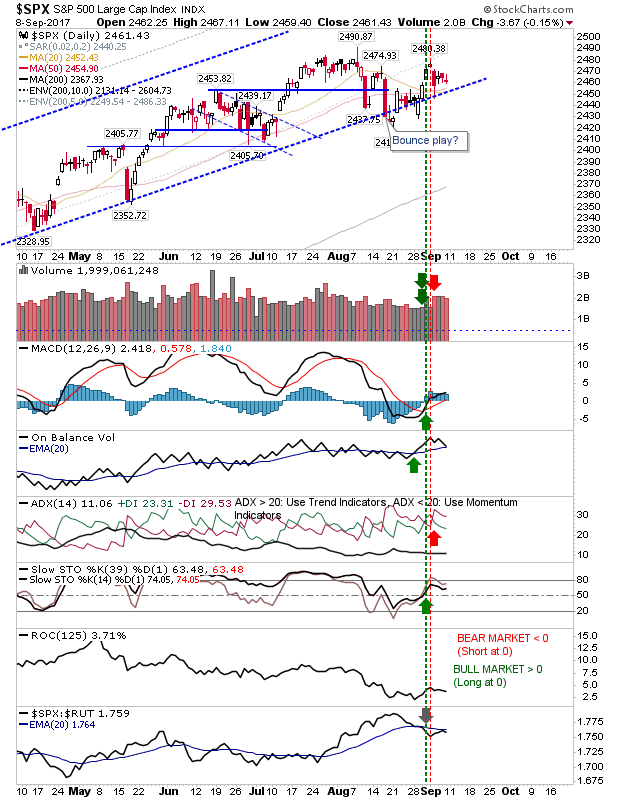

Expanded Russell 2000 Breakout - Nasdaq Ready to Follow

Yesterday saw big gains for the Russell 2000 as it accelerated past breakout support. A large part of this buying was likely driven by short covering but today's defense of those highs is a vote of confidence by buyers who are looking to hold for longer than a few days. The target of 1,560 is the first overbought target to aim for at the 85th percentile rising to 1,637 for the 95th percentile (of historical prices going back to 1987).