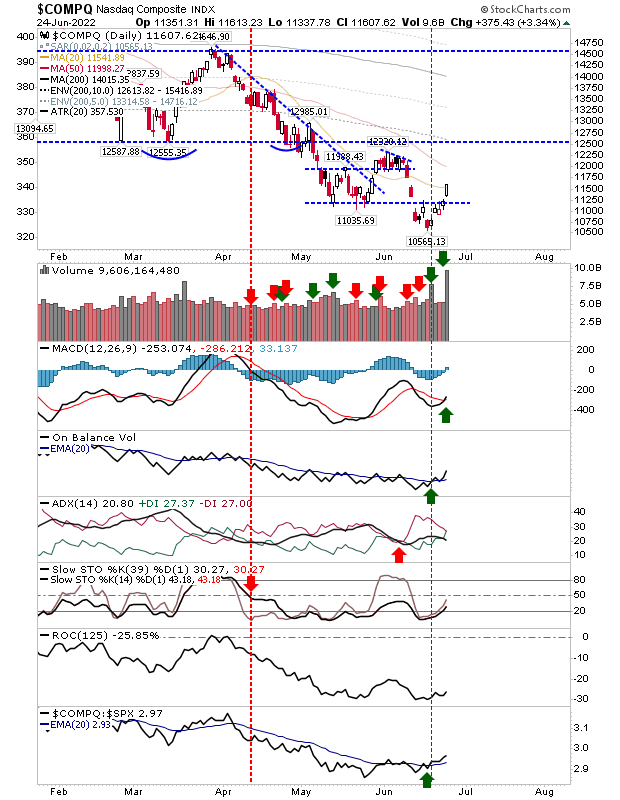

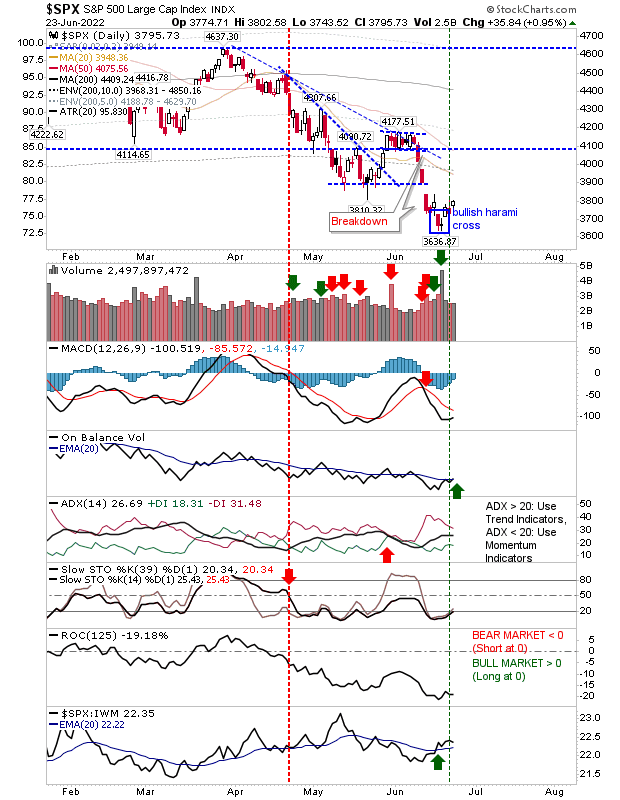

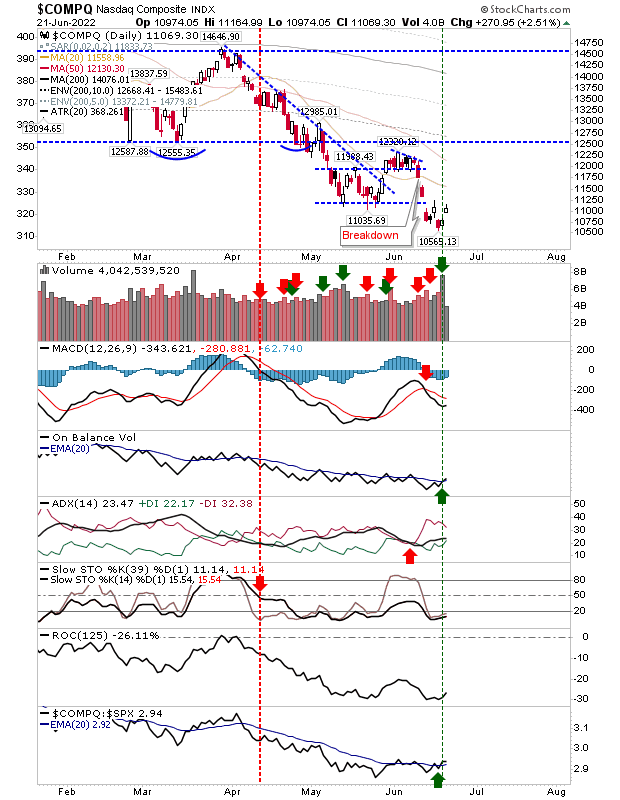

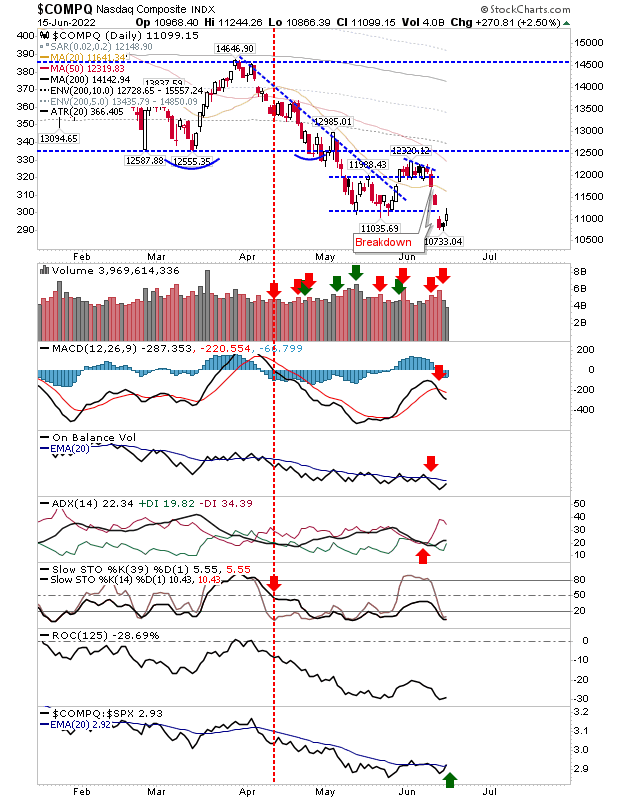

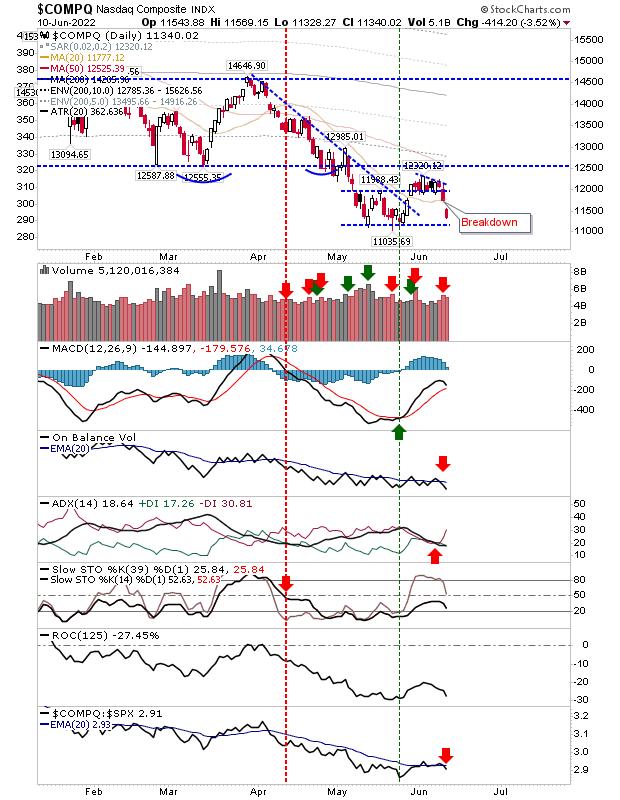

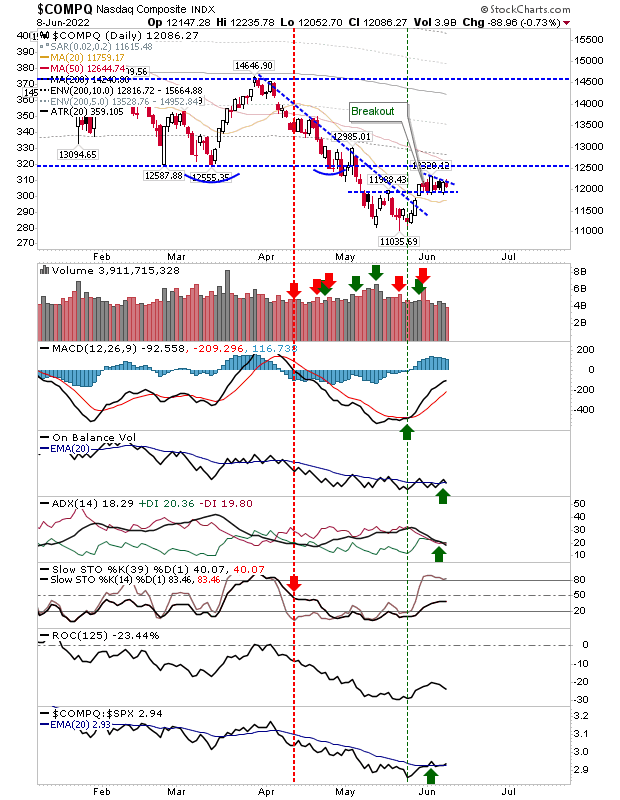

Time for the June low retest in the Indices

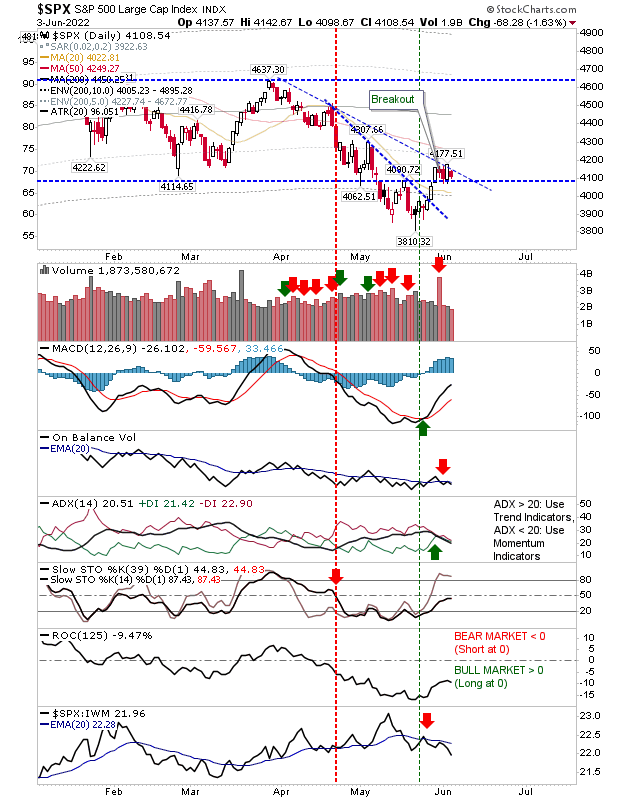

Today's selling has started the retest of the June lows for the Nasdaq and Russell 2000 as the S&P gets rebuffed by its May low. One point of concern is that none of the indices were able to mark a new swing high. Nascent bullish technicals are also looking vulnerable to reversal. The index to watch is the Russell 2000. If there is to be a recovery then the Russell 2000 has to do the leg work. Key here is that the index retains its relative outperformance to the Nasdaq and S&P - even if it suffers selling, as is likely from here.