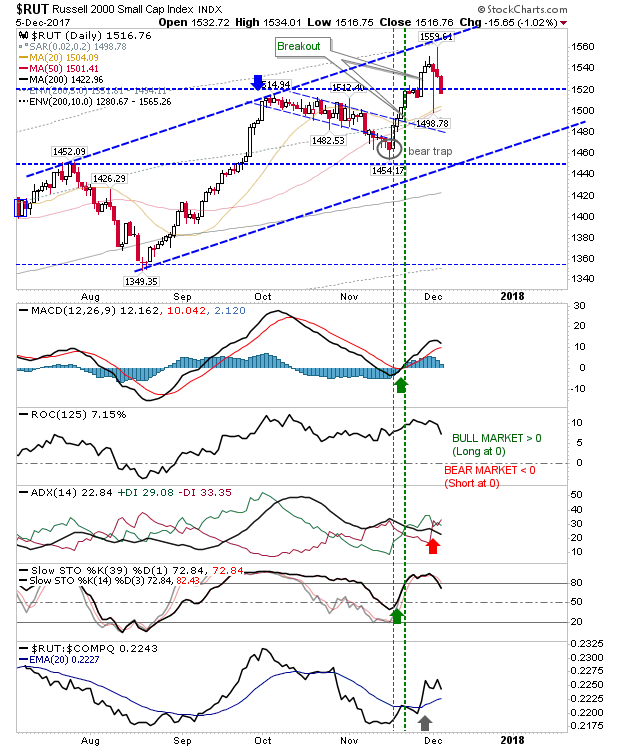

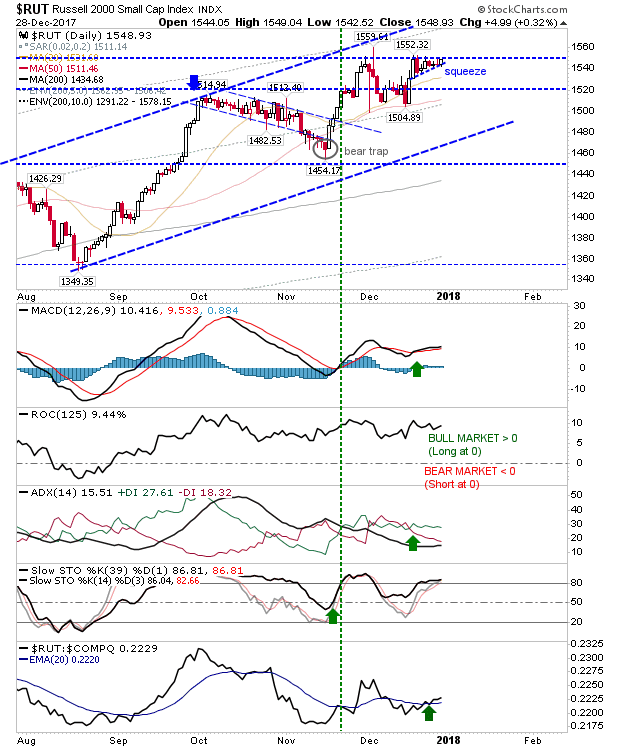

Quick Post: Markets Trade Near Highs Ready For 2018

The last week of trading of 2017 looks to be ending near all-time highs, and with markets well placed to continue this form into 2018. The Russell 2000 is looking primed to jump higher with strong pressure at resistance. Of the indices, it's best placed to break higher - negating the November 'bull trap' in the process. The upper channel line is the target for the breakout. Shorts will need a downside break of the squeeze line with a stop above 1,560.