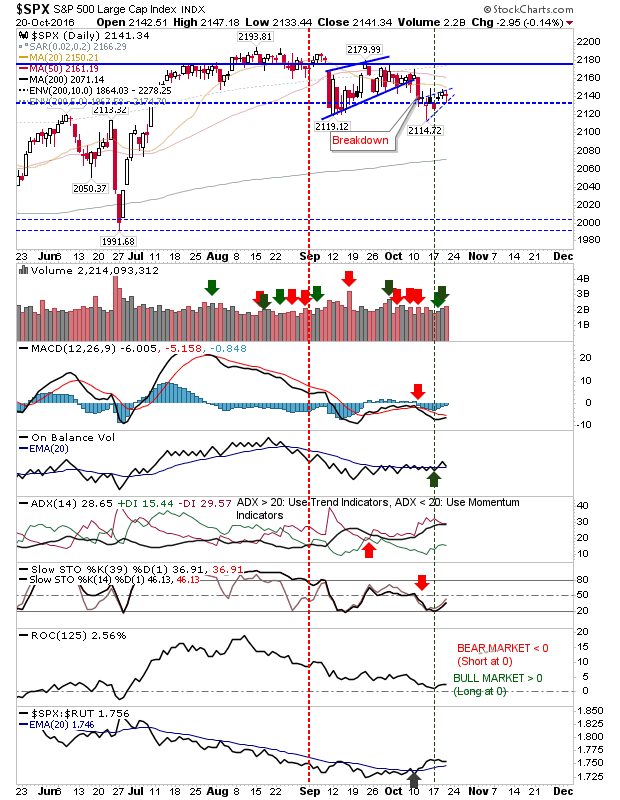

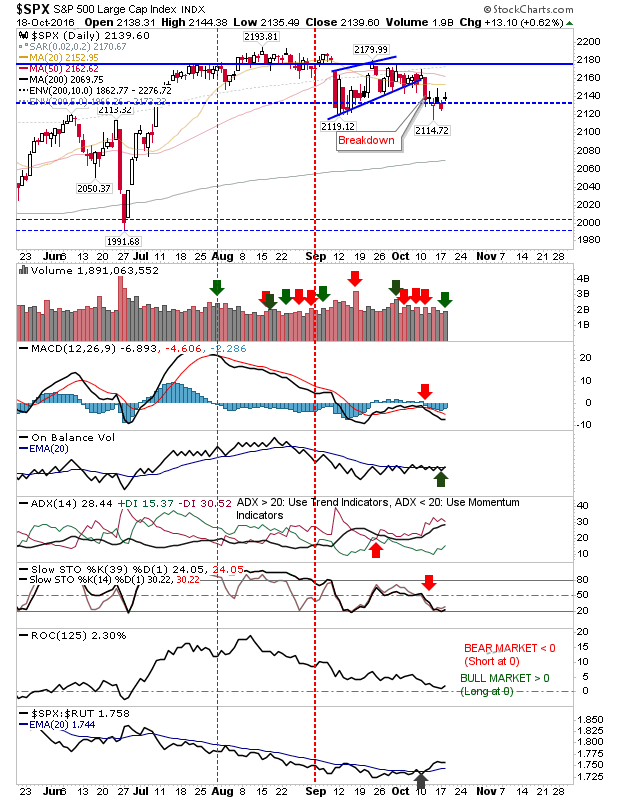

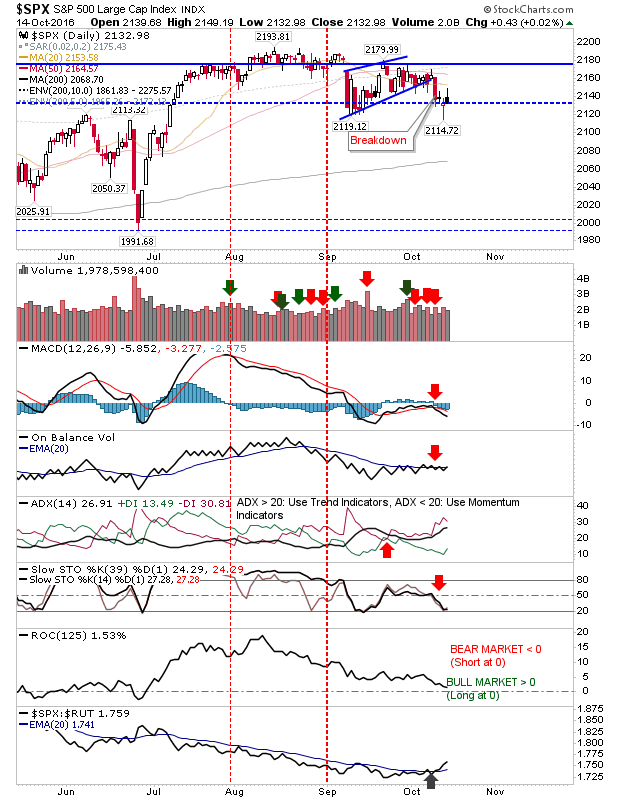

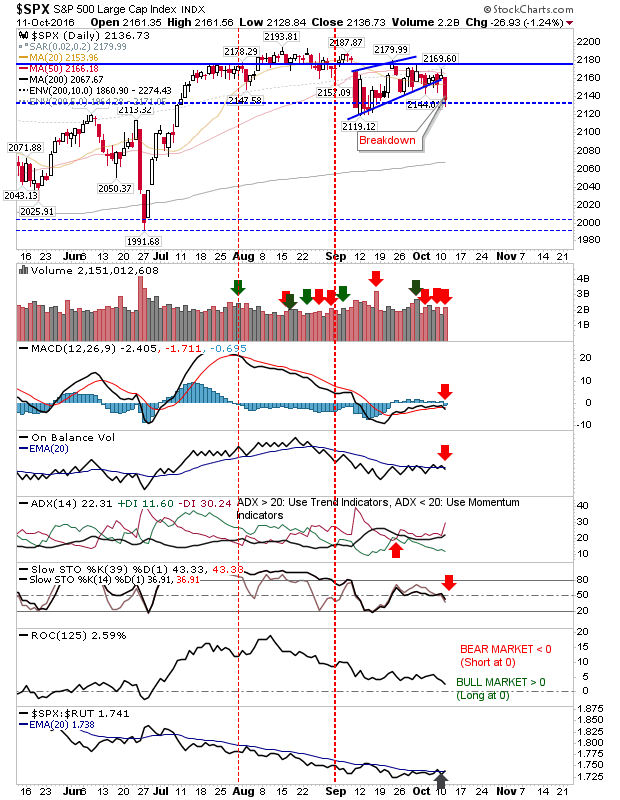

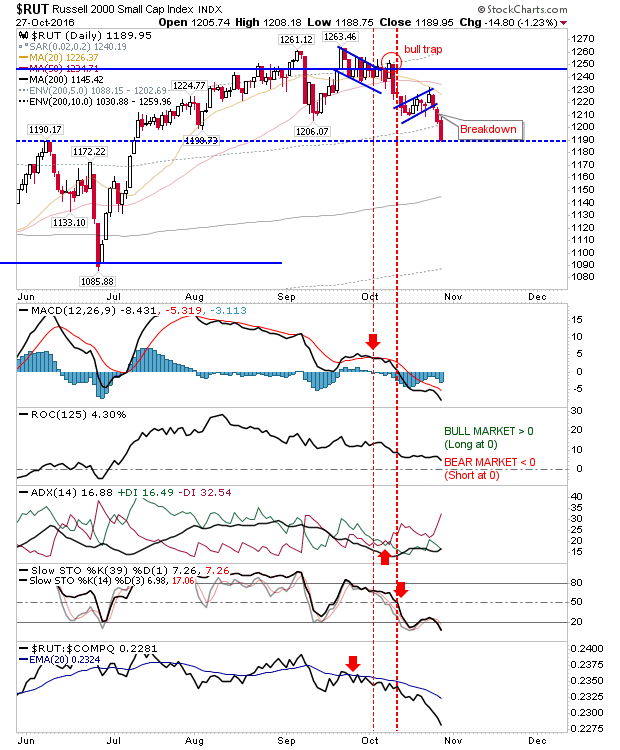

Small Caps Head South, Large Caps Drift Lower

After failing to build a swing low at September's lows, the Russell 2000 went the other way..fast. The breakdown has moved out of the consolidation which has been in play since July, opening up for a retest of the June swing low at 1,086. Technicals are heavily oversold, so a reaction bounce, potentially from the open, would not be surprising.