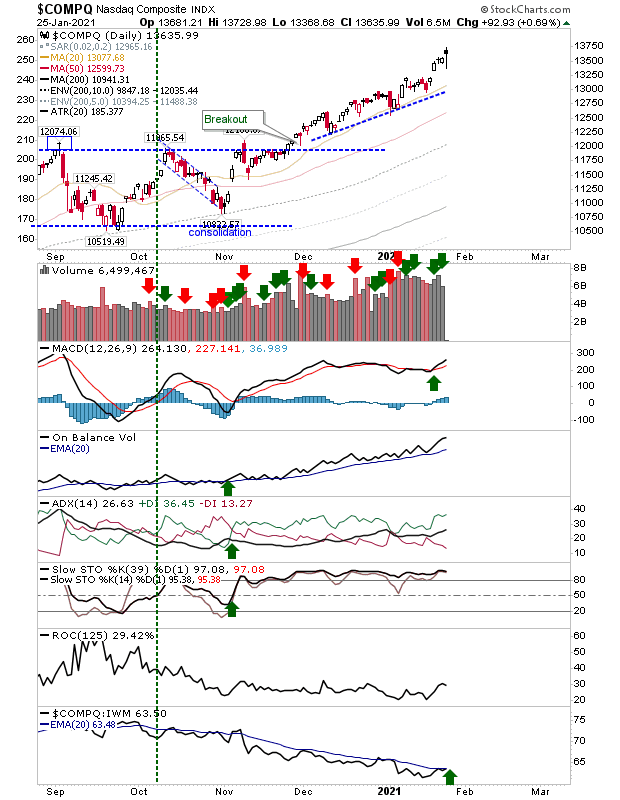

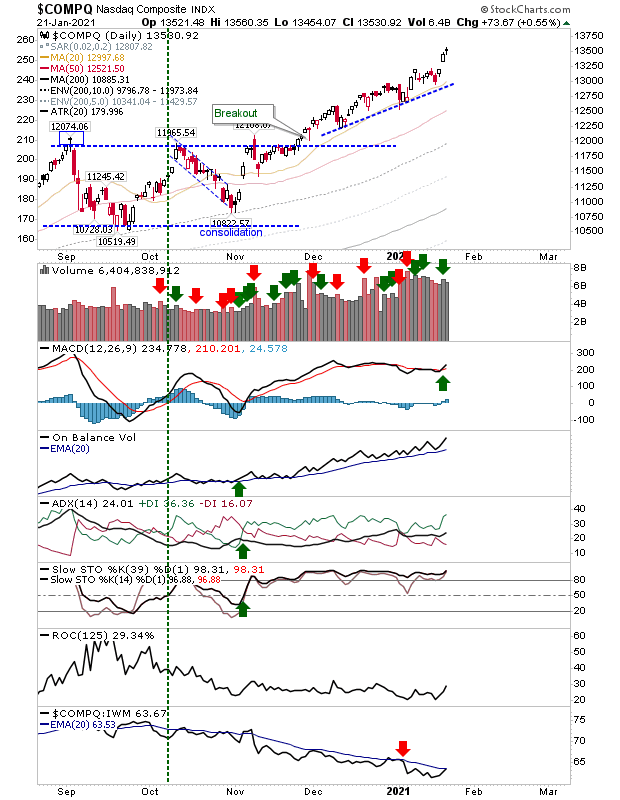

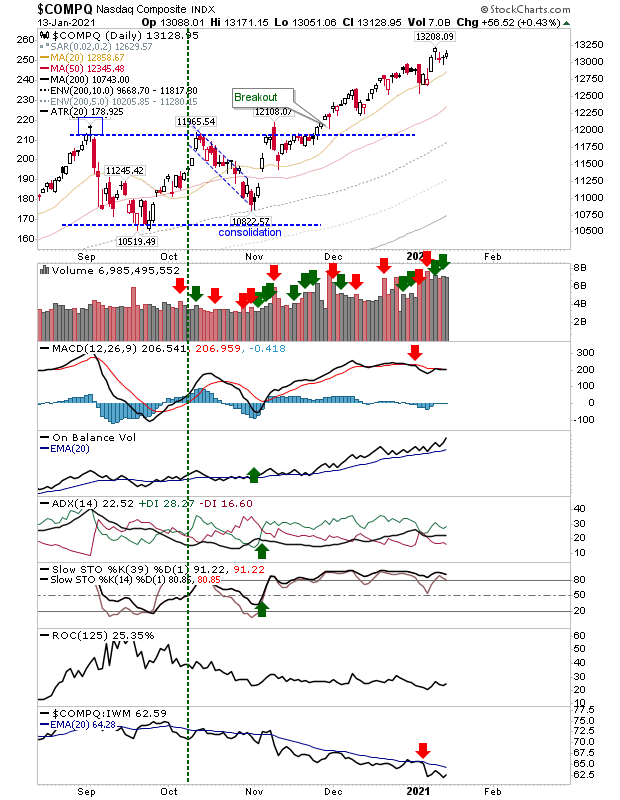

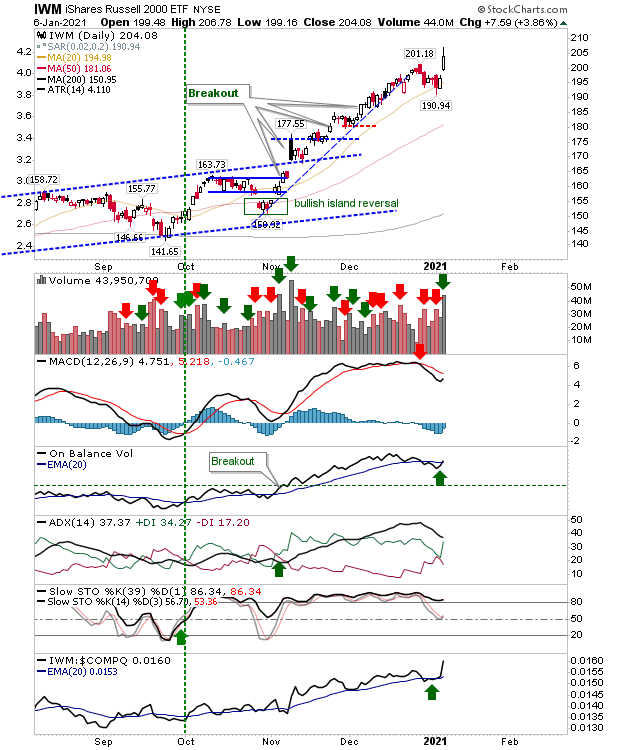

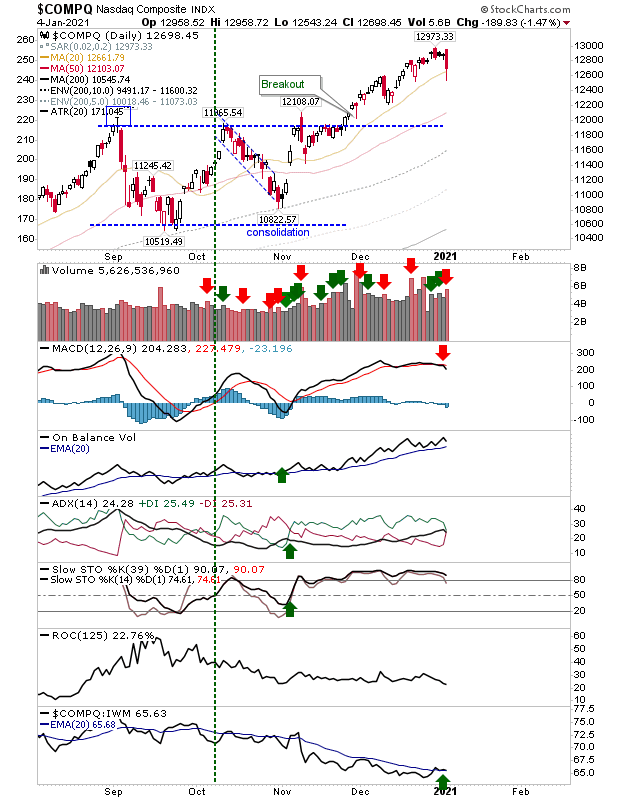

S&P breaks rising support, Nasdaq sits on support

I doubt anyone wants to read about anything else but Gamestop stock, but the broader market marches on. The S&P is trading at its 50-day MA after undercutting rising support on Friday. There was a break of the mid-line in Stochastics, but technicals are not fully bearish with On-Balance-Volume still to flag a 'sell' trigger. On a positive note, the S&P is making up ground against the Russell 2000.