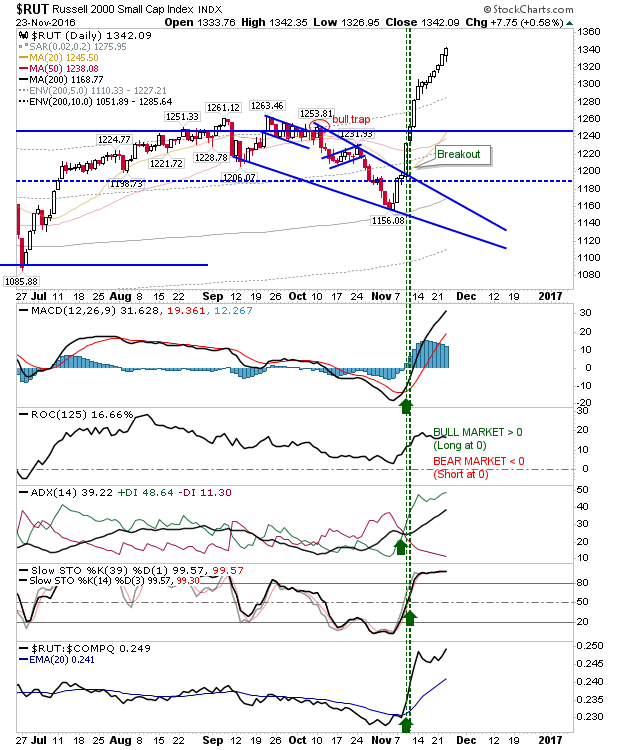

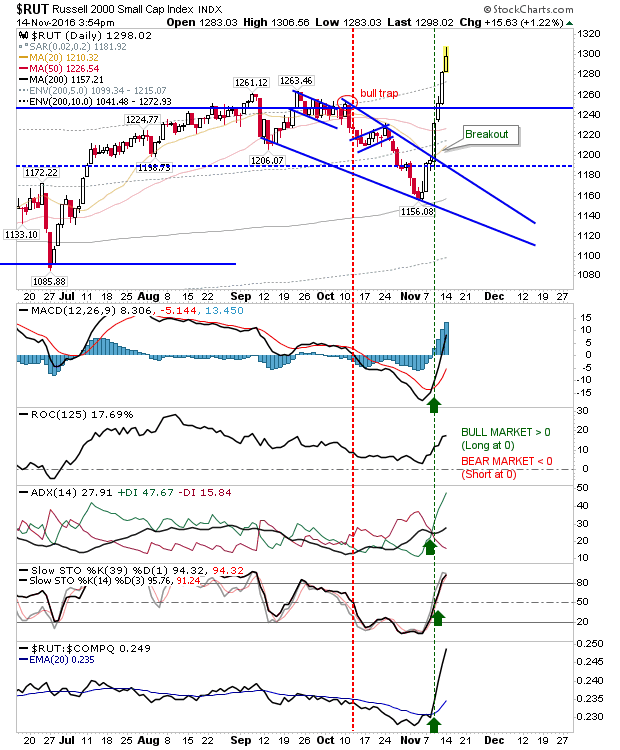

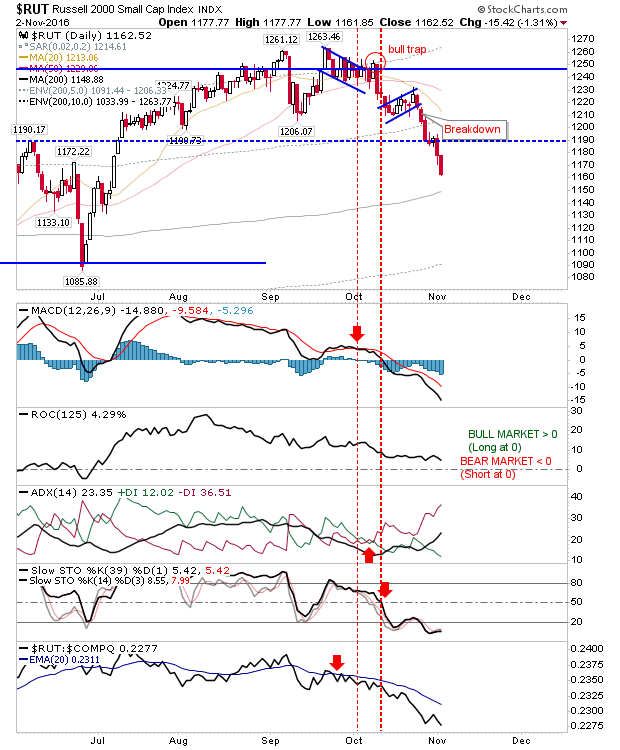

Small Caps Maintain Selling - Tech Joins In.

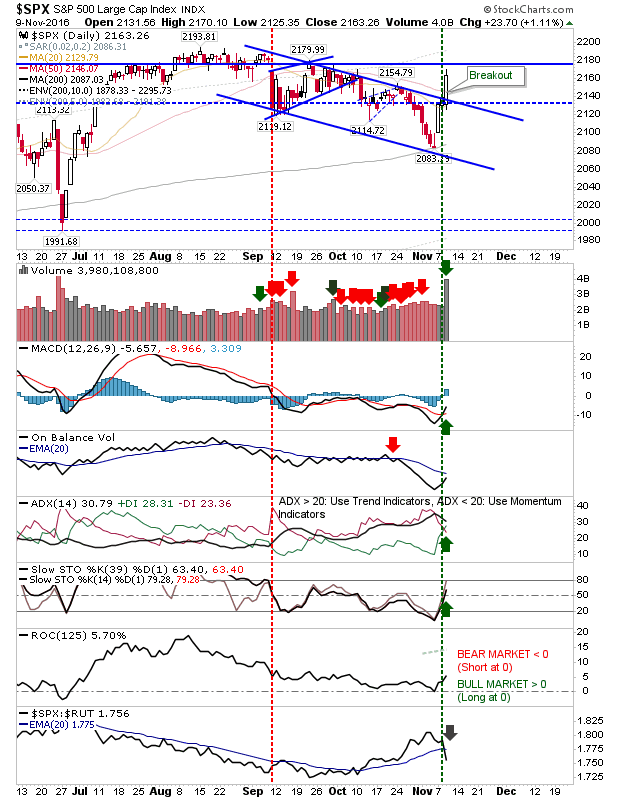

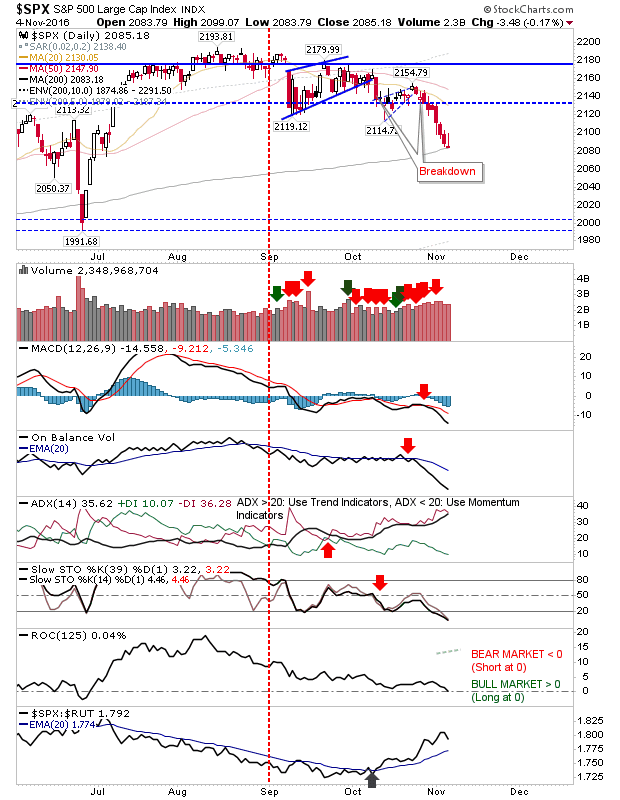

Sellers kept pressure on the Russell 2000 with the Nasdaq and Large Caps also partaking in the profit taking merrymaking. Large Caps had begun with a boost, the Dow in particular had started well, but was pegged back to finish with an inverse 'gravestone' doji. With sellers picking up the pace in the Nasdaq and Russell 2000 there is a good chance the 'gravestone' doji will hold to its name and deliver trouble tomorrow.