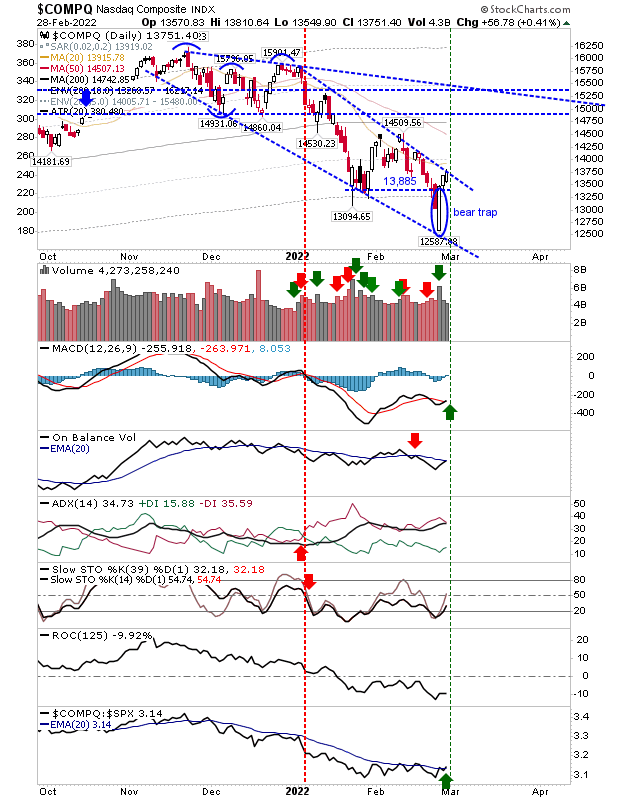

Support Holds Despite Weekend Futures

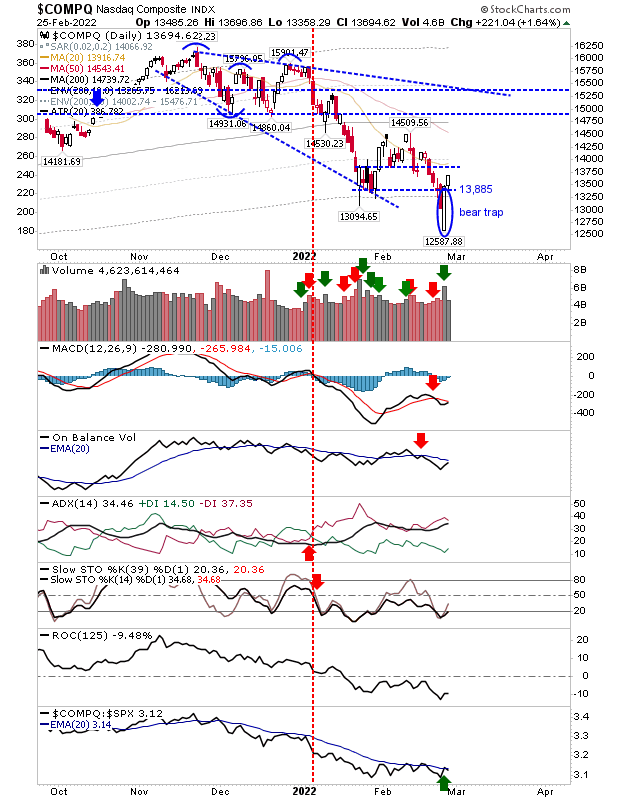

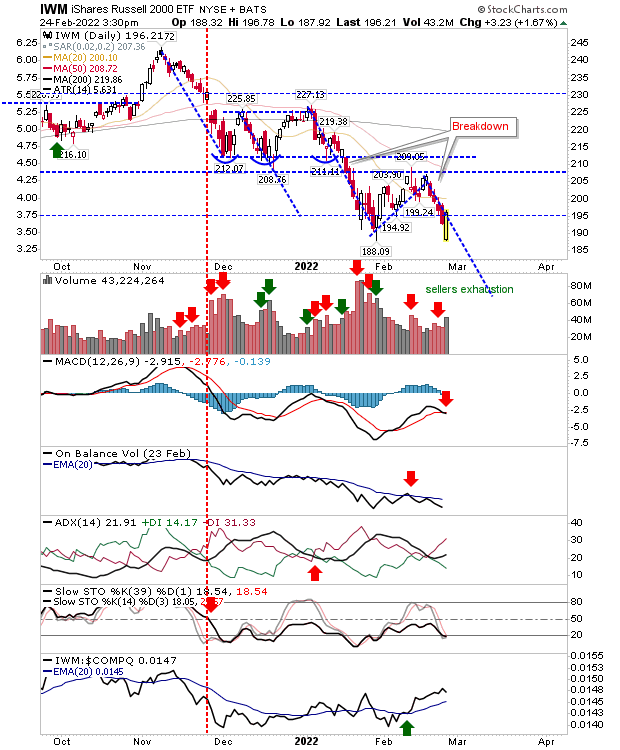

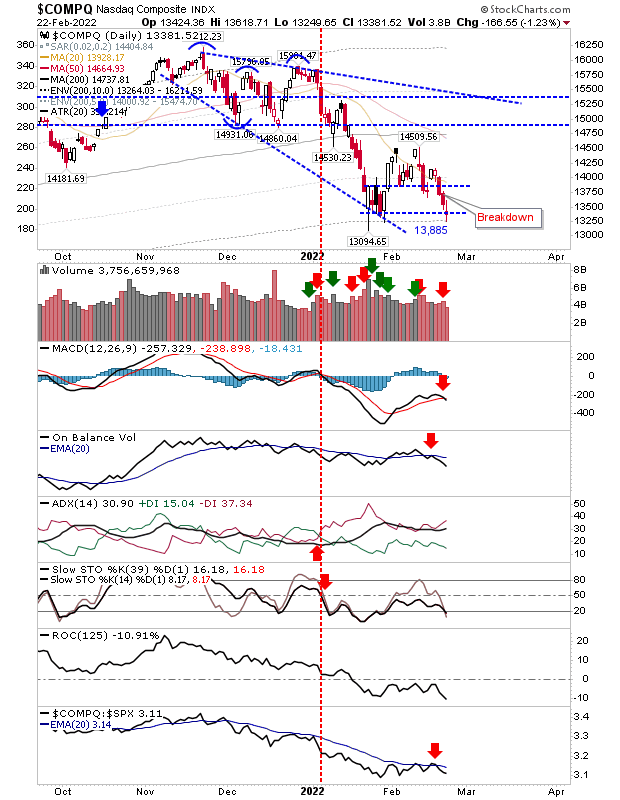

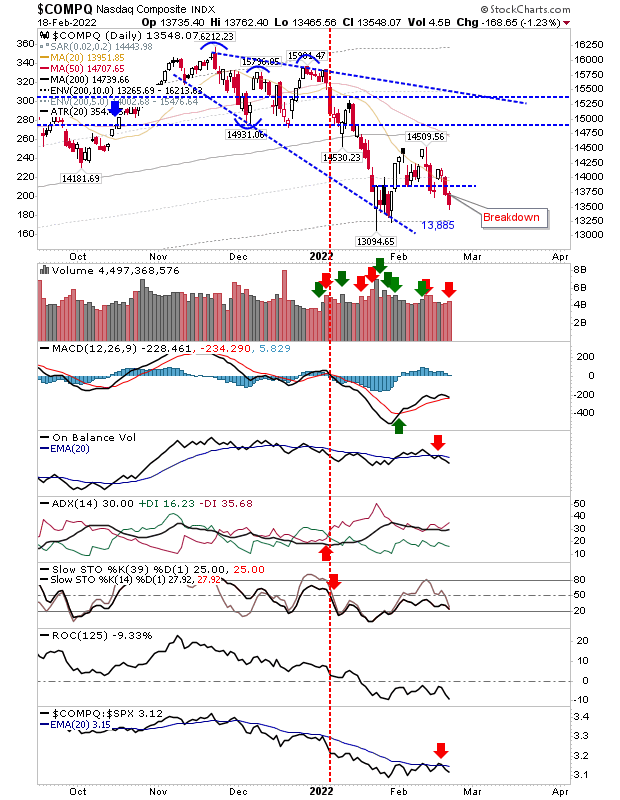

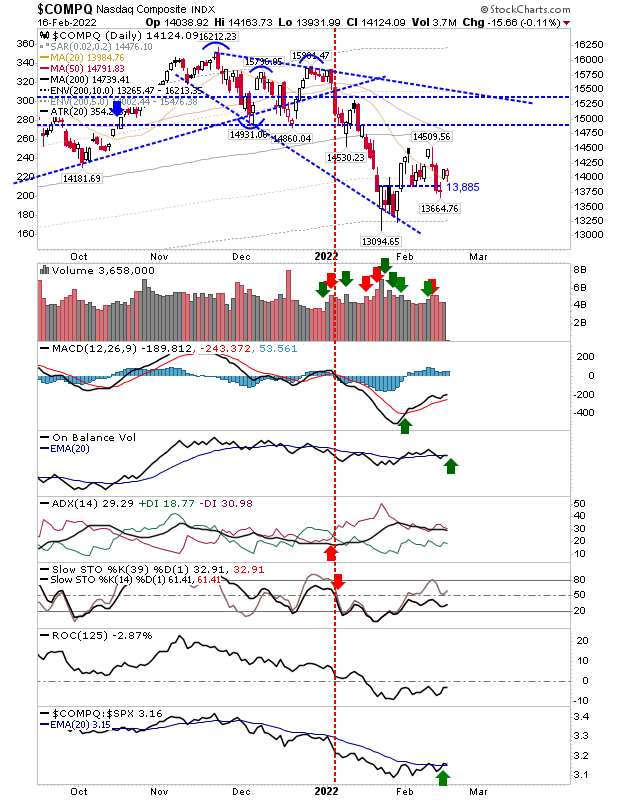

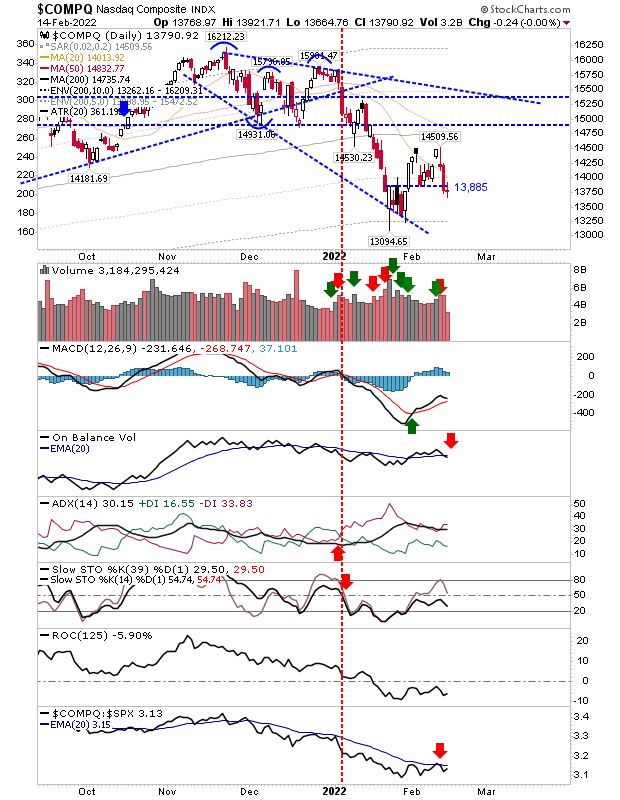

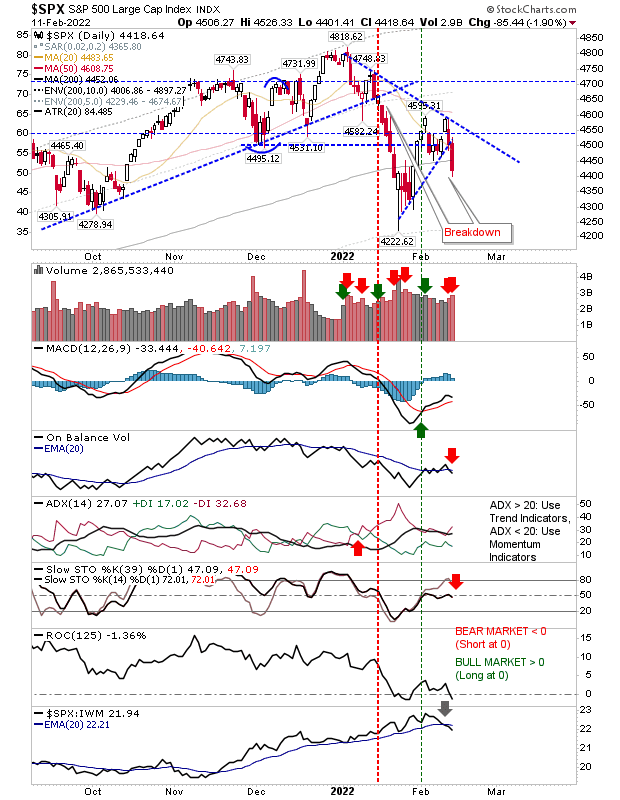

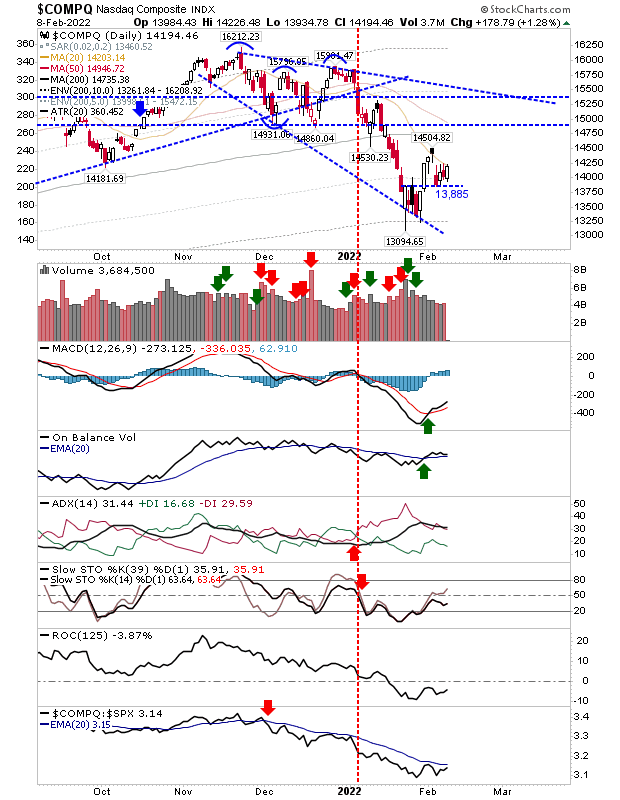

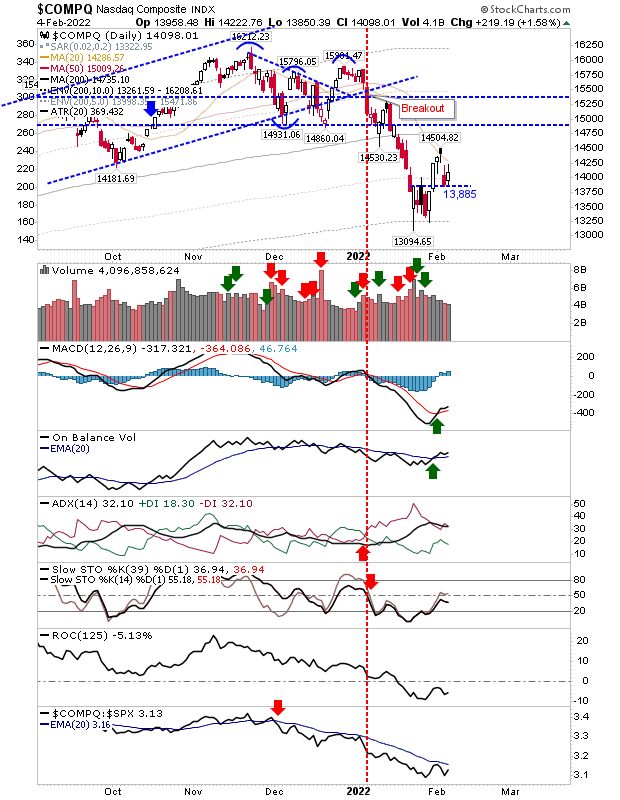

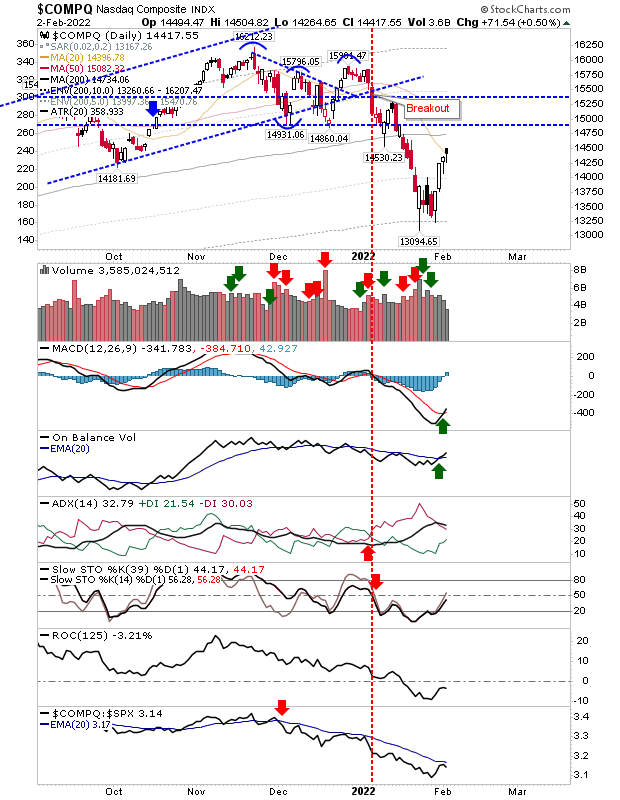

After posting yesterday - then seeing the state of Futures Sunday evening - I thought I was going to be left with egg on my face, but support was well defined on Friday and today's action effectively confirmed these levels as working support. Of course, we can still go lower from here, but given the economic state of Russia and the war in the Ukraine, today's action was very tepid. The Nasdaq is about to run into its first piece of price resistance at the 20-day MA, but it does have a 'buy' trigger in its relative performance to the S&P, not to mention a (weak) 'buy' signal in the MACD.