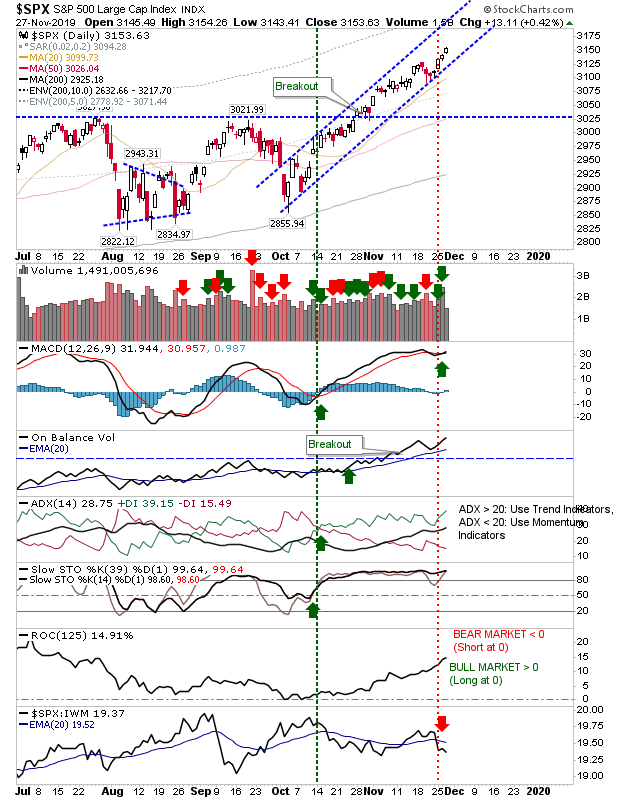

Rallies Continue Their Gains

Bulls are starting to put a bit of distance on the prior consolidation of early November and this will only make it easier to extend gains when Santa comes to town. As it stands, all bar the Russell 2000 are at multi-year (10-year+) highs. The S&P is running inside a rising channel with well defined support and resistance. It's still underperforming against the Russell 2000, but other technicals have returned net positive.