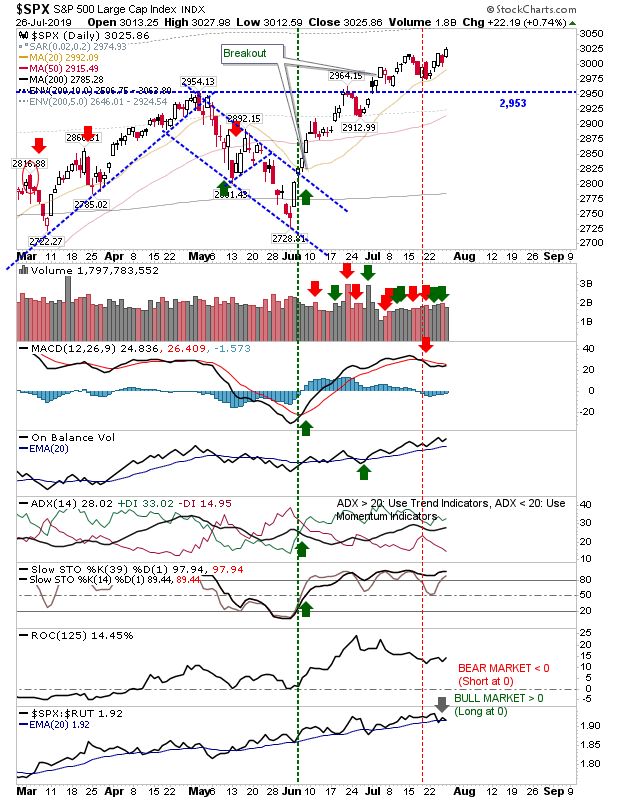

Fed Confusion Tames Gains

Markets didn't react well to the Fed rate cut or the words of Jerome Powell, although today's selling didn't kill the breakouts, it did leave them under pressure. The S&P undercut its 20-day MA and only tagged breakout support of 2,953 but volume did rise in confirmed distribution. Today's action undercut the signal line in on-balance-volume and generated a sell trigger in ADX.