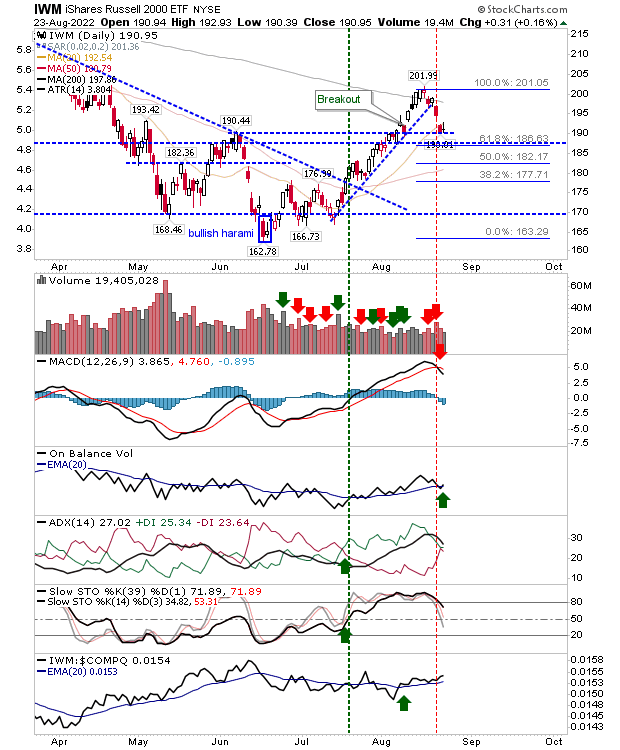

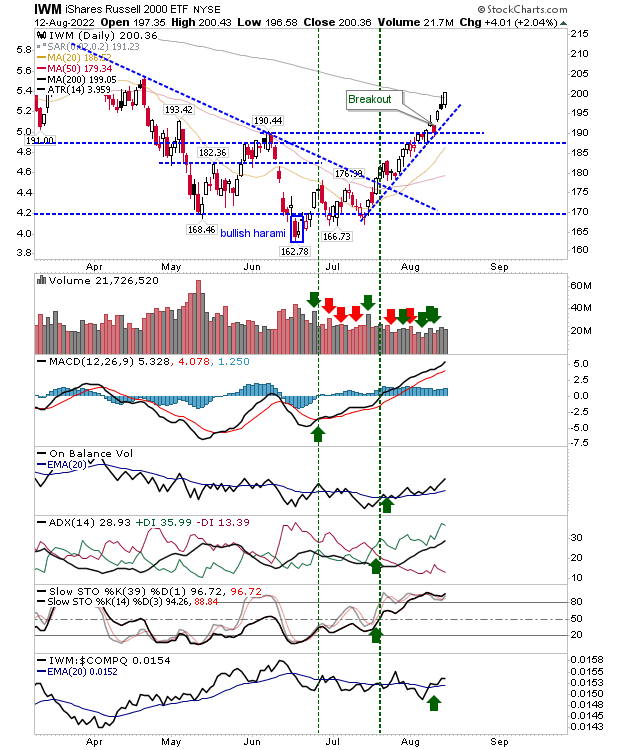

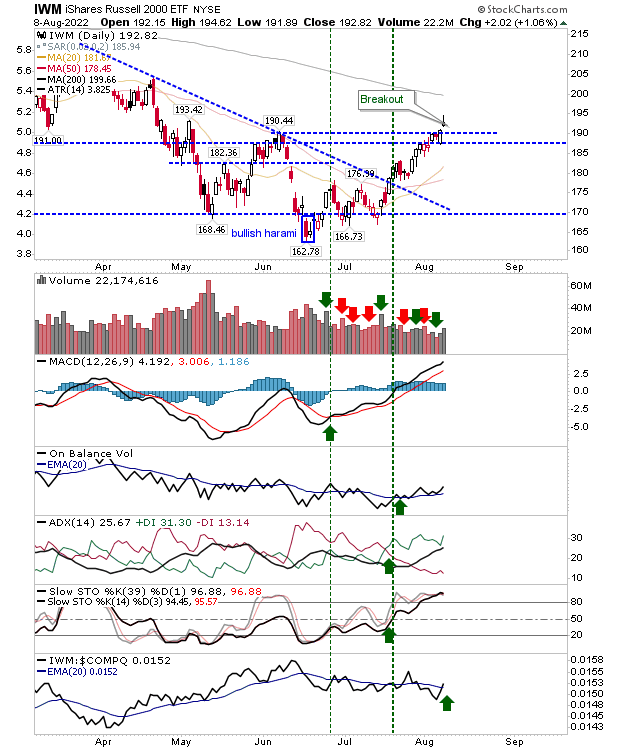

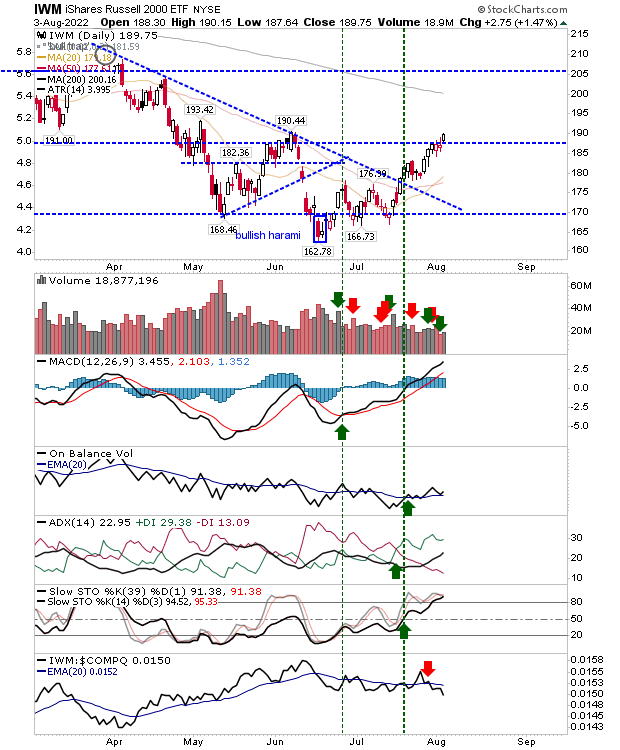

50-Day MAs tagged - now let's see what happens...

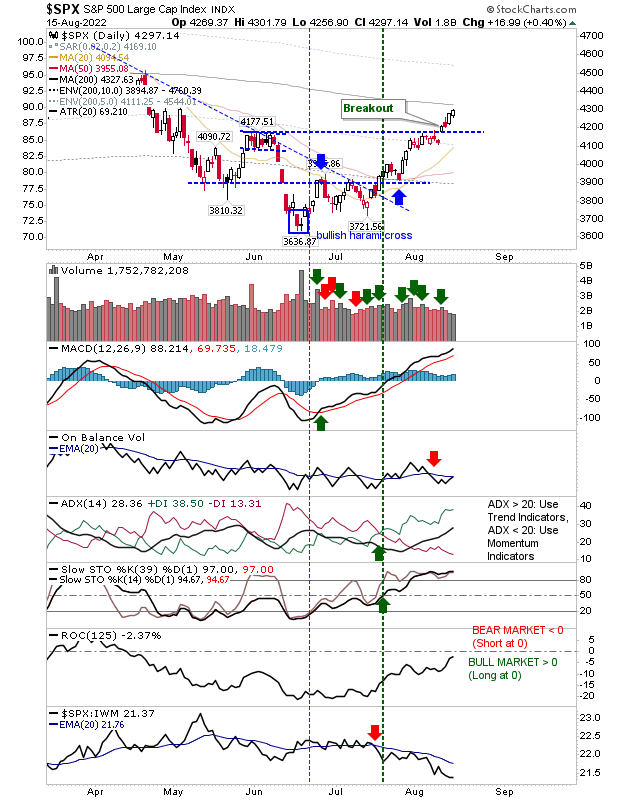

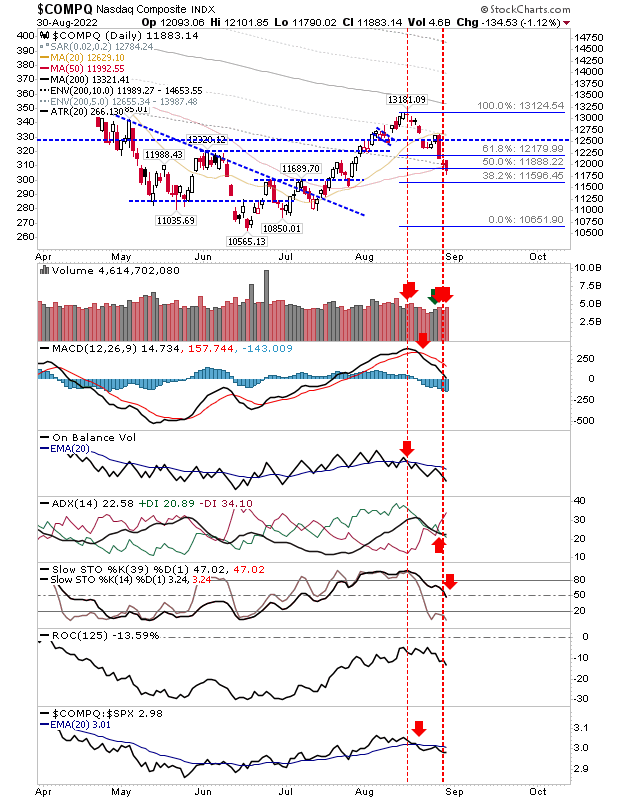

I've been looking for these tests of 50-day MAs since the reversals off 200-day MAs. These tests have coincided with moves into 50% Fibonacci levels which increase the possibility of support kicking in. While the tests of welcome, the 'how' of these tests is less so. Ideally, I would like to have seen more bullish candlesticks, but this was not the case. The Nasdaq had a standard bearish sell off on confirmed distribution, with the added trouble of a return of net bearish technicals. If I had a preference, it would be for a 'bullish' hammer with a close above today's close.