Nasdaq consolidates its latest breakout

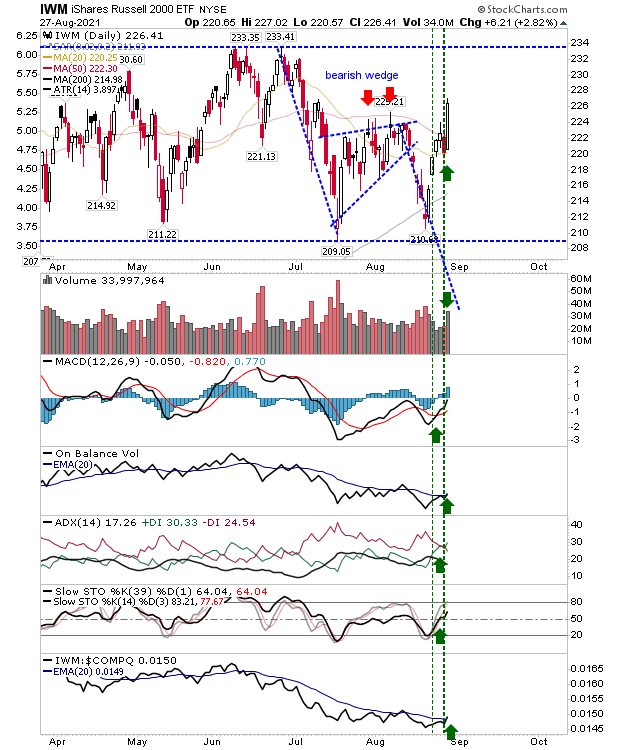

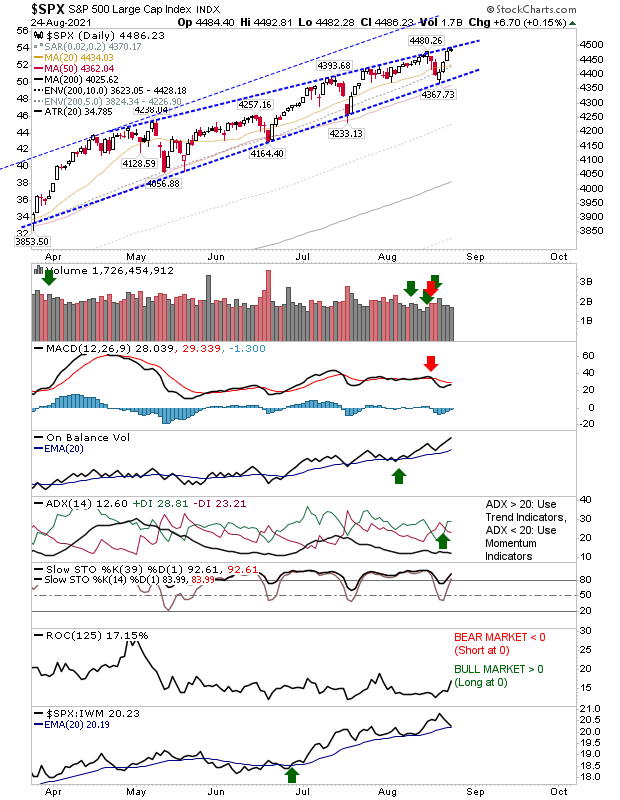

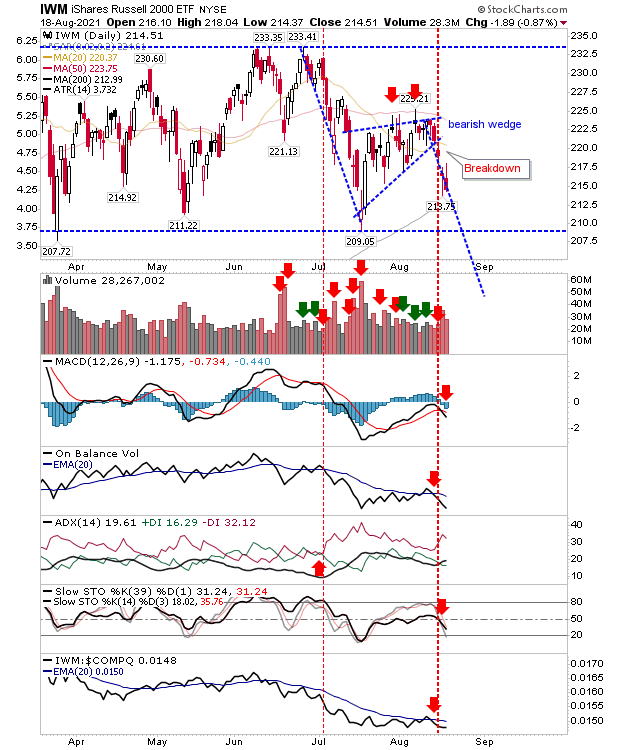

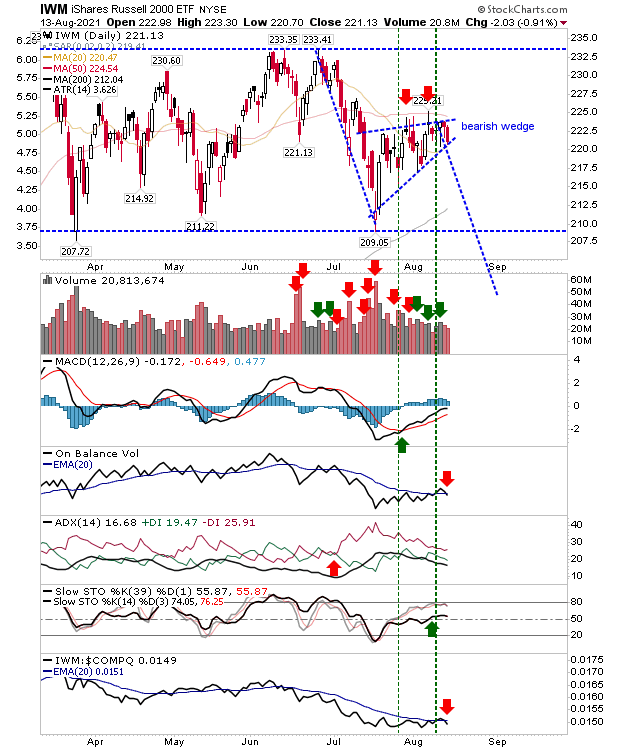

The bait-and-switch of the Russell 2000 gain followed by the move in the Nasdaq has left the latter index in the best position to push on. While Friday's gain in the Russell 2000 was welcome, the trading range muddied the issue. The Nasdaq has none of this overhead and the breakout has room for further upside given its working at all-time highs. Technicals are net positive; it even managed to regain its relative performance advantage against the Russell 2000