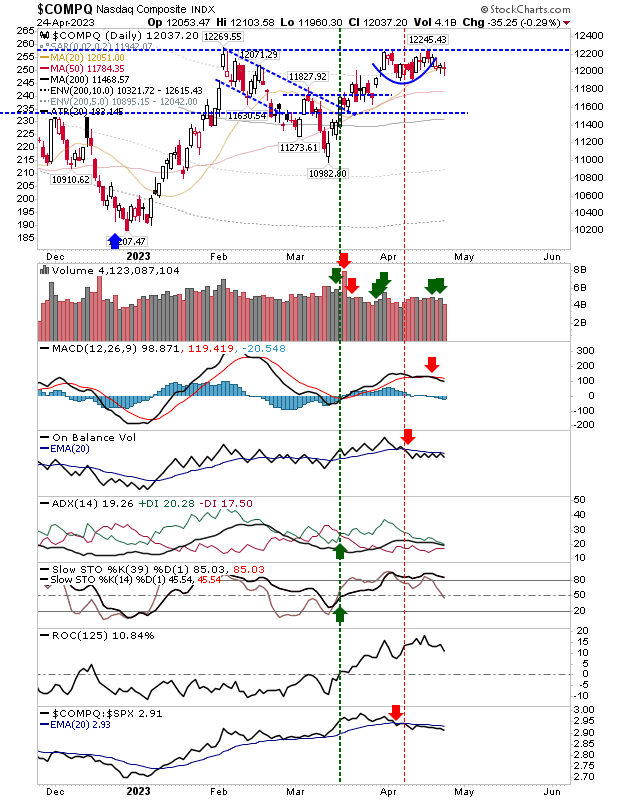

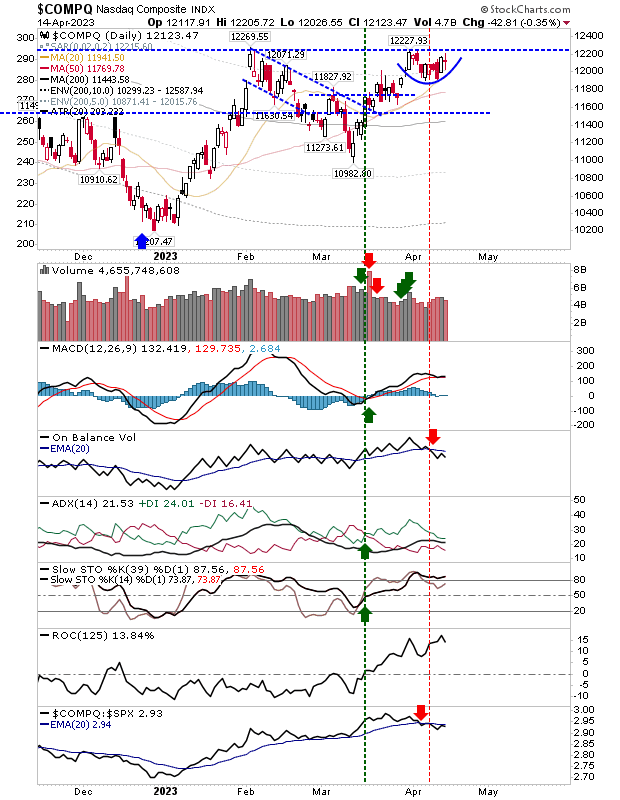

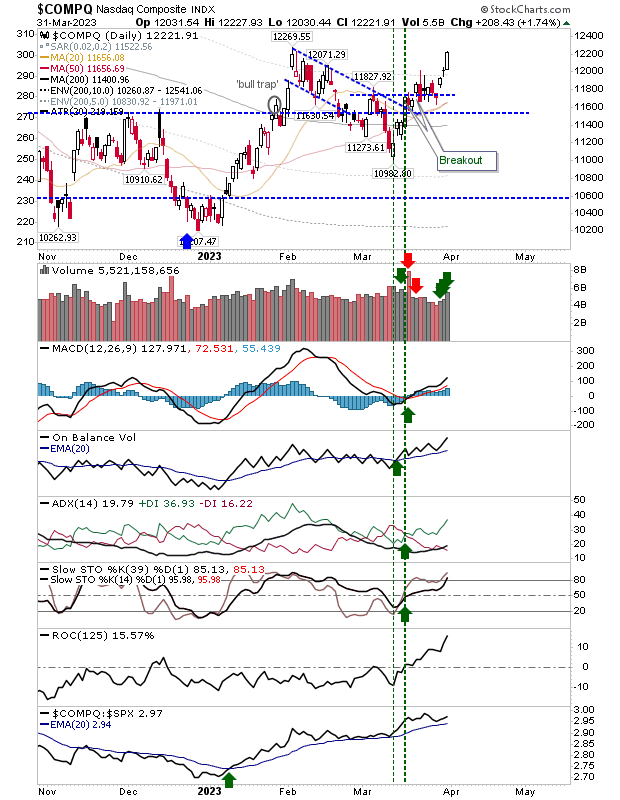

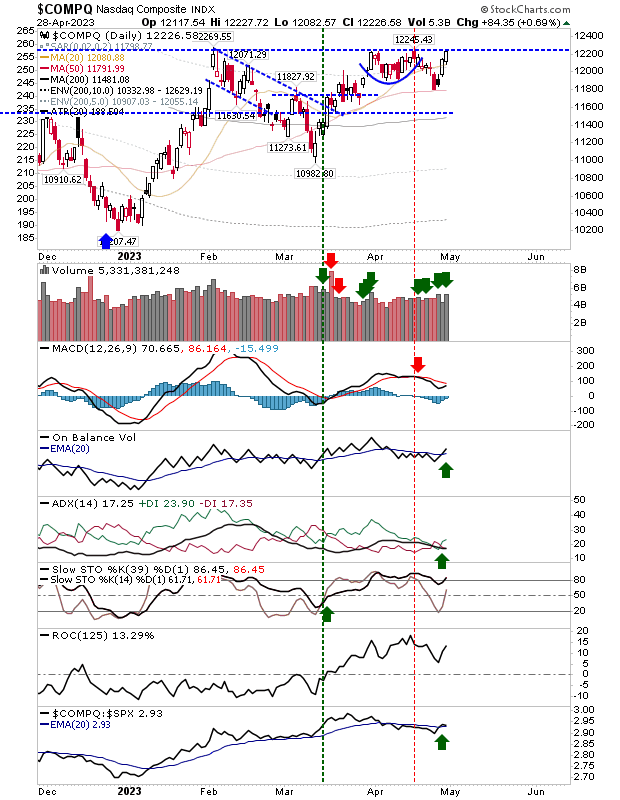

Nasdaq and S&P launch another attack at resistance as Russell 2000 struggles.

Bears were unable to press their advantage when the first challenge of resistance failed. Instead, buyers mounted a fresh charge with the Nasdaq and S&P recording accumulation days. For the last couple of months, when buyers have had control of the Nasdaq, they have done so on bullish accumulation, but when bears had the edge they haven't been able to control the story. The Nasdaq returned a fresh 'buy' signal in On-Balance-Volume and ADX, and a return in bullish relative performance over the S&P. With the index back at 12,225, we have yet another knock on the door of a breakout. Remember, triple tops are rare, and for bears to have the edge they will need a small miracle to drive this lower. I would be looking for a breakout at minimum, bears may yet win out with a 'bull trap', but we cross that bridge when we come to it.