Second Day of Quiet Action

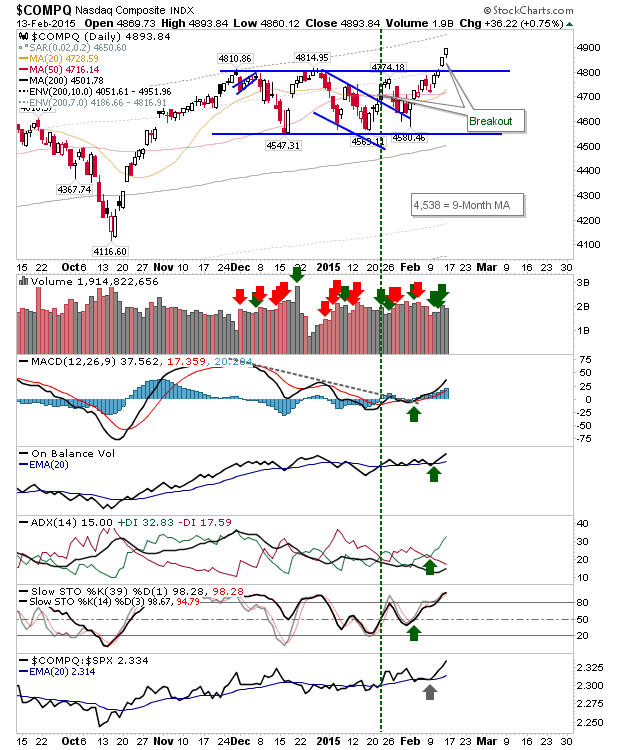

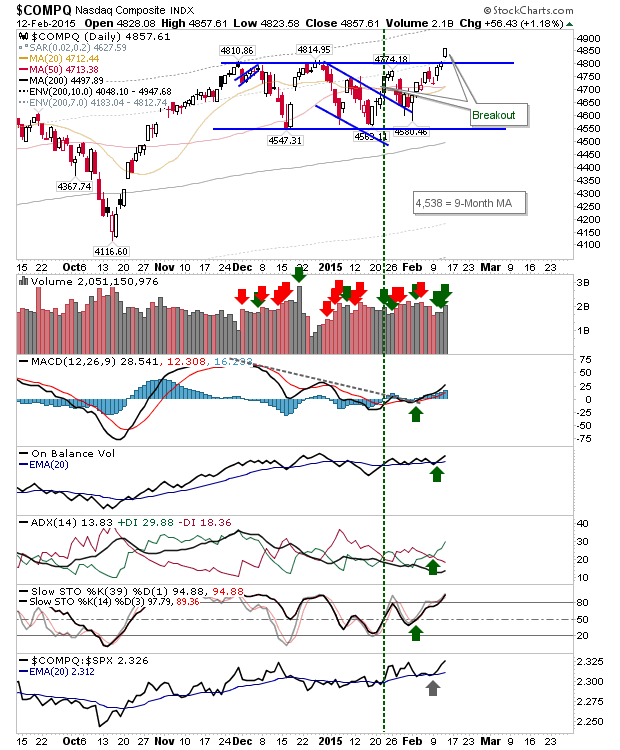

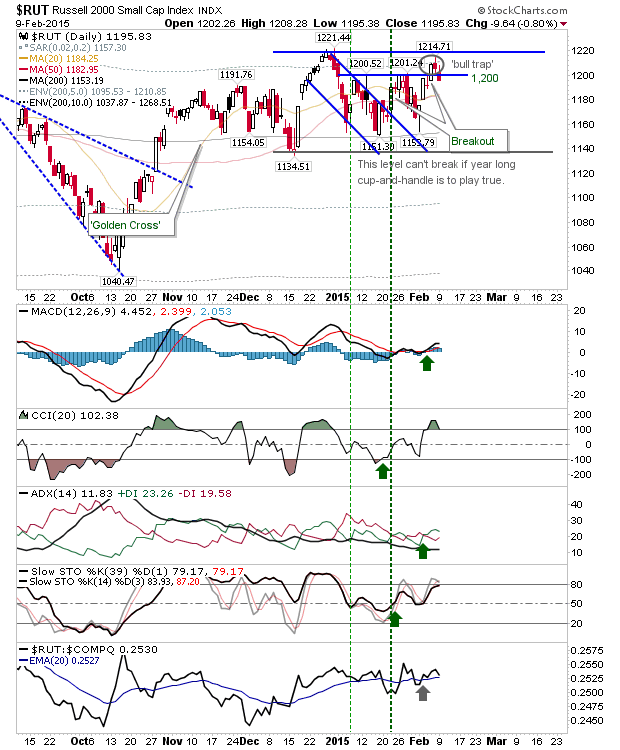

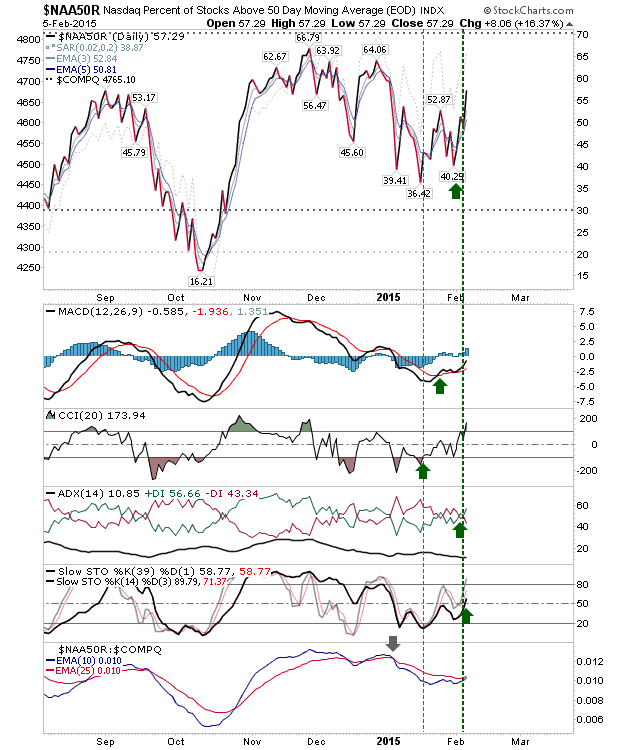

The S&P lost a little, the Nasdaq gained a little, but there was no change in the larger picture. The S&P registered a distribution day, of sorts: volume climbed, but as the index finished with a doji it doesn't really qualify as a heavy sell off day. The selling volume was enough to generate a 'sell' trigger in On-Balance-Volume too, but the whipsaw risk is high.