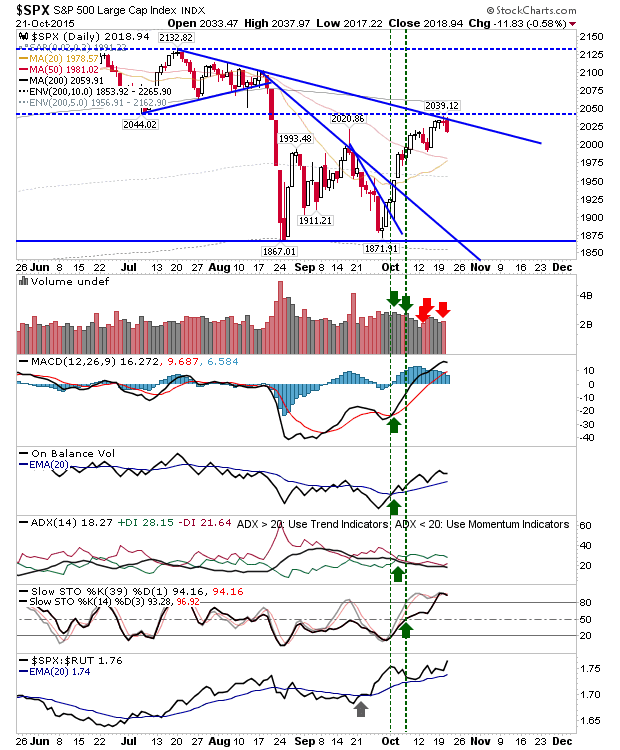

Bulls continued to squeeze shorts. This time I was thankful not to attack it as a short, but there didn't appear to be a lack of others on the wrong side of the trade. Volume wasn't great, but long holders won't mind that. The S&P is approaching a crux of resistance between the swing low of July and declining resistance from July/August highs. Above that lies the 200-day MA, which may offer a spike high. Bears would ideally like to see a failed move above 2,044, with a close at or below 2,044. Technicals are all in the green, which gives bulls reason for optimism.