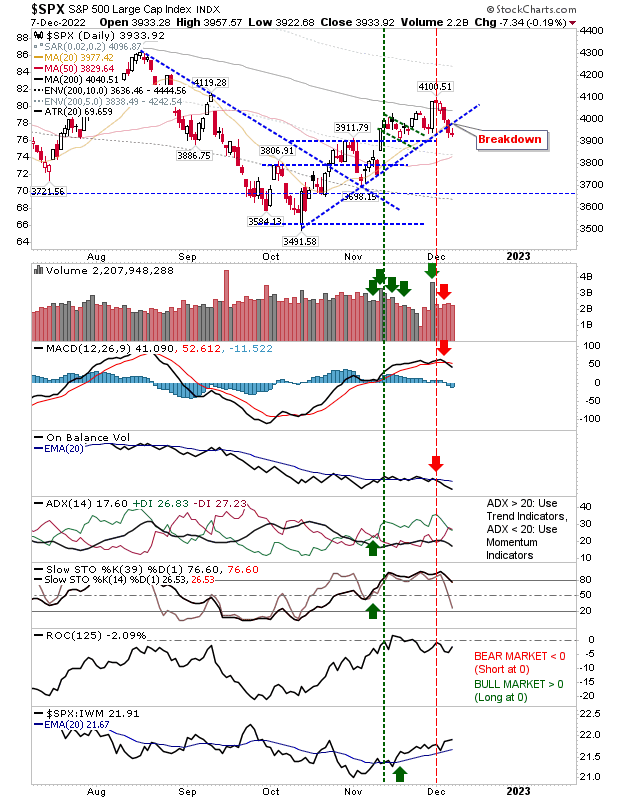

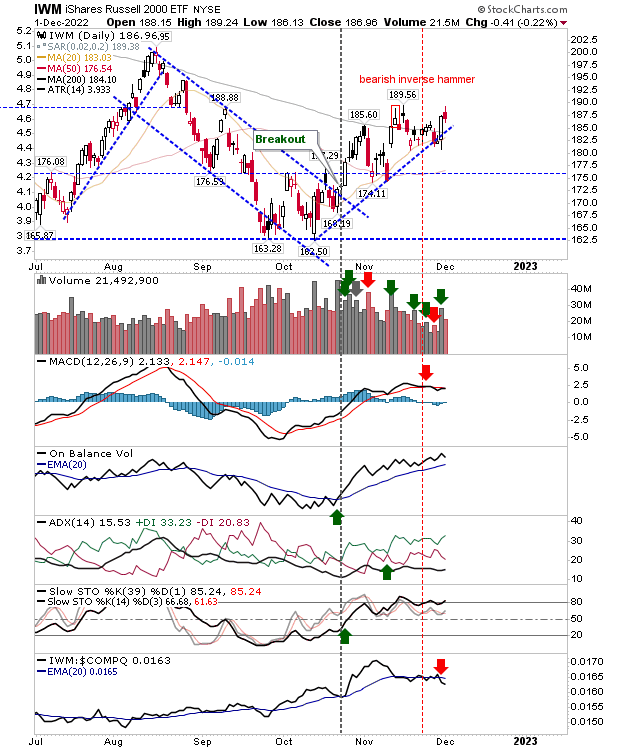

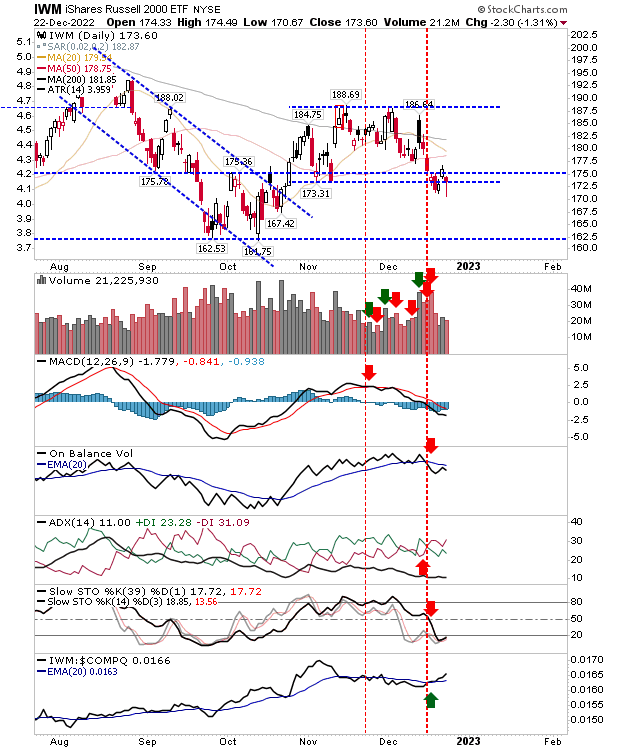

Bullish reversal candles in time for Santa

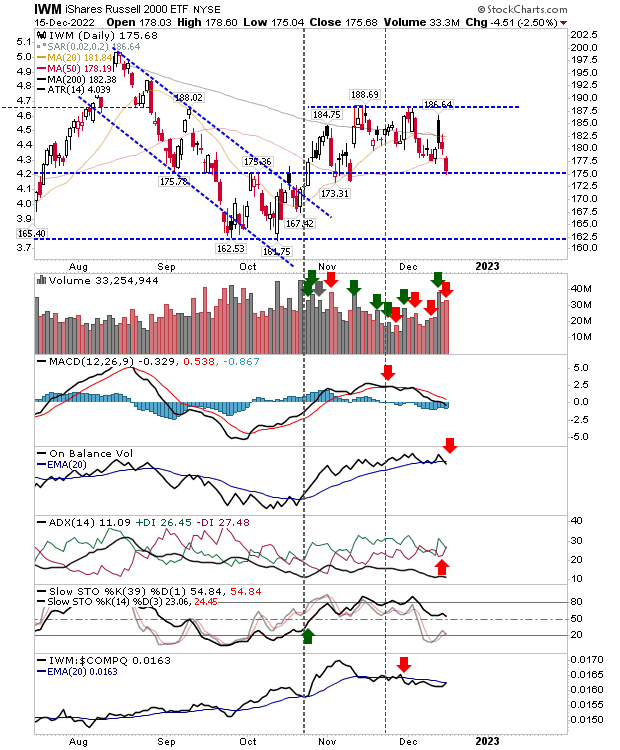

It has taken a while, but the 8-day decline has finally flashed reversal candlesticks across indices. Lead indices finished with 'bullish' hammers with spike lows marking increased demand. Indices are at or near support, strengthening the potential of the reversal. The Russell 2000 ($IWM) had the longest spike low on oversold technicals. The index has the additional benefit of outperforming the Nasdaq and gaining ground on the S&P. Traders can measure risk:reward using a stop at the loss of today's low with a target of November's highs.