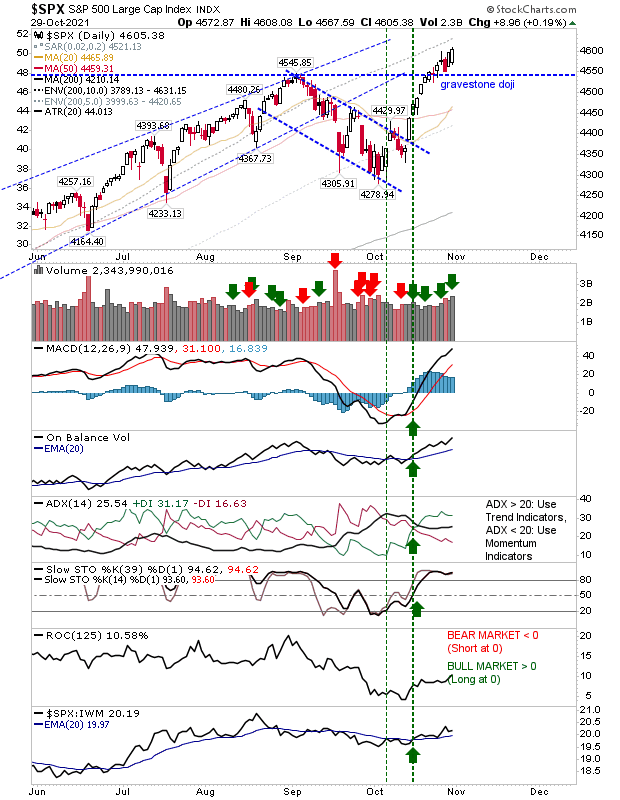

S&P 'Gravestone doji' negated - index rallies continue

Friday maintained the good form of indices, the S&P did particularly well as it finally cleared the spike high and managed to register an accumulation day by the close of business. Technicals are net positive and the index is accelerating in its relative performance advantage to peer indices.