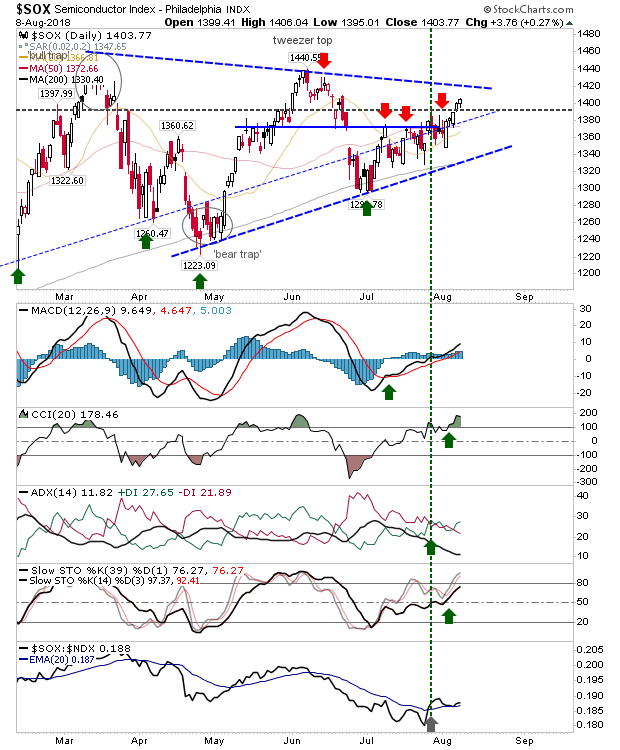

Sellers returned today as bulls and bears tussle for control. With the constant back-and-forth, the short-term moves become more difficult to define, making it necessary to take a step back and look at the big picture. The Semiconductor Index is at one such juncture. The index finished the day at rising support defined by the April and July swing lows. Wednesday's spike low illustrates underlying demand - offering a buying opportunity; stops on a loss of 1,321. The initial target is 1,420 but a larger breakout could deliver a lot more. The only negative on the day was the net bearish turn in technicals as intermediate-term stochastics [39,1] crossed below the mid-line into bearish territory. However, a rally to triangle resistance would likely reverse this.