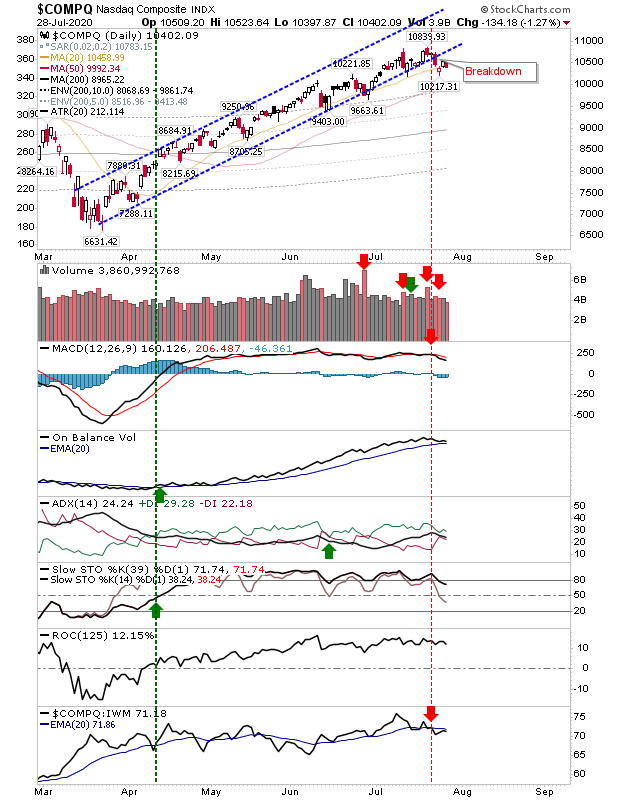

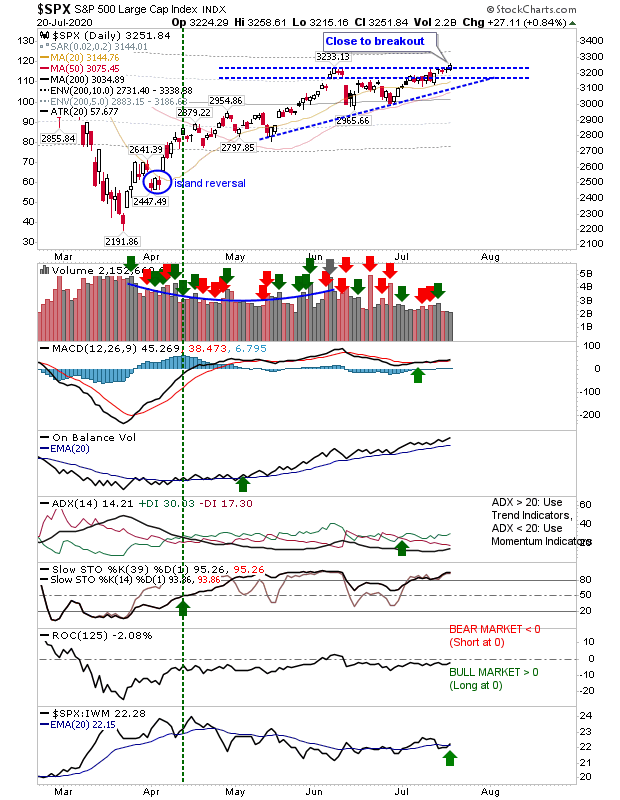

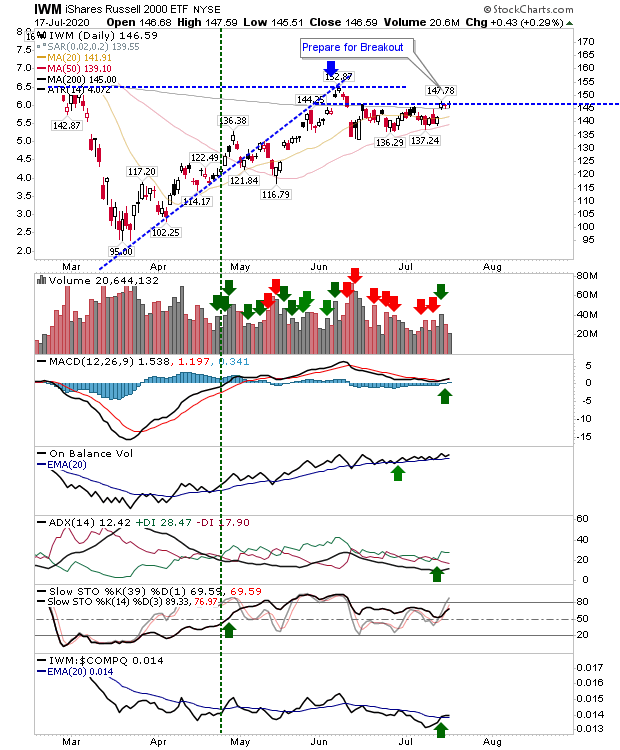

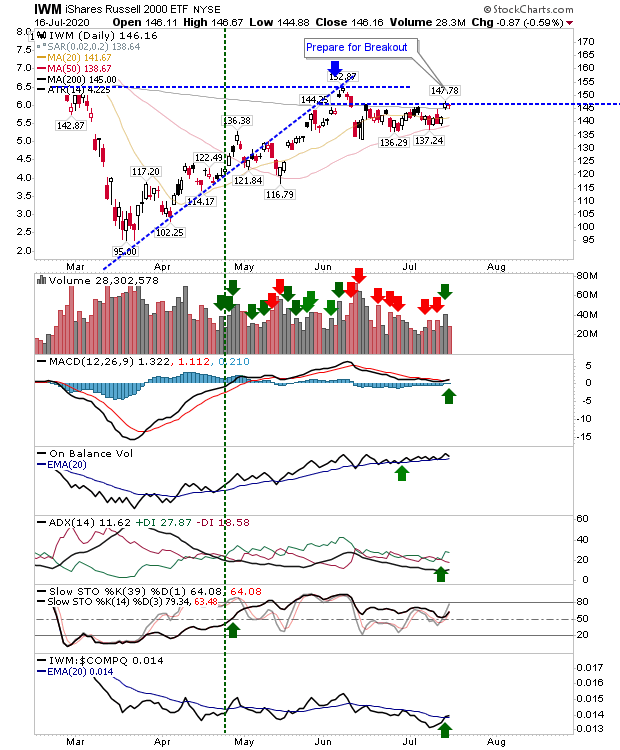

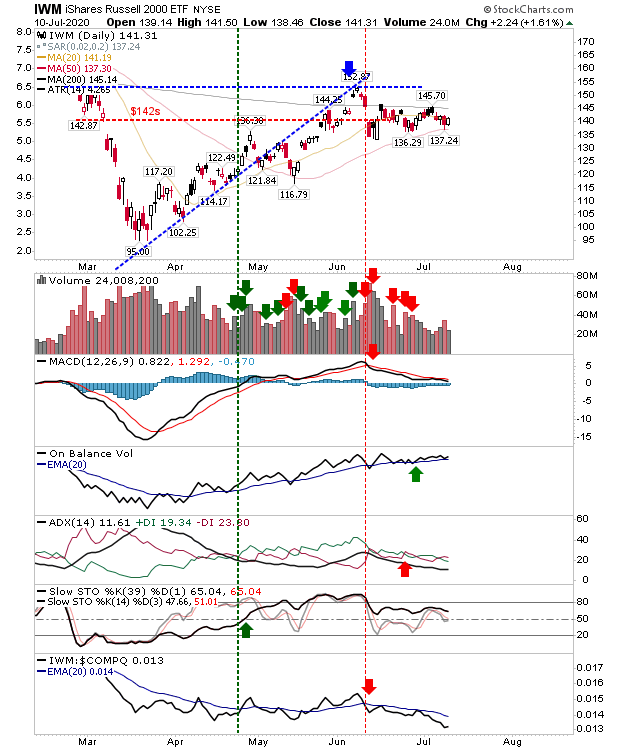

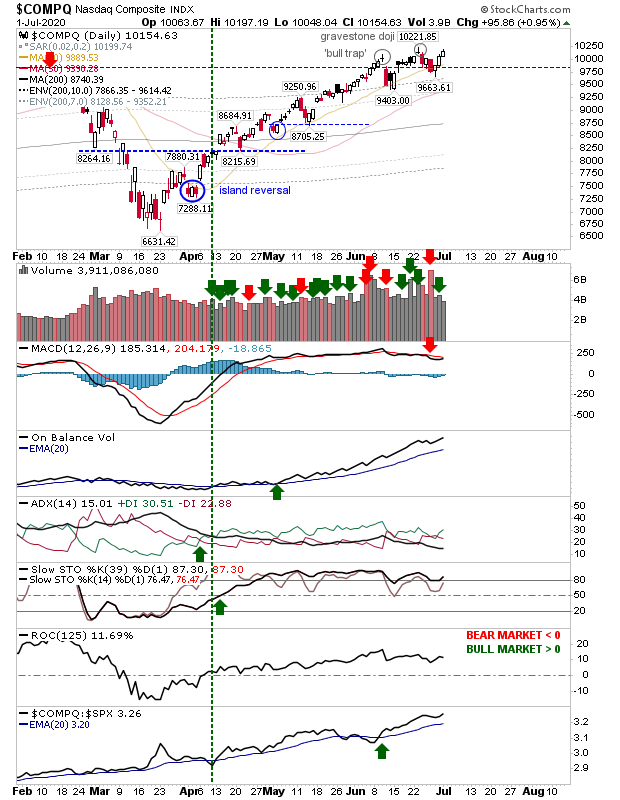

There has been a slowing of the rising trend in the Nasdaq, to the point it has dropped outside of its four month rising channel. This should not be viewed as outright bearish, but simply a slowing of the advance - and probably a sideways shift in a trend consolidation. The edge breakout in the S&P has drifted back to support and will find itself under threat should such losses continue in the Nasdaq. Selling volume has been light and the strong accumulation trend in On-Balance-Volume has not been adversely impacted by this selling. The index - as with the Nasdaq - is underperforming relative to the Russell 2000, which may help it in the long term when money again cycles back to defensive stocks. The Russell 2000 has been trying to clear its base (within a base) but has so far struggled. Trading volume has fallen off a cliff compared to the volumes from March so if a breakout is to stick we will need to see much stronger buying volume. On a positive front, On-Balance-Vol...