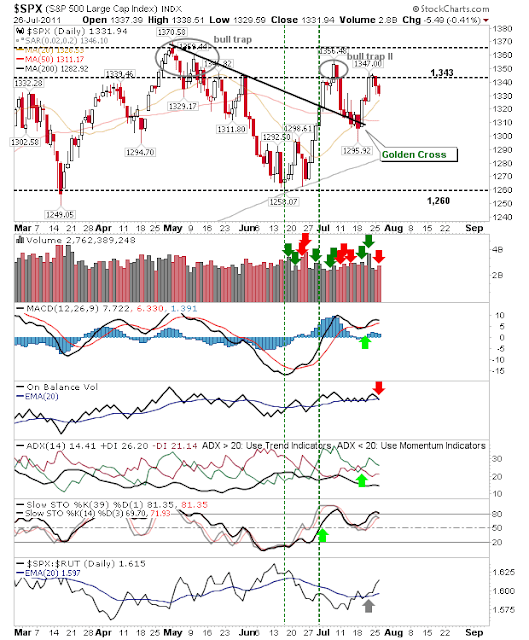

Weekly Market Commentary: Russell 2000 and S&P Under Pressure

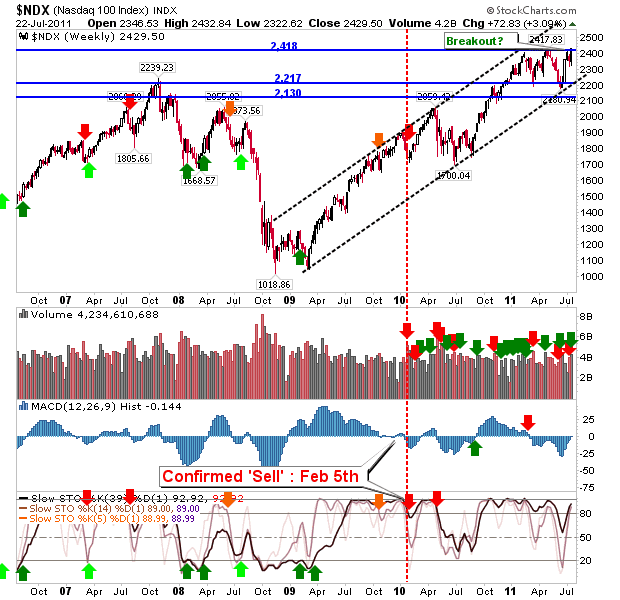

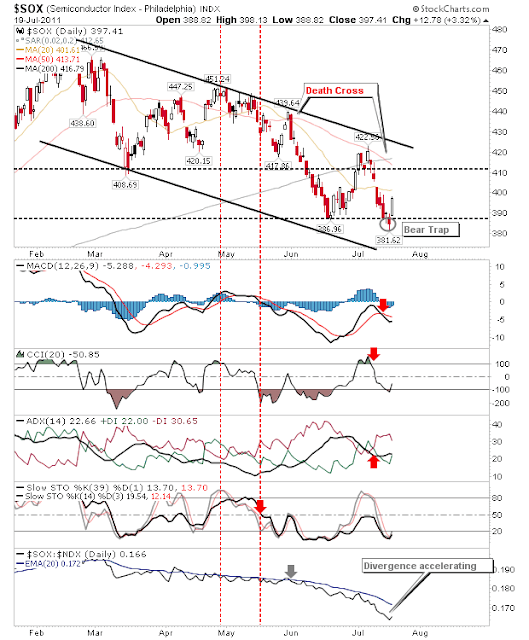

A bad week for markets, overshadowed by Washington politics, pulled indices closer to support. Looking at weekly charts it's not hard to see the reason for the selling, especially for the 'smarrt' money holding from 2009 looking to take profits, or buyers in 2011 who have seen their positions meander around with little to show for it. The strongest index before the week started was also the index to suffer least by the selling. The Nasdaq 100 may have reversed last week's breakout, leaving behind a potential 'bull trap', but it's still the index best positioned to lead should there be any semblance of buying interest. ($NDX) via StockCharts.com Strength in the Nasdaq 100 has a positive knock on effect on the Nasdaq, despite the latter index shedding over 5% on the week. The index also hasn't cracked above 2,887 resistance, but remains well positioned inside the bullish channel. Nasdaq via StockCharts.com Unfortunately, the Russell 2000 pulled ...