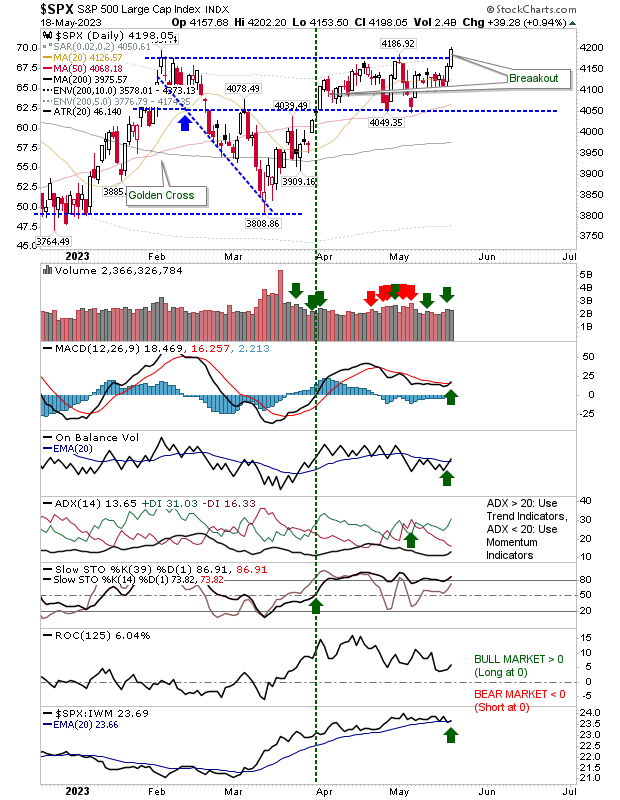

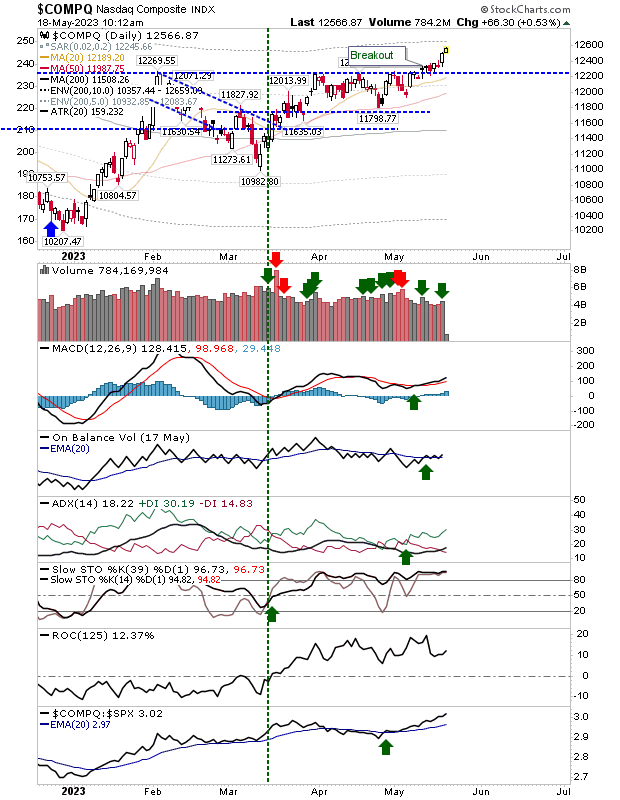

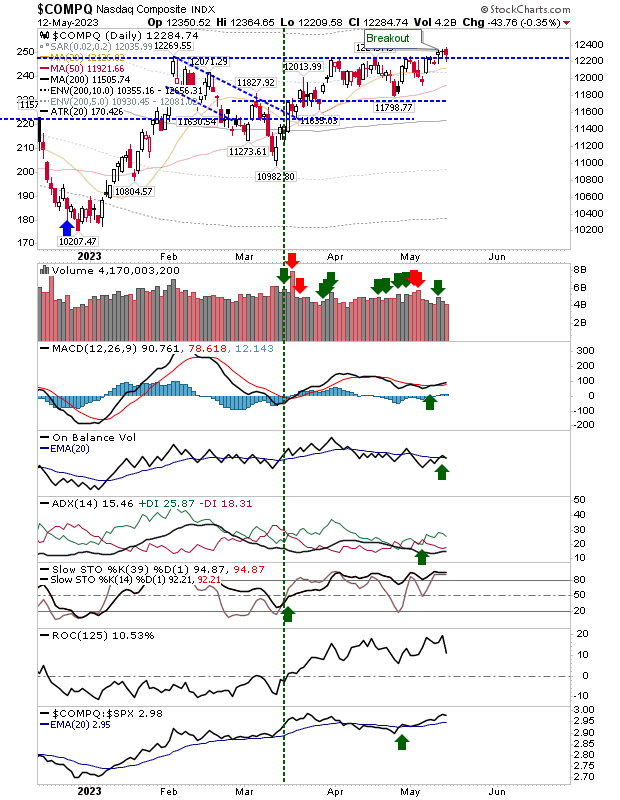

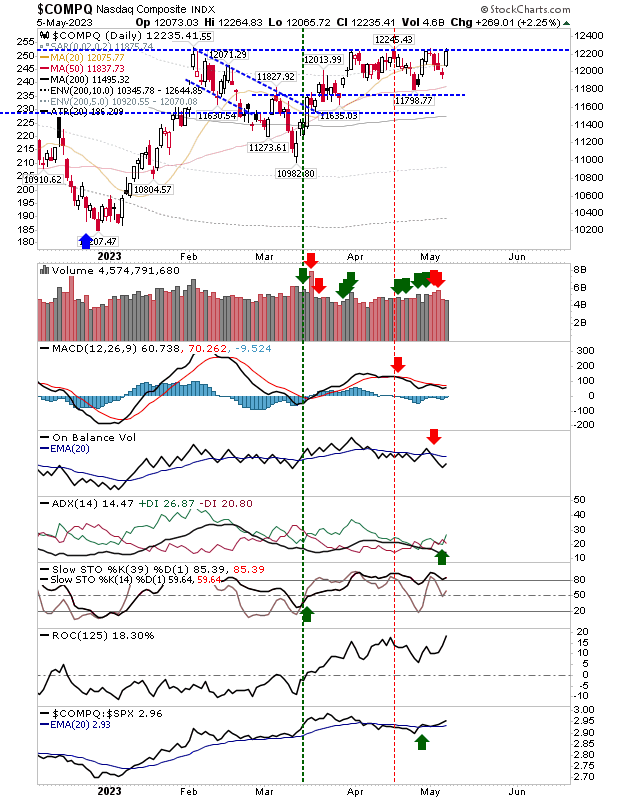

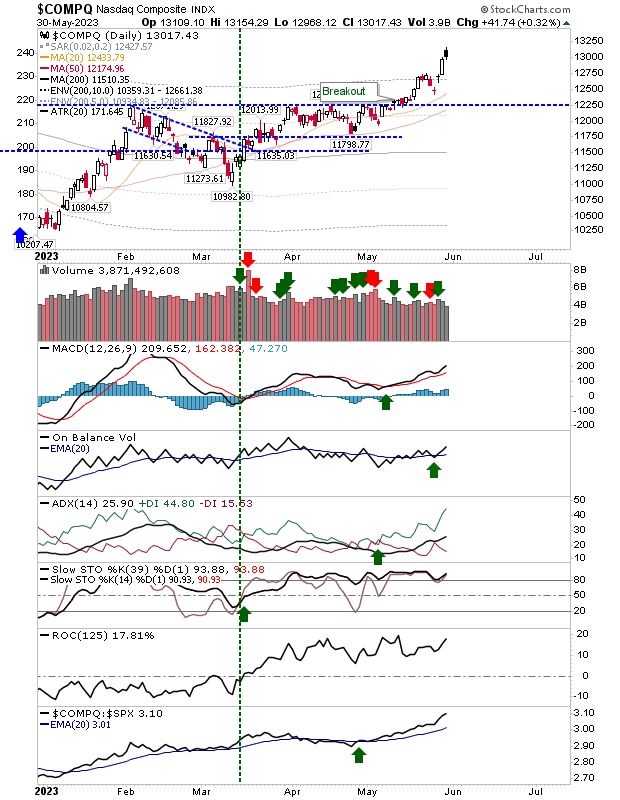

Peak "Black Candlesticks" again offer cause for concern

With junior traders likely to be still holding the reigns after the long weekend it was worrisome to see 'black' candlesticks pop into the charts of the Nasdaq and S&P. If there is a bullish caveat, it's that the significance of these candlesticks is reduced in the absence of a prior rally. The Nasdaq is perhaps the most vulnerable in this regard, but only because it has extended itself beyond its breakout point. However, I would expect this index to come back towards the 12,250 level over the coming days and weeks.