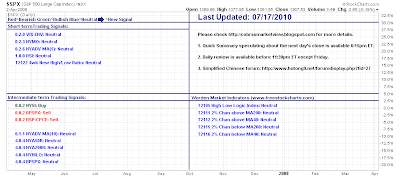

Weekly Market Commentary: Slows as Resistance Approaches

The rally of the last few weeks slowed as the week finished with a narrow doji for many of the lead indices. The bear flag highs remain resistance and the bulls challenge to break the intermediate-term bear trend. Volume dropped, reflecting a consolidation - not a sell off, to the slightly lower close on the week. With the slowing in the up trend it might be a quiet couple of weeks. The watch areas remain Fibonacci retracements with the first test of 61.8% so far a success but two more remain to challenge on future weakness. ($SPX) via StockCharts.com The Nasdaq still has a bearish head-and-shoulder pattern to consider, although the July decline put this to the test. Nasdaq via StockCharts.com Likewise for the Nasdaq 100, it has an alternative neckline which extends back to 2006 at 1,702. ($NDX) via StockCharts.com The Russell 2000 has a large trading void to fill. The void is made all the more enticing with stochastics well off oversold conditions; 614 support down to 59...