Markets Extend Losses

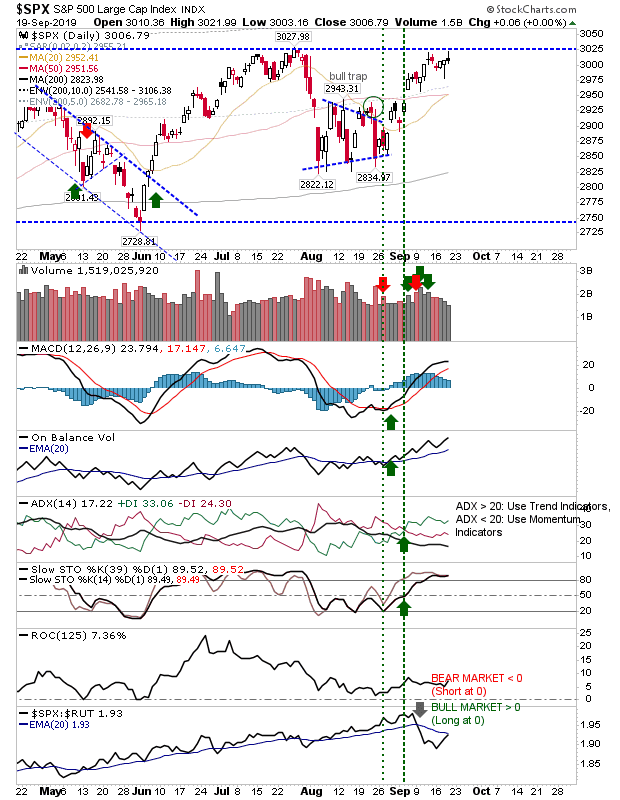

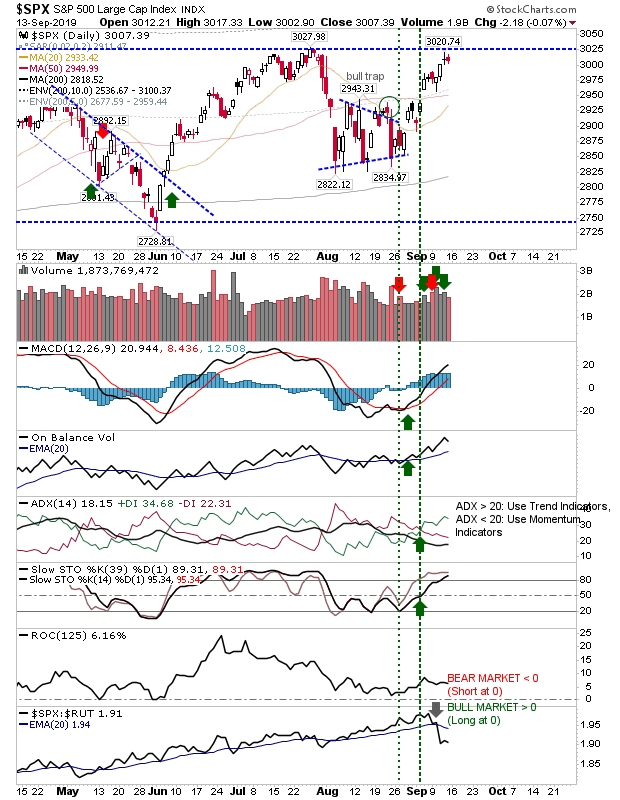

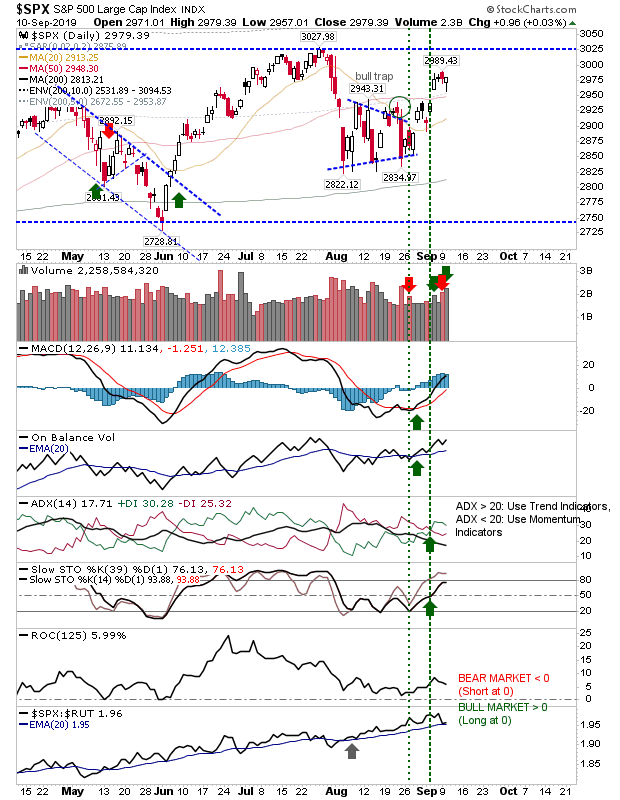

Friday belonged to Bears as sellers finished the week in control but bulls still have support to lean on in the shape of moving averages. The S&P is leaning on the 50-day MA with 'sell' triggers in the MACD, On-Balance-Volume, and ADX, although relative performance ticked up against the Russell 2000. Volume rose in confirmed distribution. Monday is a fresh chance for bulls to recover the losses.