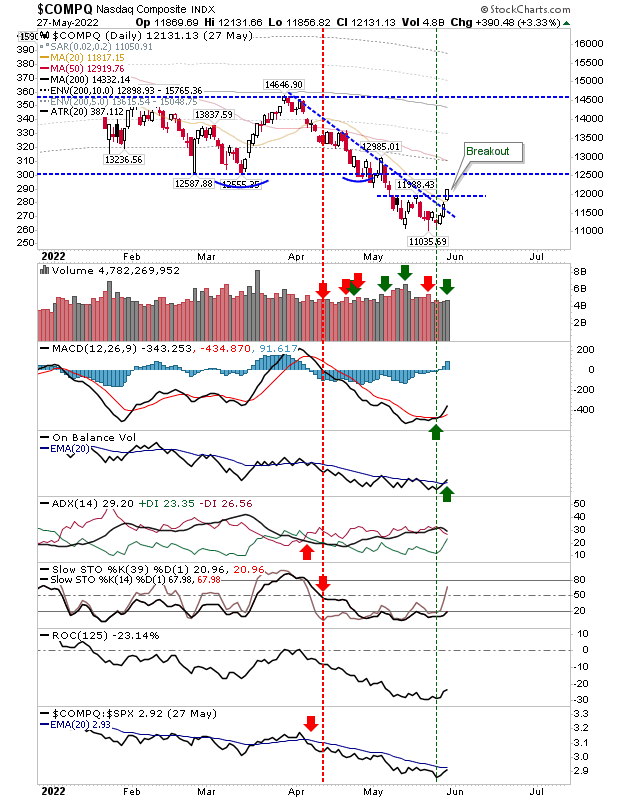

Indices pressure last Friday's highs

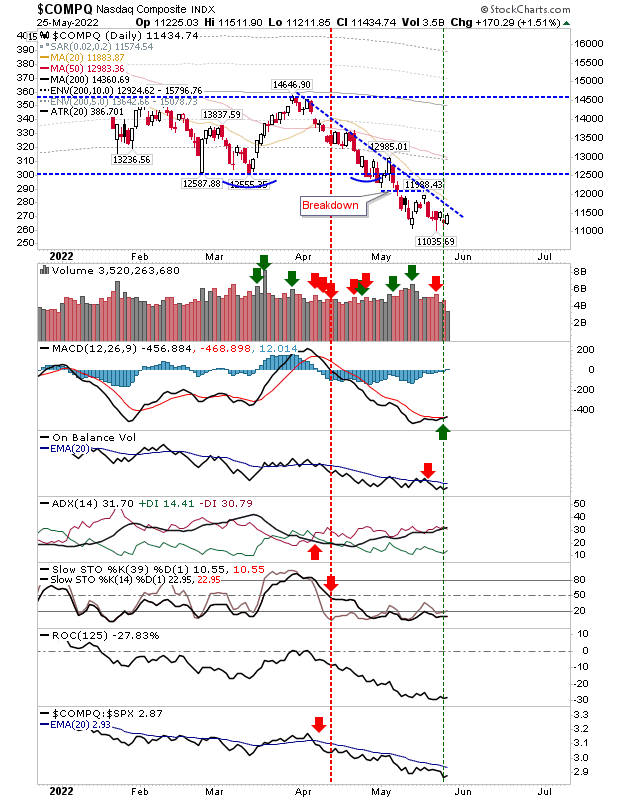

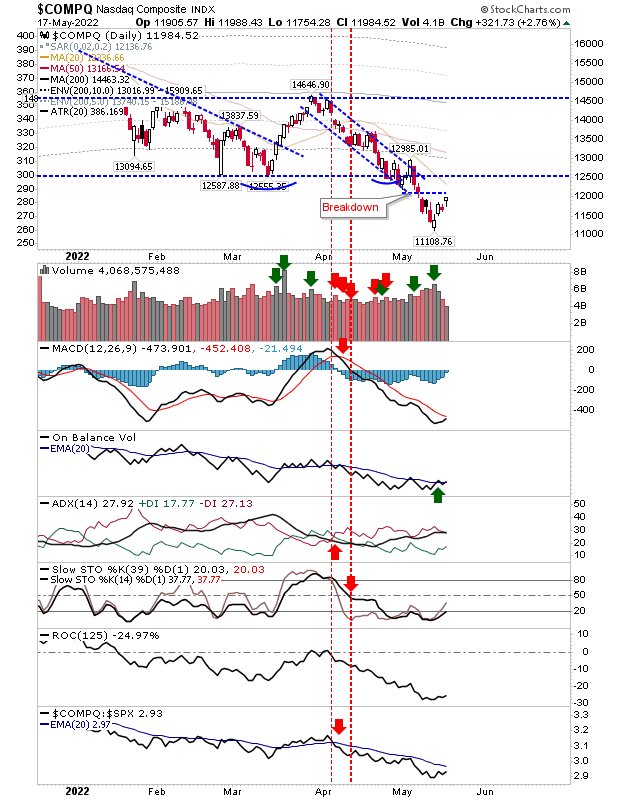

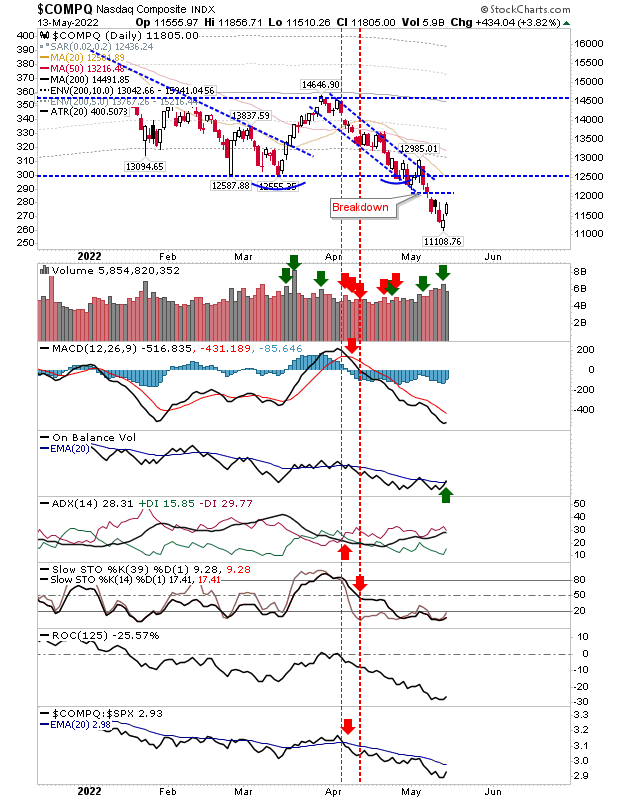

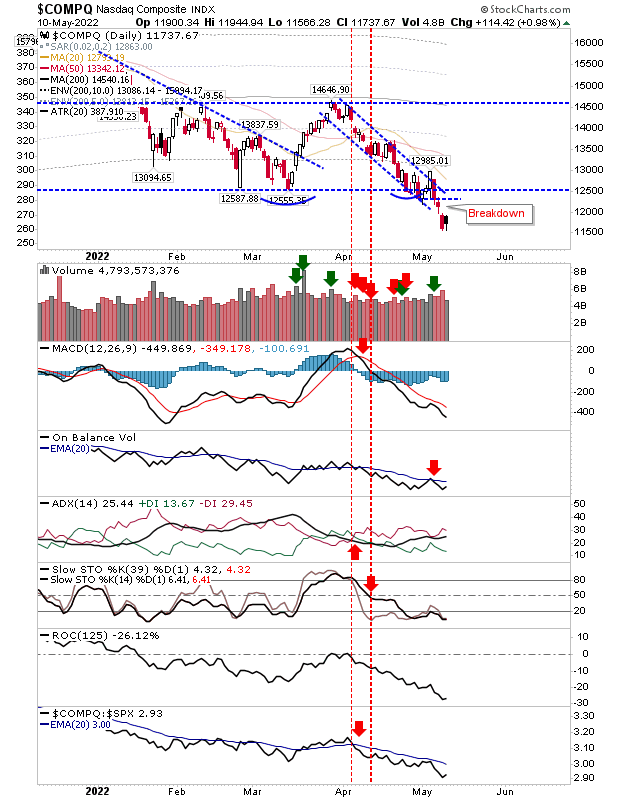

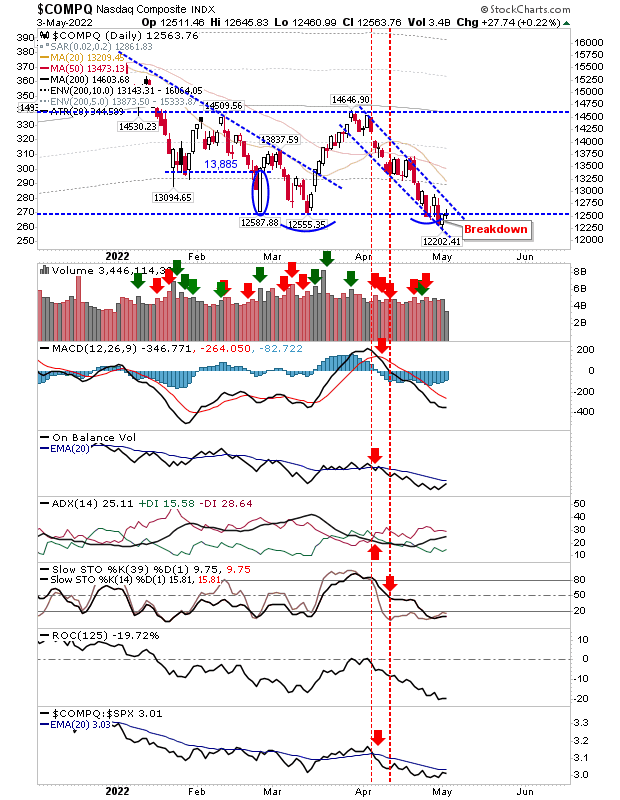

In many respects, today's action was better than Friday's in that effectively confirmed the strength of end of week buying from last week. For the case of the Nasdaq and S&P we had inside (doji) days. Ideally, the "bullish harami cross" occurs at a swing low, but what we have is something similar when considered in the context of the decline from March highs. It will soon be time to raise the stop of the index trades . The Nasdaq is holding on to its breakout with the 'buy' triggers in the MACD and On-Balance-Volume retained.