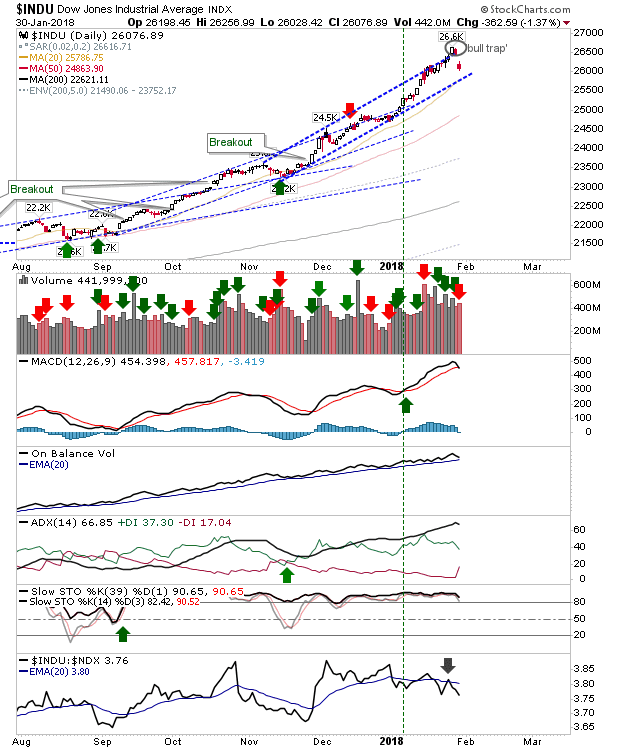

Dow Leaves a 'Bull Trap'

Two days of selling has finally put a stop to the accelerated gains from December but it should also provide an opportunity to shake the weak hands out of their positions and set up a more sustainable rally. The nascent breakout in the Dow has been undone by the fall back inside the prior channel, leaving in its wake a 'bull trap'. Shorts will use the 'bull trap' highs as a place for stops. Typically, 'bull traps' from channel breakouts go all the way and drop out the other side - this would be a secondary shorting opportunity but we are not there yet.