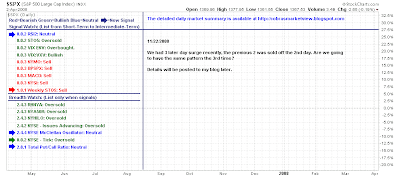

Holding Station: Watching Summation Indices with interest

With Thanksgiving soon upon us there was little to add to yesterday's consolidation. Suffice to say, no existing resistance levels were breached. The best thing that could be said for Tuesday were the new MACD trigger 'buys': Summation indices shaping bullish divergences with respect to their parent indices as double tops develop in the VIX and VXN. Clearest case for a bottom yet: Get the Fallond Newsletter Dr. Declan Fallon, Senior Market Technician, Zignals.com the free stock alerts, market alerts and stock charts website