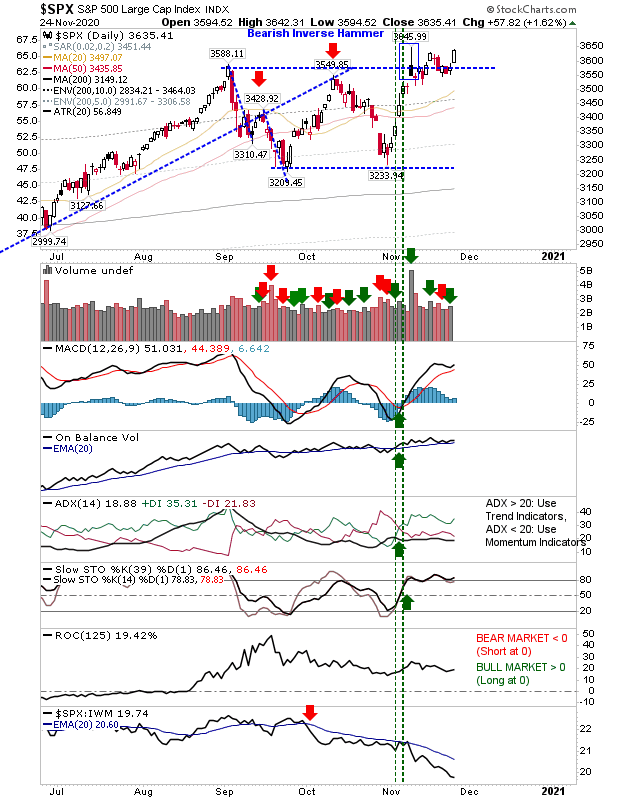

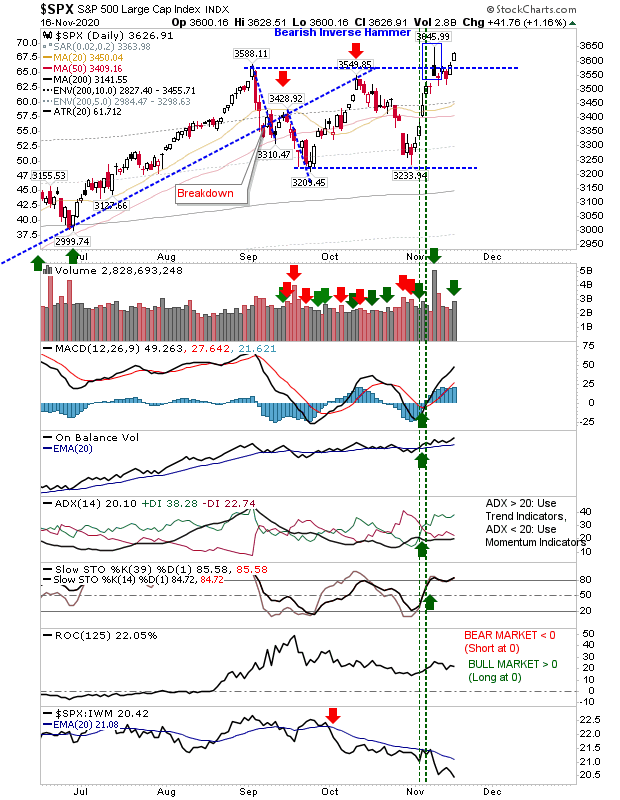

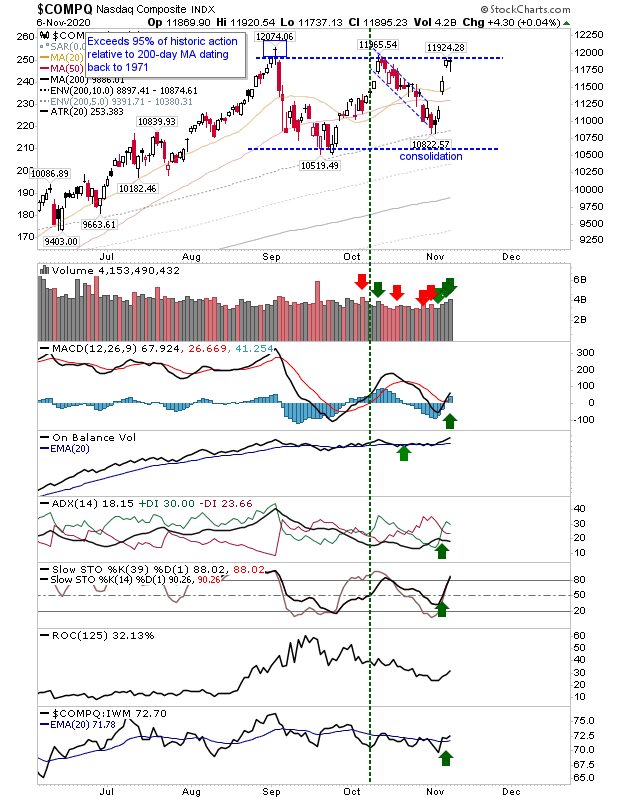

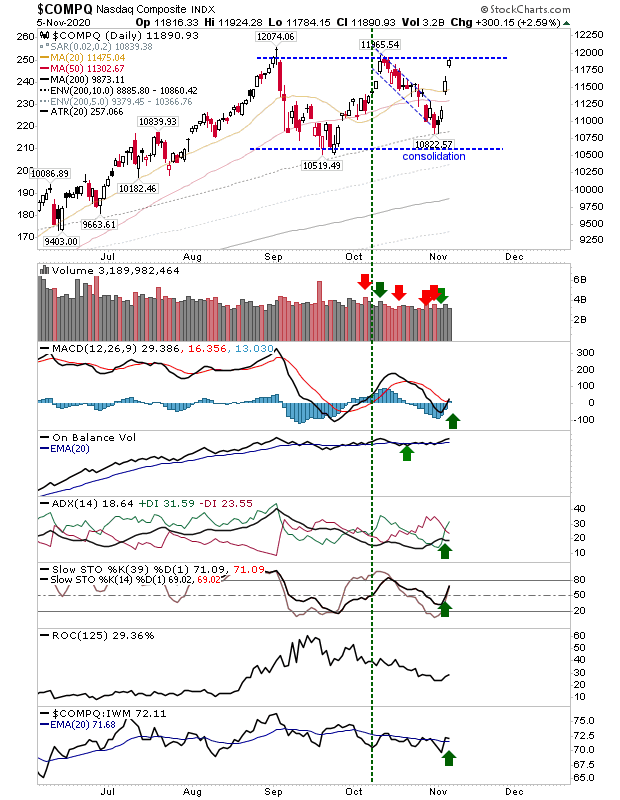

Russell 2000 sees some selling

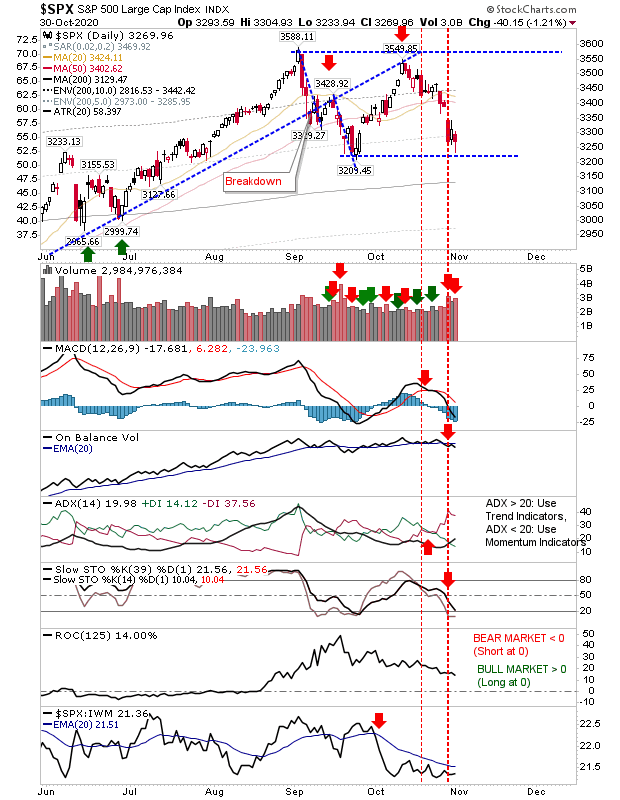

There wasn't too much damage done to the gains made on Friday's junior trader watch. Volume was up significantly across indices to register today as a distribution day, but the relative price loss was small. Only action in the Russell 2000 left a mark on the chart. Even with the selling in the Russell 2000, it remained well above breakout support and held a significant performance advantage relative to the S&P and Nasdaq. Technicals remain favorable with no major bearish divergences to be concerned with.