Weekly Market Commentary: Large Caps Break 'Bear Flag' Resistance

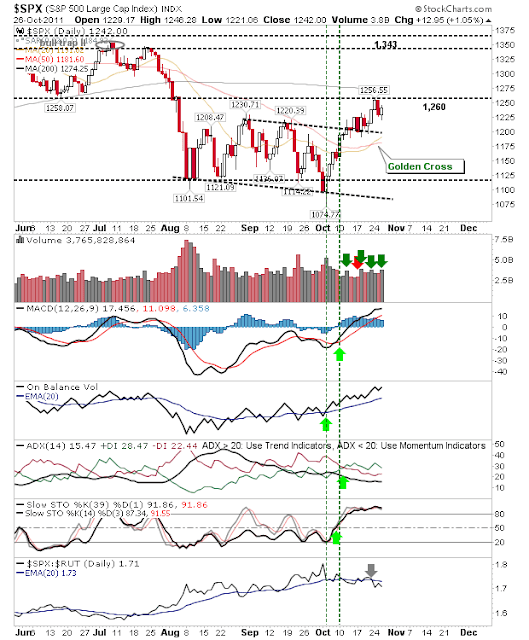

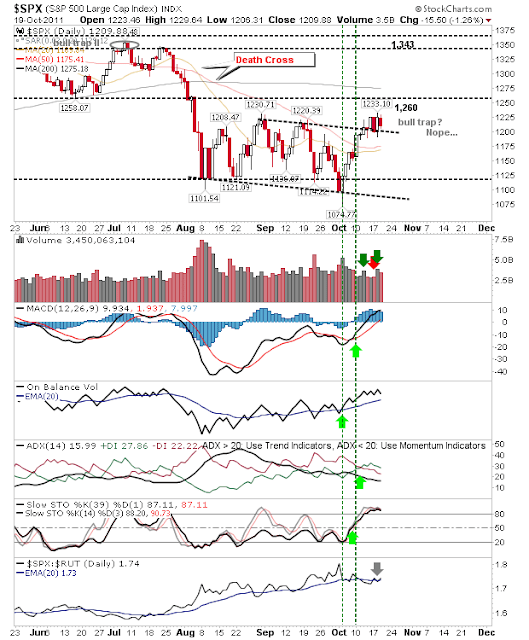

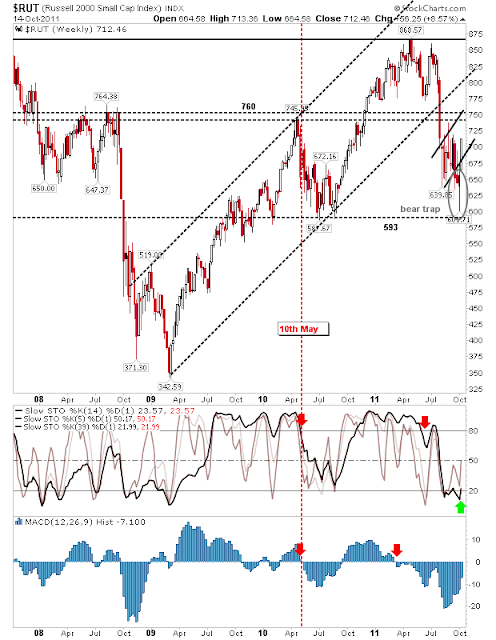

It was a solid end of week for Large Cap indices, even if trading volume was a little on the light side. The Dow cleared a thick band of supply between 11,730 and 11,895 and pushed into congestion of early 2011. It has been a straight rally from the 10,400 low so the former band of supply should now play as demand. Look for buying volume to increase on the next push below 11,900. The S&P was able to push past strong resistance of its own at 1,209, although it finished the week just shy of minor resistance at 1,300. A successful back-test of 1,209 would be preferable (against a further push higher) to confirm the breakout. The Russell 2000 is up against 'bear flag' resistance, but given the action in Large Caps a break higher is favored. Likewise for the Nasdaq. Helping it is the higher volume accumulation enjoyed over the week. As for next week, keep an eye on Large Caps. It will likely be a 'soft' week with little net change. But with se...