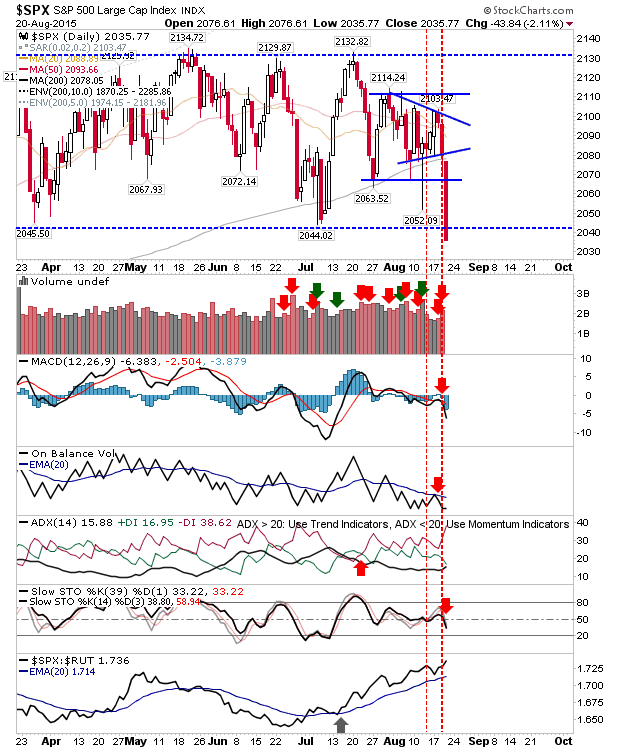

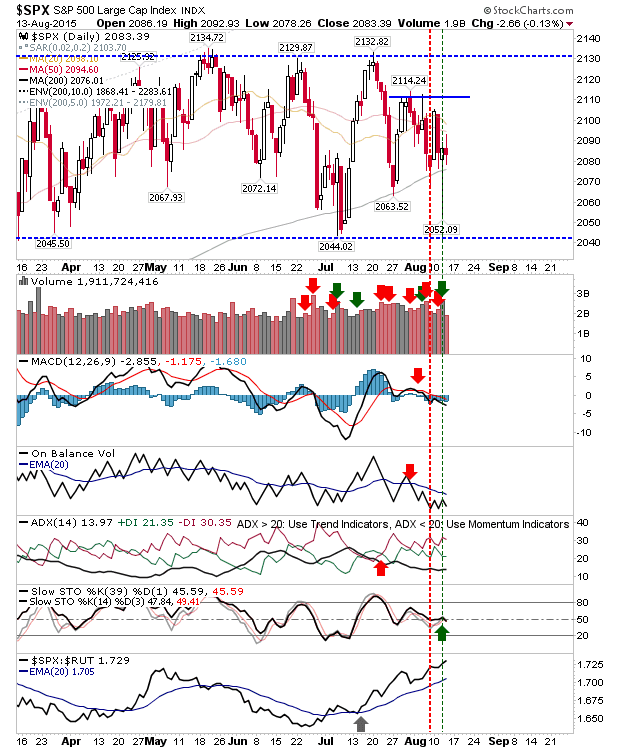

Modest Losses

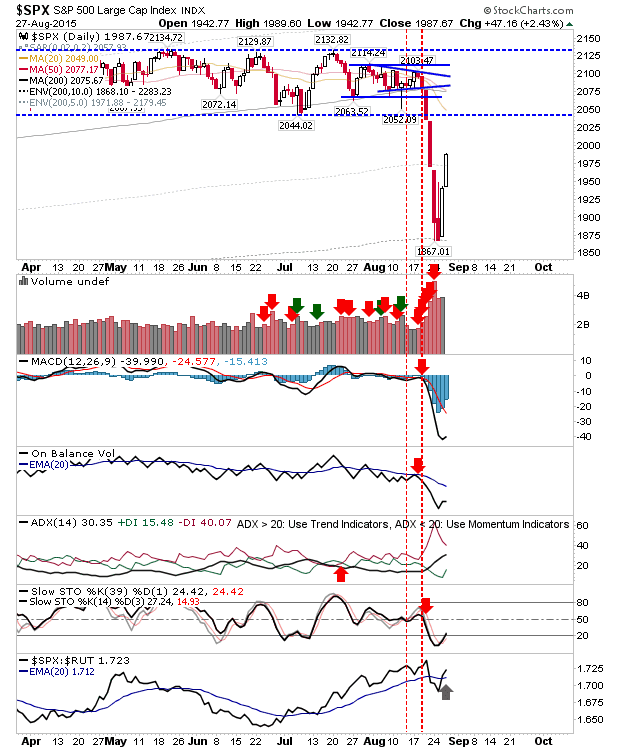

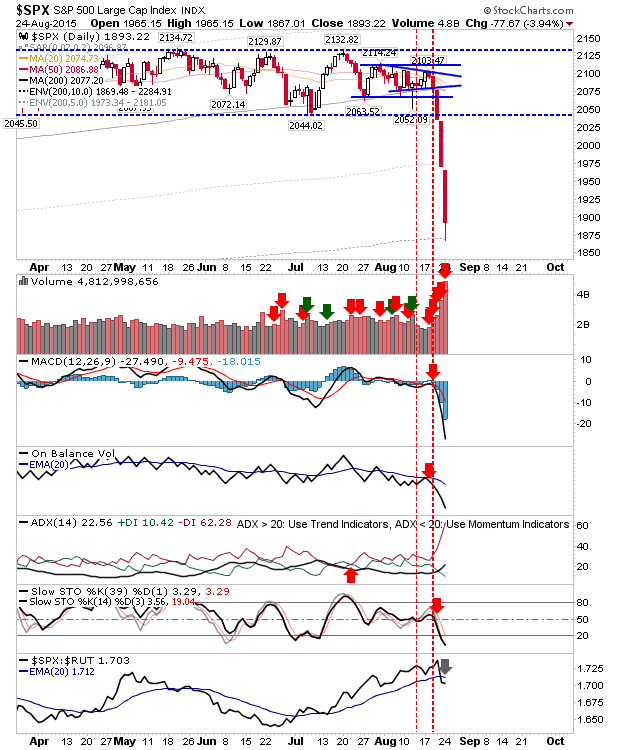

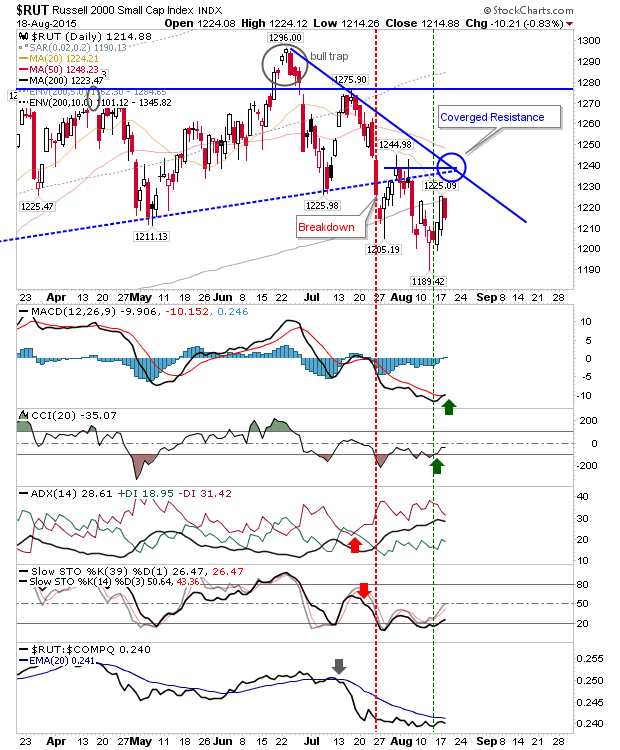

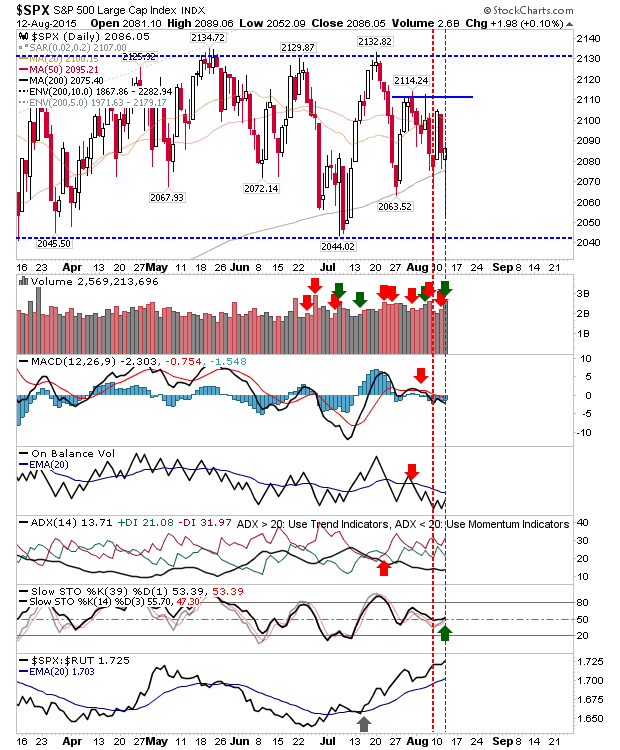

Bears took it upon themselves to press their advantage into the close of business. Selling volume was light and lacked the conviction that had accompanied the rout of the previous week. The S&P is caught in a no-mans land, with a retest of 1,867 likely needed at some stage to rebuild confidence on bulls.