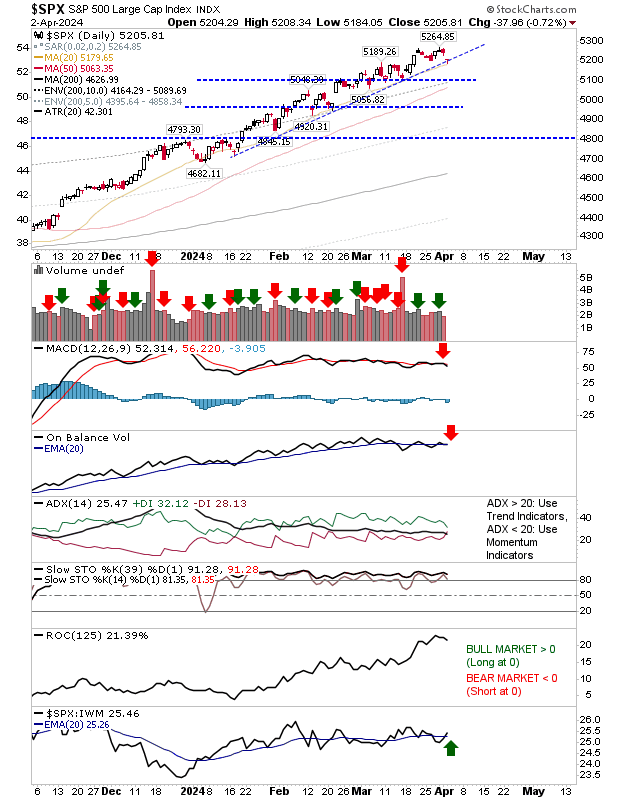

Moving averages peg back rallies in the S&P and Nasdaq

The S&P was most affected by the presence of converged 20-day and 50-day MAs as it finished Monday with a neutral 'doji' just below these moving averages. The small gain was enough to generate a new 'buy' trigger in On-Balance-Volume, but the critical mid-line in Stochastics continues to play as resistance, and this means the bearish outlook is favored. For Tuesday, I will be looking for some downside, but if the S&P can close with another neutral candlestick - and not a big red one (or something better) - then we may have a more bullish response by end of week.