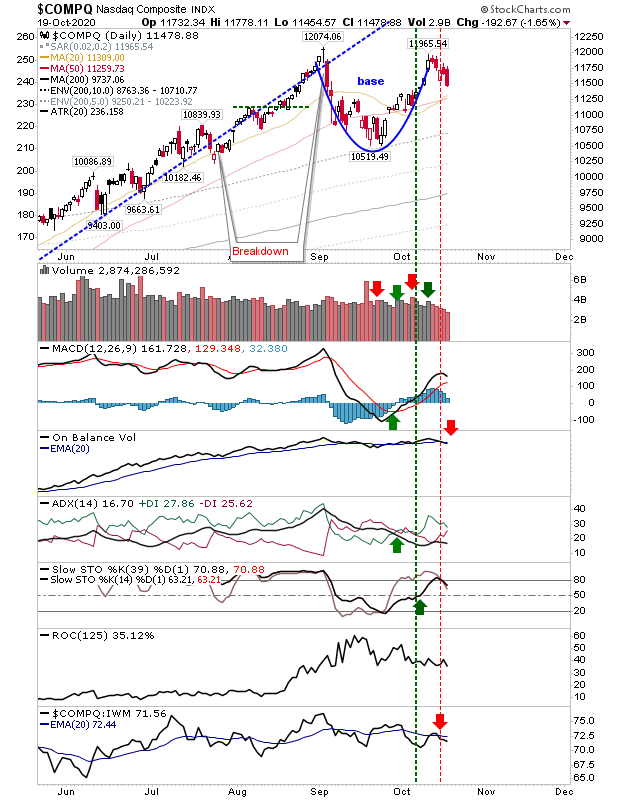

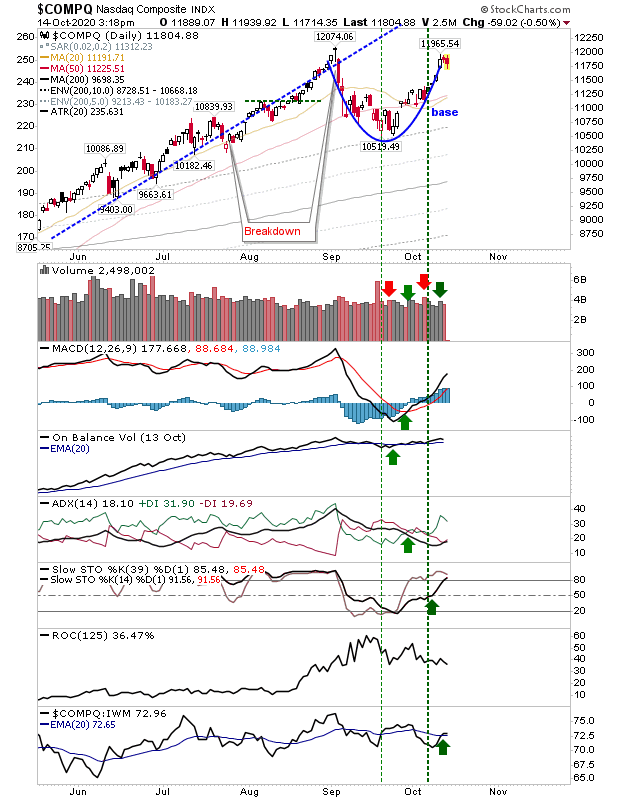

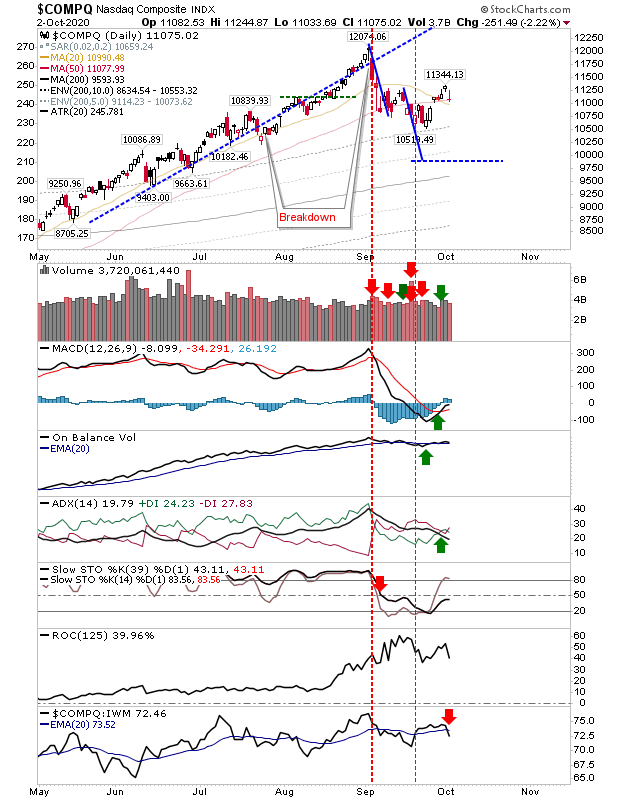

Active Selling Leads To Gap Downs

Media sources blamed increasing Covid19 cases for today's selling but this is hardly news. Up to now, the selling has been consistent but today saw things accelerate to the downside which left difficult breakdown gaps behind. What this means in broader terms is of instead of looking at a rally continuation we need to look at a broader consolidation. The Nasdaq is on course to testing the September low but the gap now establishes a break to prior action. In real terms, today's action is not as damaging as headlines might suggest, but we are looking at a shift to a sideways consolidation. Even with that, there is a long way to go before long term support of the 200-day MA is tested - but it's not a buyers market.