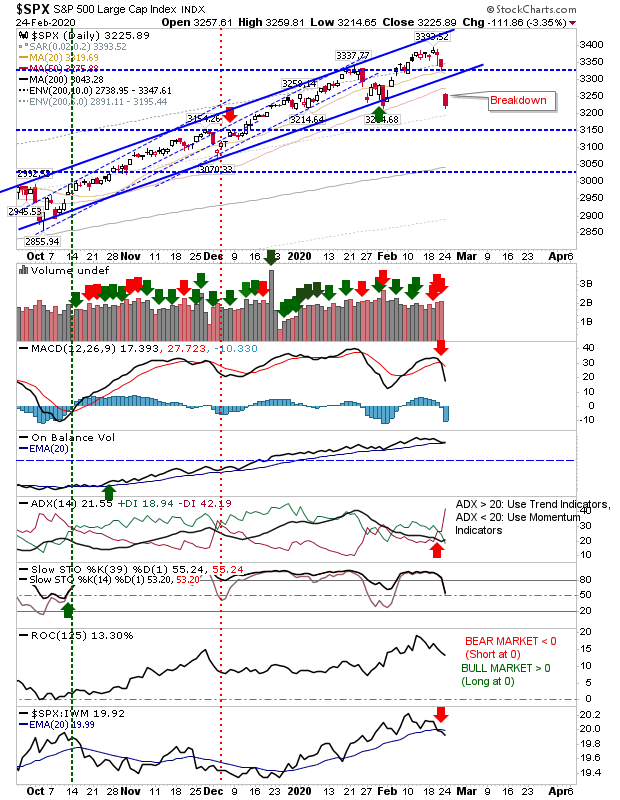

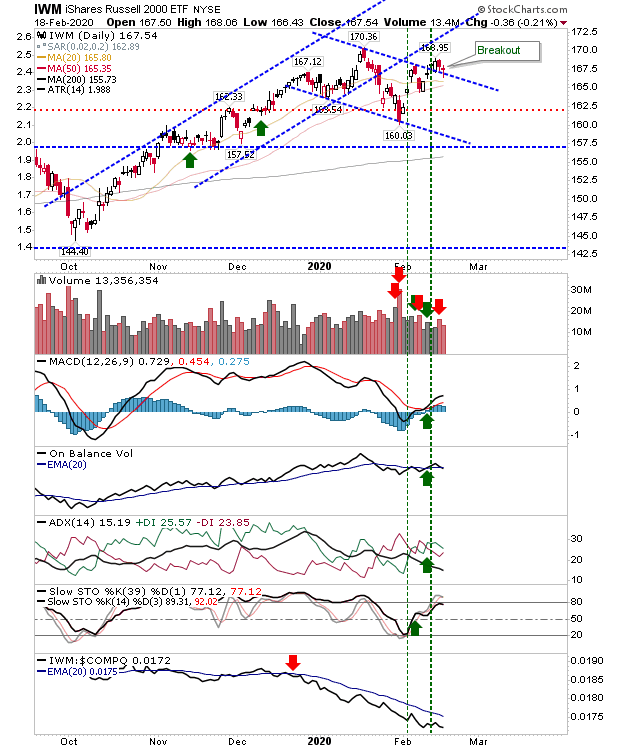

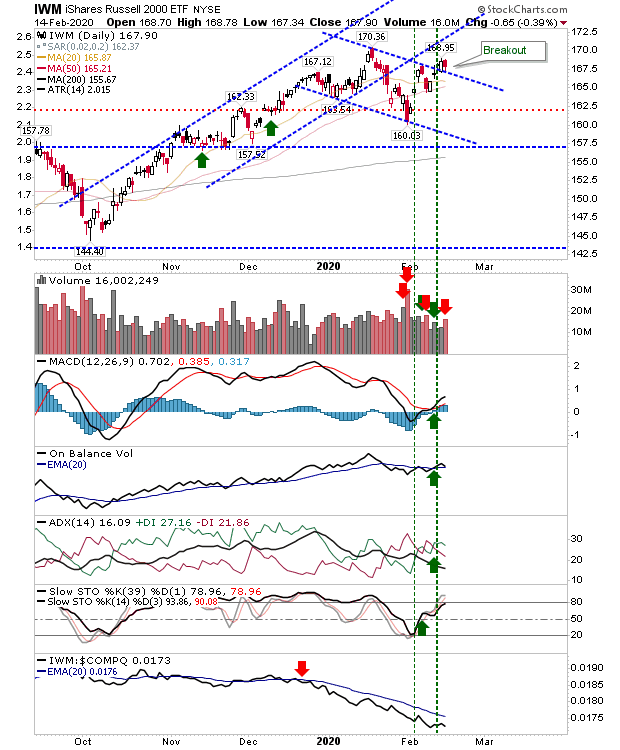

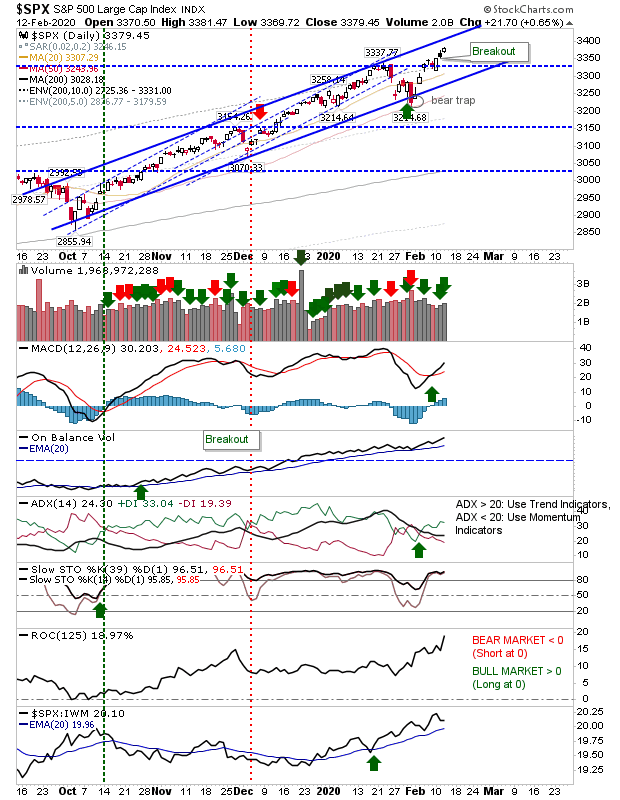

Between's Apple disappointing sale guidance, HSBC's 35,000 employee layoff plan, and lingering Coronavirus, it was looking like markets were heading towards a clear downward session - but this was not the case. Instead, there was a large degree of indecision as existing holders were reluctant to sell but few buyers were willing to step in to defend these elevated prices. On a pure technical view, markets look well positioned for further gains, the Russell 2000 in particular, but the Coronavirus hasn't yet revealed its full impact on economic supply chains or consumer confidence. The key trigger (for me) remains the Russell 2000. The channel breakout remains valid, even if the index hasn't yet blown past 52-week highs. Technicals are good, although On-Balance-Volume is on the verge of a 'sell' trigger. Relative market performance remains very poor and is a long way from a new 'buy' trigger.