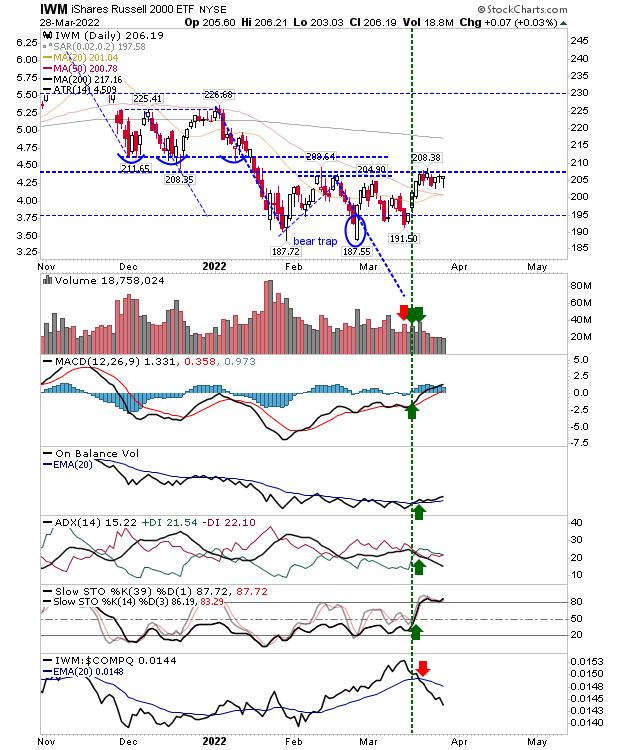

Low volume selling after Russell 2000 breakout

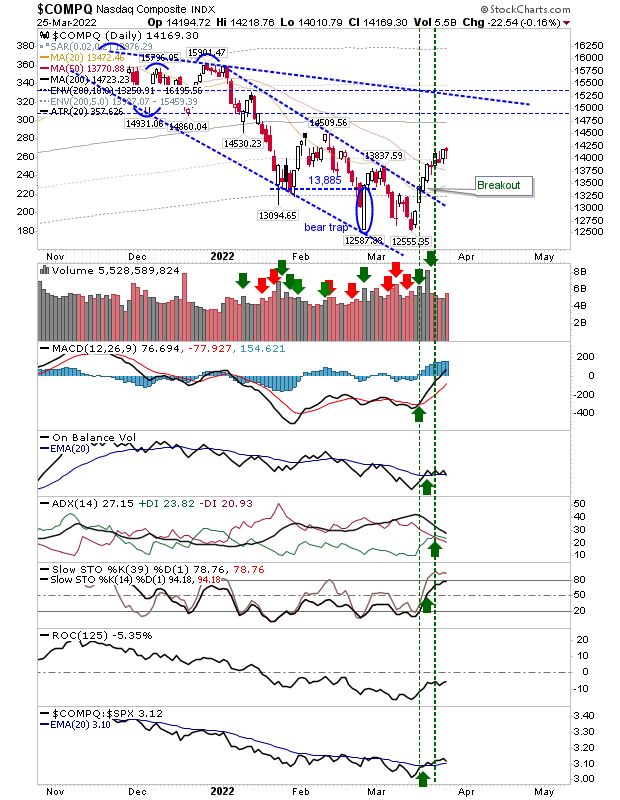

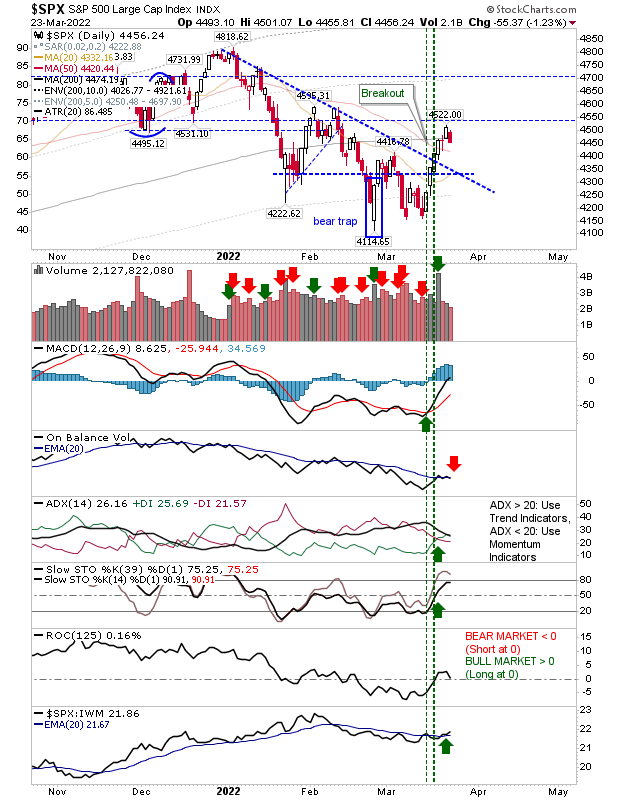

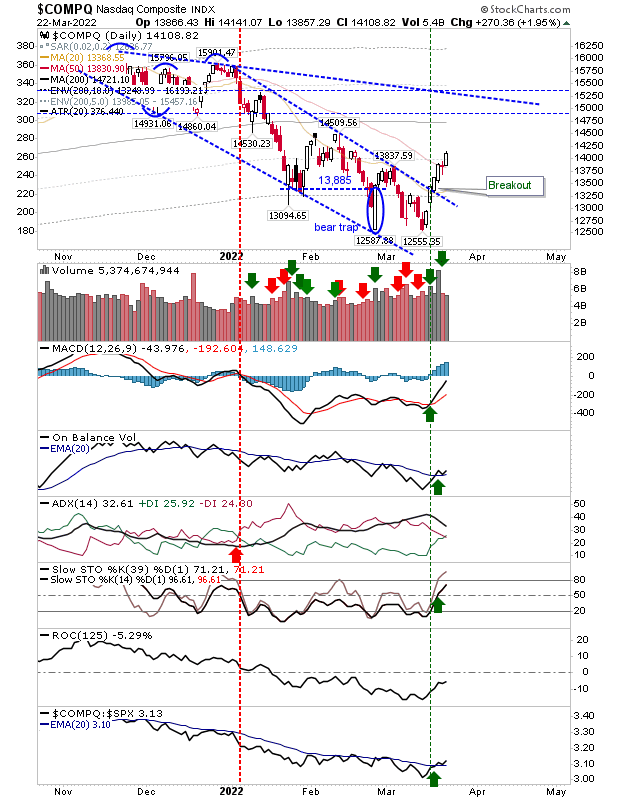

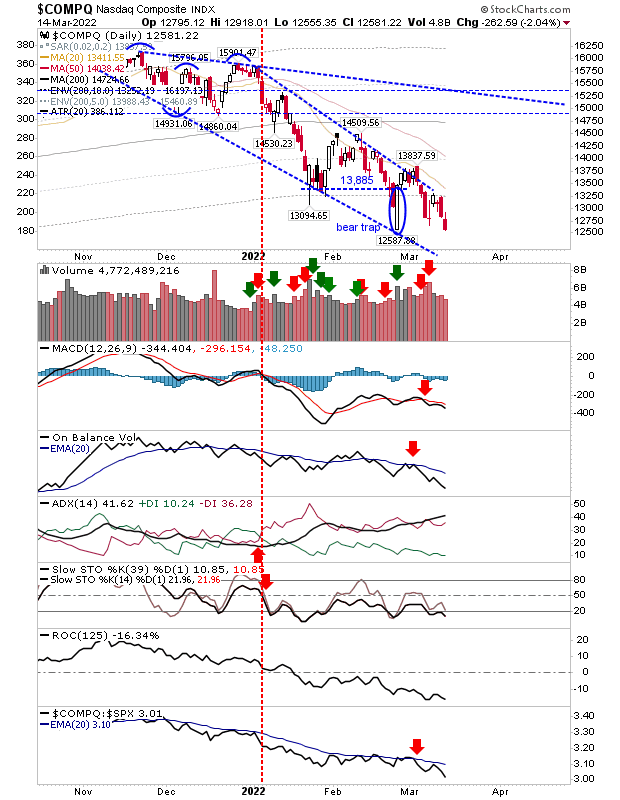

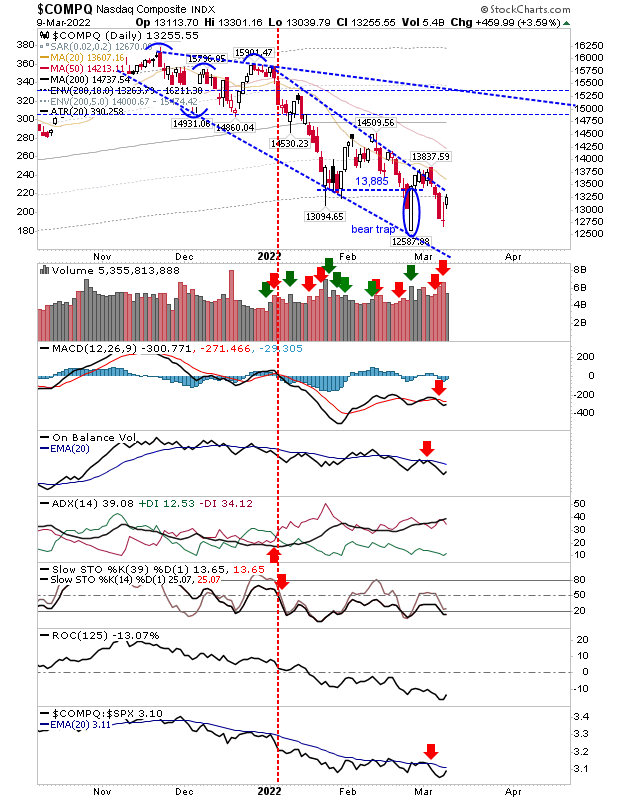

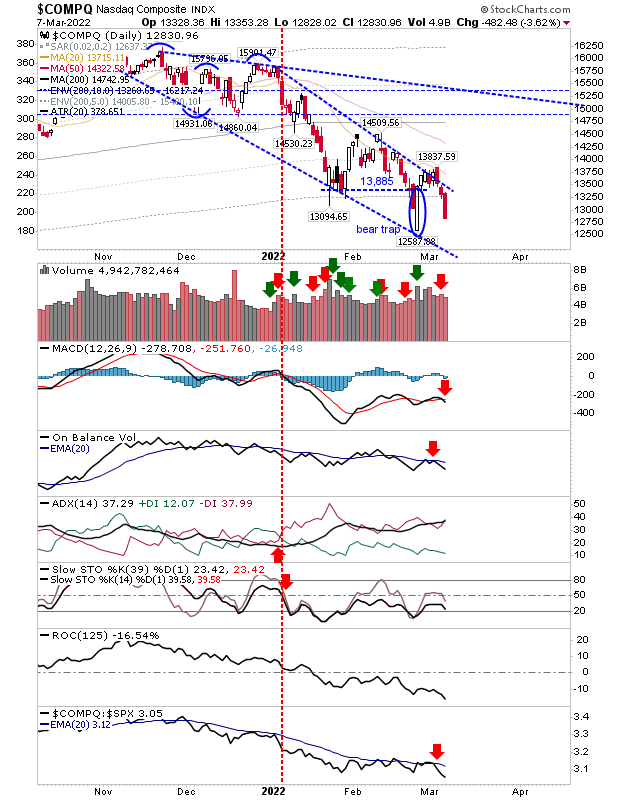

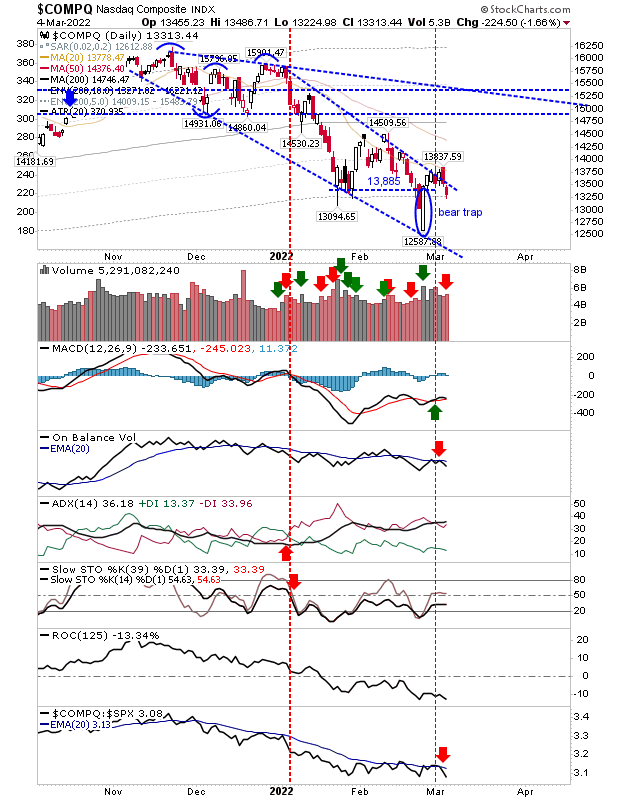

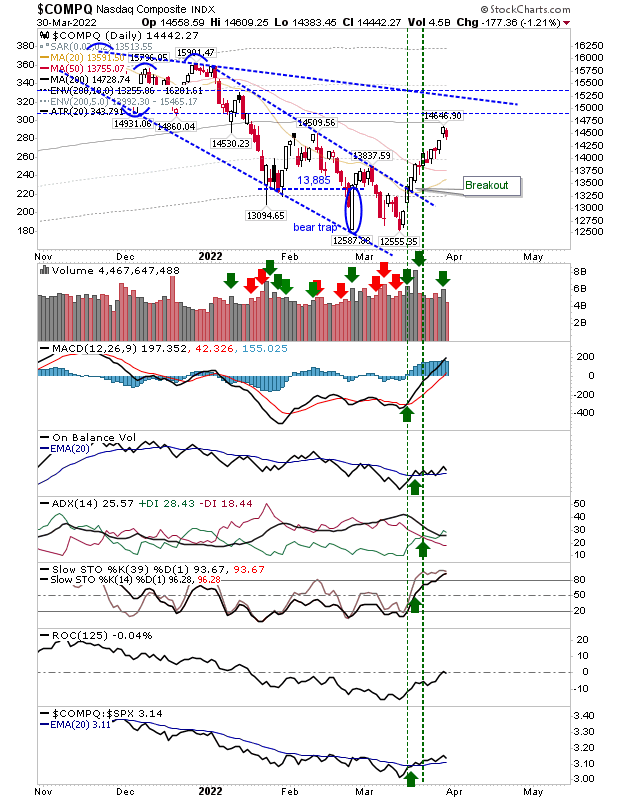

Yesterday finally delivered the long awaited breakout in the Russell 2000 on higher volume accumulation. Today saw some low key selling on lighter volume, but the selling was not accompanied by distribution. The Nasdaq still offers net bullish technicals, but today's selling kicked in on the test of its 200-day MA. Yesterday's buying did count for accumulation.