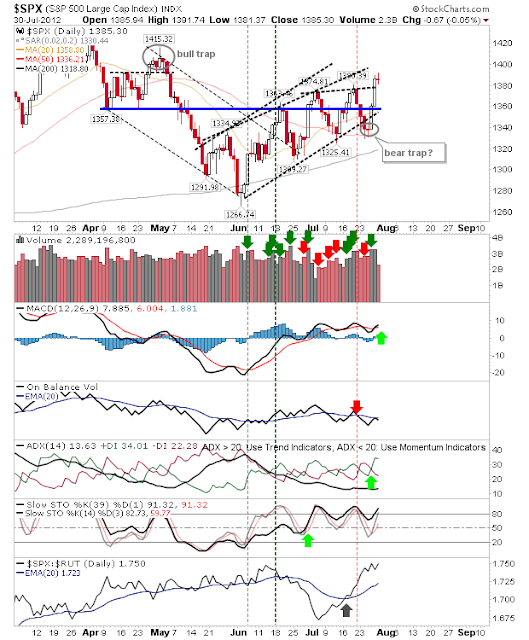

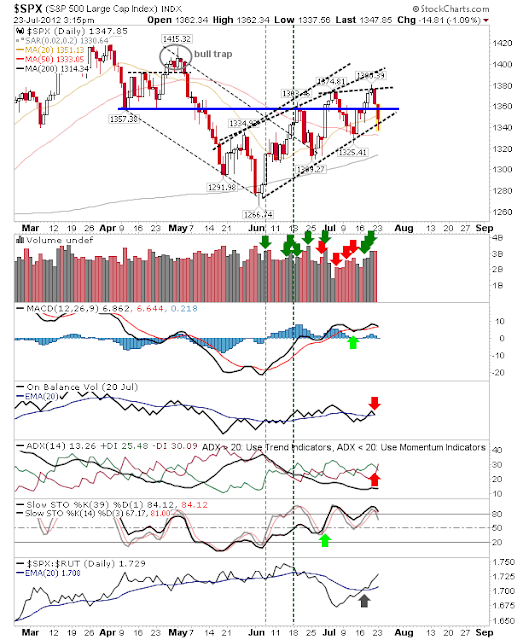

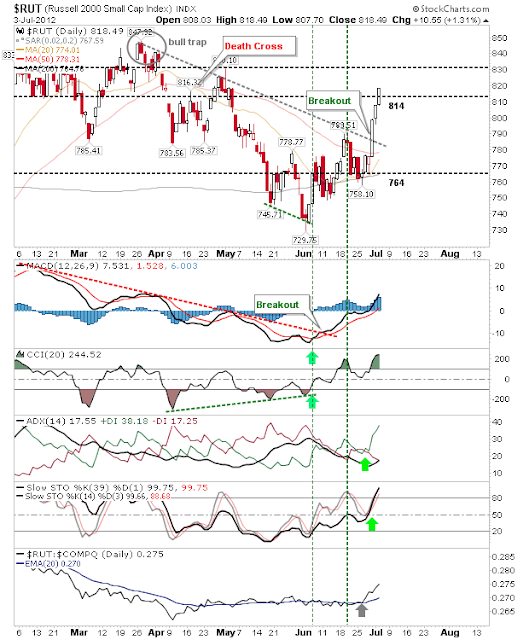

What stood yesterday, held today. One of the exceptions was the Nasdaq 100 which undercut the 50-day MA, but the prior swing low from early July held. Technicals continued to decline. On the other hand, the Dow was able to mount a small rally, gaining 58 points from working off its 50-day MA. It also saw an uptick in relative strength to the Nasdaq 100, reflecting a flight to safety. Volume was considerably lighter, which in itself is a warning sign suggesting the 50-day MA is not major support. The Semiconductor Index was another index to benefit which rallied, but got stuck at its 50-day MA. Another gain in the next few days to take it past the 50-day MA will set up the 200-day MA as a target. The rally in the semiconductor index may provide the impetus for a move higher in the Nasdaq. Today's loss confirmed a channel break, but a rally Thursday sets up the potential for a 'bear trap'. Tomorrow is set up for a gain. Any gain whic...