Stockcharts.com Weekly review

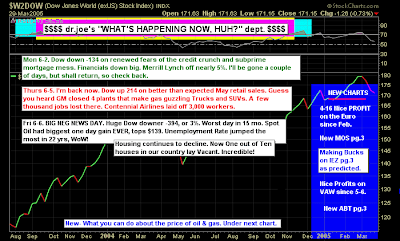

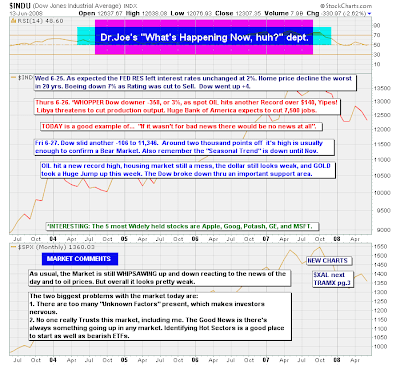

A torid week for bulls (unless your Spanish!). What did the Stockcharters see in it all? Maurice Walker has his weekend summary up on his public Stockchart list. He notes the decline in PCE inflation for the year. I would disagree with his analysis we are not in a bear market; this is a secular bear market which kicked off in 2000, with a cyclical bear market from Oct 07 based on action of breadth indicators. As a sidenote, Ireland is in offical recession with the latest GDP at -1.5%; given the strong business relationship with the U.S. it may have some relevance (or it may not - but given Intel, Dell etc have their European bases in Ireland it's not good news). But here is his opinion because it's (always) worth reading: Sorry for posting so late in the weekend but I was feeling ill, and no, not because of the market. We have done very nicely in our short positions taken on May 20, along with the swing trades made back and forth along the way. This week we found out that inf...