Daily Market Commentary: Weakness Continues

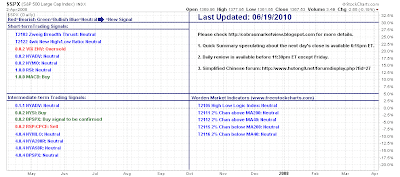

Yesterday's huge losses had the potential for a counter rally but after a weak attempt to regain support, sellers returned in the last hour of trading. With losses over 1% there is no doubt support has broken. The S&P is very close to a "Death Cross" between 50-day and 200-day MAs although today's selling volume was light. ($SPX) via StockCharts.com Will the former resistance line help as support for the Nasdaq? Buy the open and use a 1% stop - sell on test of 20-day MA. ($COMPQ) via StockCharts.com The Dow is offering a similar buying opportunity to the Nasdaq. ($INDU) via StockCharts.com The Russell 2000 failed to cling on to support and followed the other indices lower. But if other indices rally tomorrow will it create a 'Bear Trap'? ($RUT) via StockCharts.com It's hard to say whether the buying opportunities available in the Nasdaq and Dow will prove fruitful given a similar test in the S&P failed. A series of sharp down day...