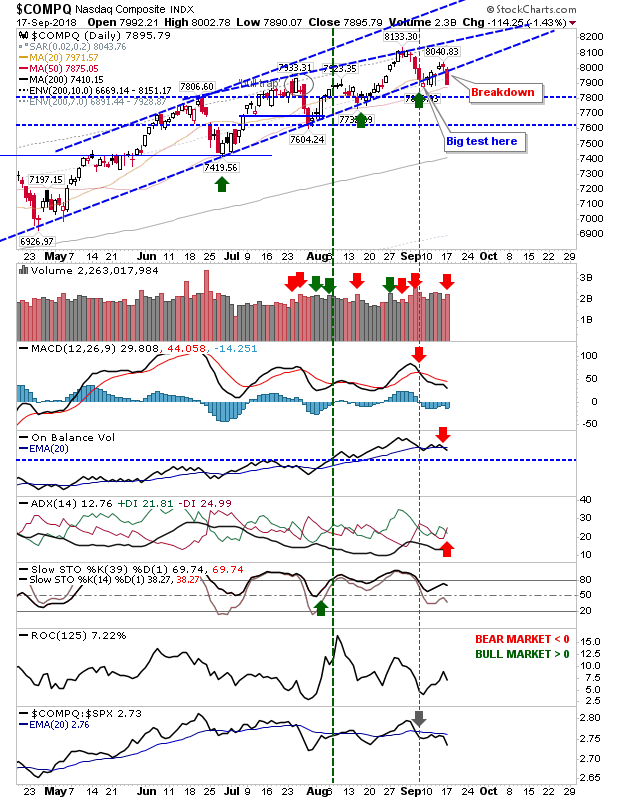

Nasdaq 100 ready to breakout? Other indices hanging on.

The Nasdaq 100 is the one index which looks ready to break higher as it pressures the August 'bull trap'. While Friday ranked as higher volume selling - technical distribution - the loss was small and the index continues to push against resistance. Technicals are mixed with a 'buy' trigger in the MACD offset a weak 'sell' in On-Balance-Volume. The main positive is the surge in relative performance against the Russell 2000.