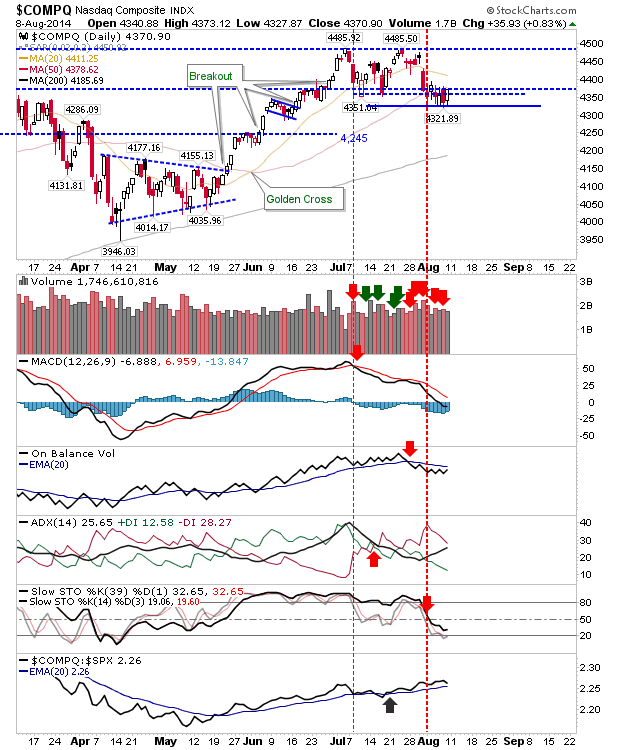

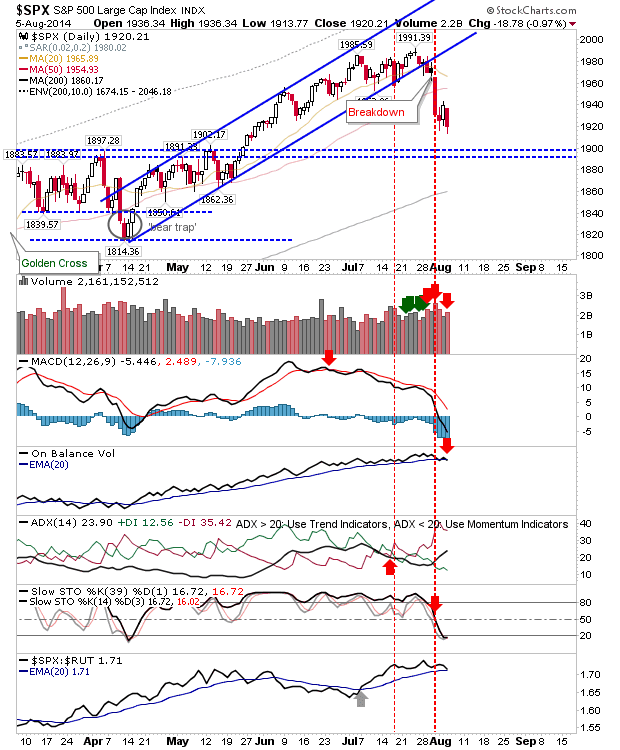

Yesterday was a bit of reverse from my expectations. Had I seen a gap down with a 2-hour sell off, followed by a steady recovery to the (same) closing price, then I would have been much happier. As it stands, there is a risk the selling could drift into today and keep buyers away until markets get closer to last Thursday's lows. Having said that, it does look like Thursday's lows will mark a strong support level. The profit taking which took markets down did knock breadth metrics down near, but not quite at, oversold levels. The Nasdaq 100 perhaps offers the most natural support as marked by the rising channel. The 20-day MA is providing some supply, and if the index was to reverse and undercut the channel then this 20-day MA will become a shorting zone. The nearby presence of the 50-day MA complicates this a little as it has held as support (in conjunction with channel support).