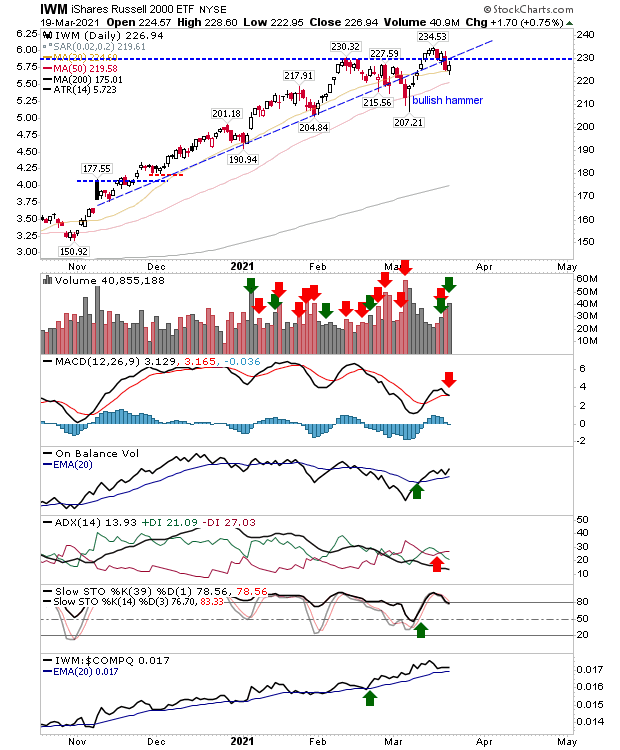

Russell 2000 continues to feel the pressure

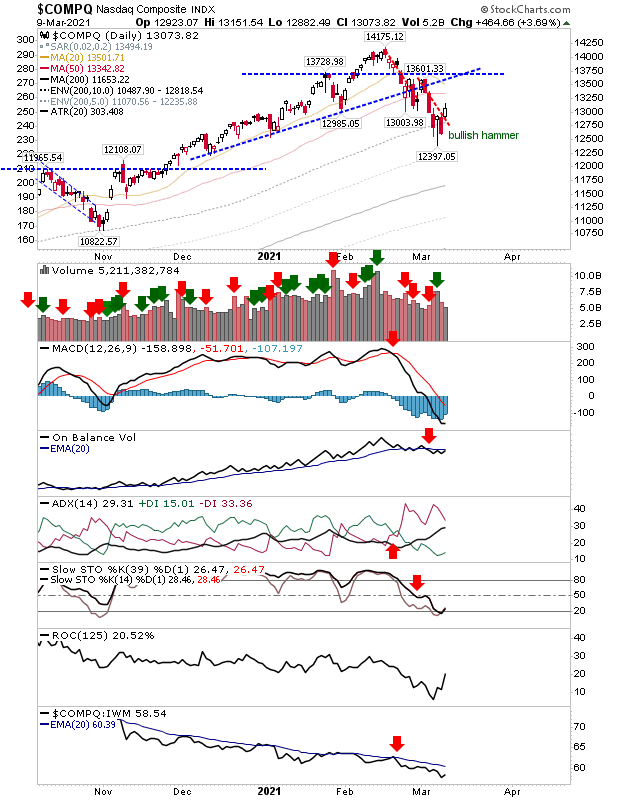

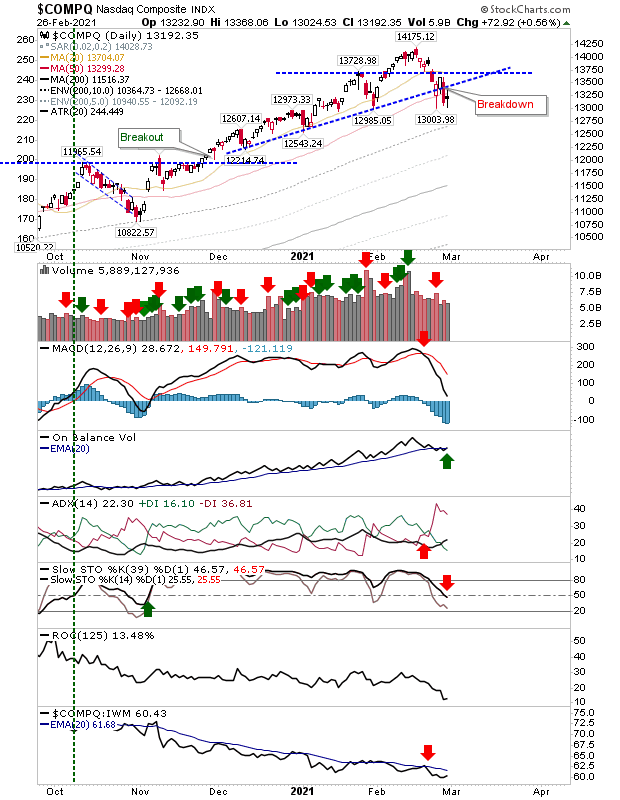

Last Thursday's gain in the indices had established the groundwork for consolidations, with the Tech and Large Caps best positioned to gain. The Russell 2000 may have already run into trouble with its consolidation as today's loss came off its 50-day MA on higher volume distribution. Technicals are mostly bearish, although On-Balance-Volume remains on a 'buy' trigger despite today's distribution.