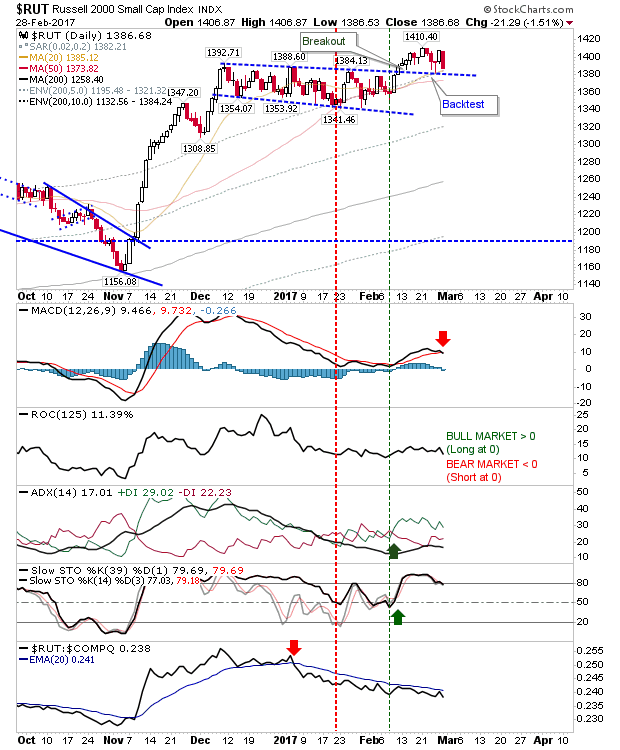

Profit Taking Hits Russell 2000

After successfully defending former resistance turned breakout support, the Russell 2000 experienced a relatively heavy reversal. It hasn't yet given up breakout support, but the index now finds itself back at the 20-day MA. It did so with a 'sell' trigger in the MACD and another relative loss in performance against the Nasdaq