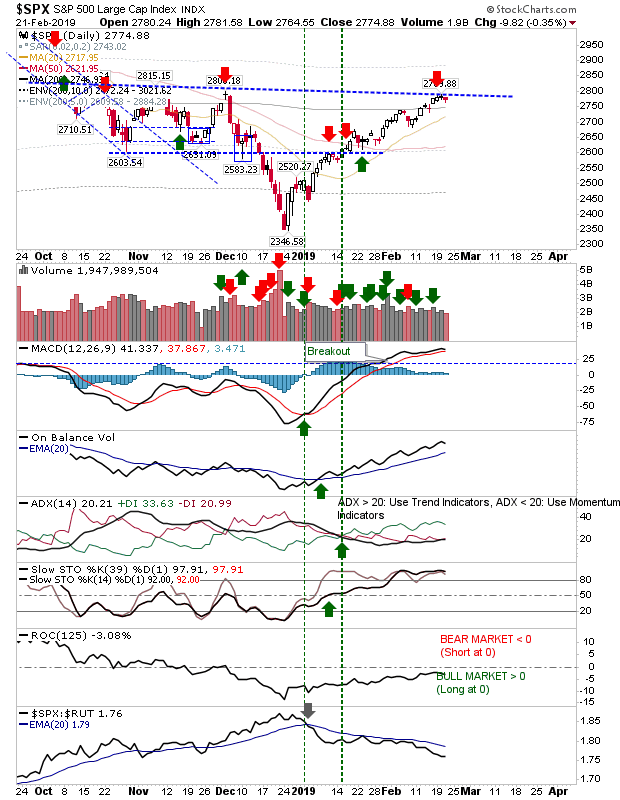

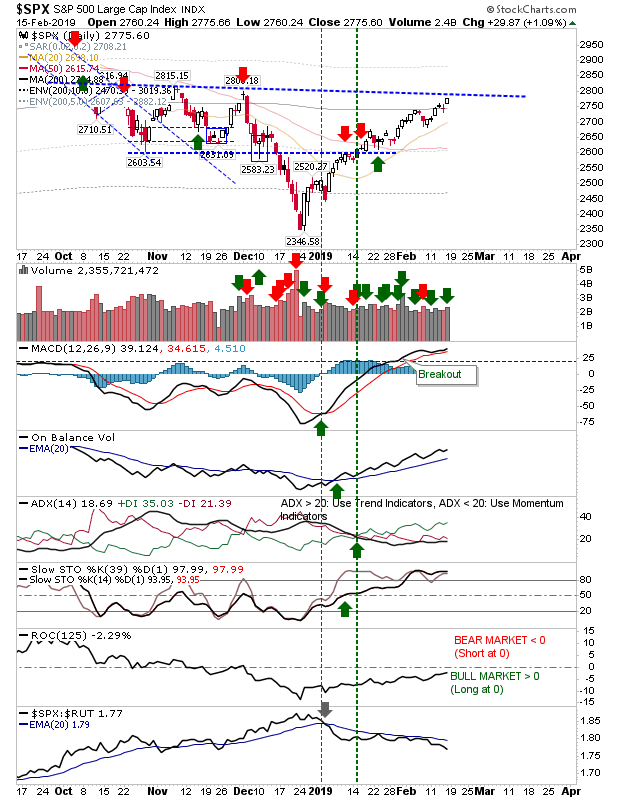

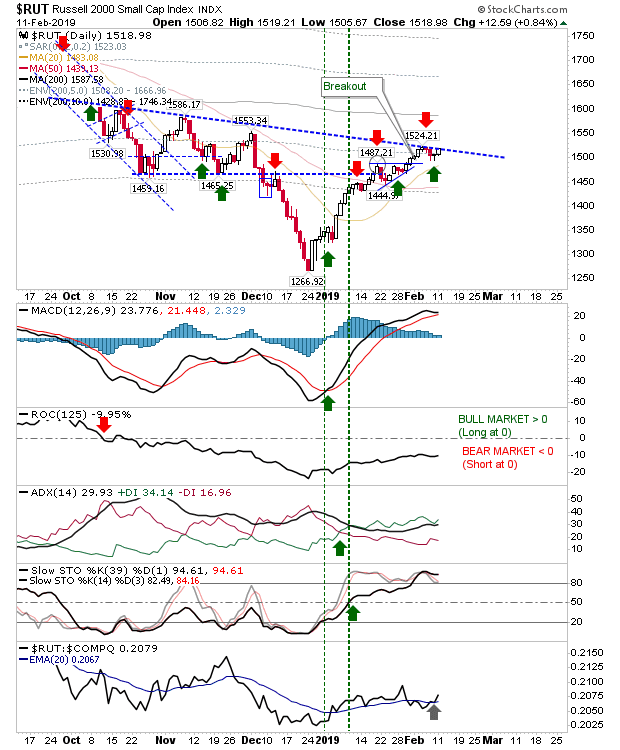

Volume selling picks up as prices hold

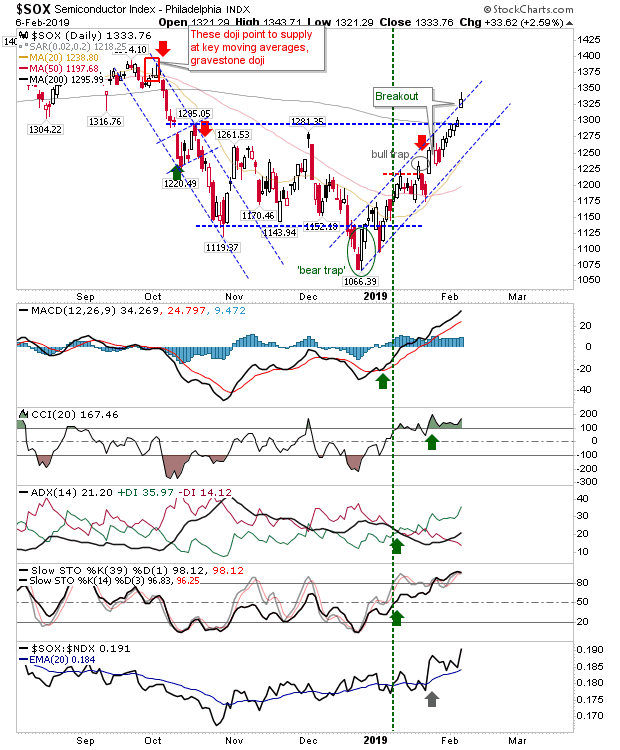

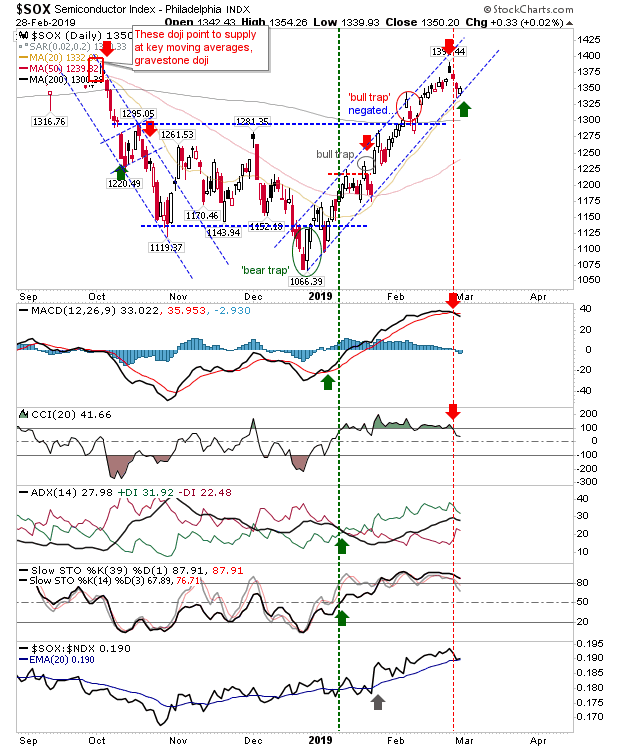

While sellers ticked up their activity there were enough buyers to keep prices stabilized, although supporting indicators have started to slowly rollover. The one exception was the Semiconductor Index as it started the day at channel support and rallied higher. While the Semiconductor Index rallied off channel support it was left with a 'sell' trigger in the MACD and CCI. Price action is dominant so I have marked a 'buy' trigger at support but use a loss of the channel line as support.