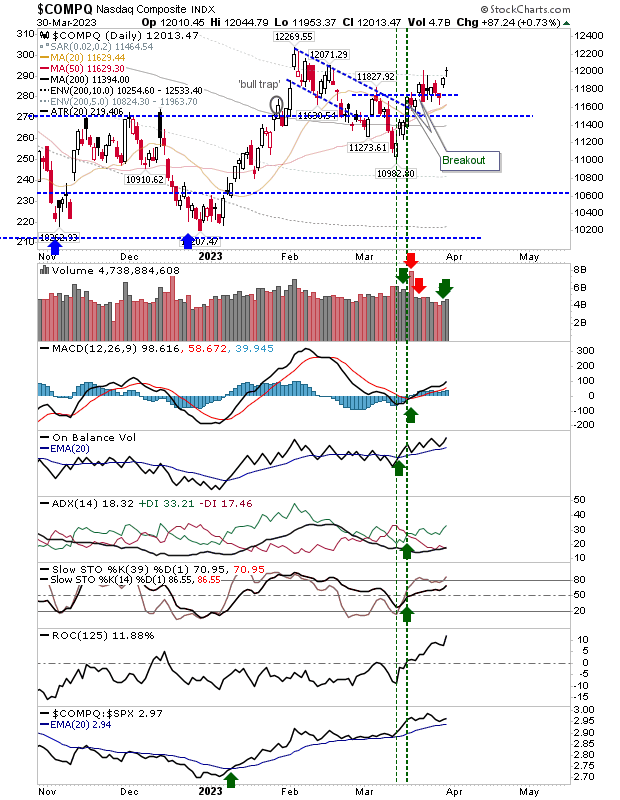

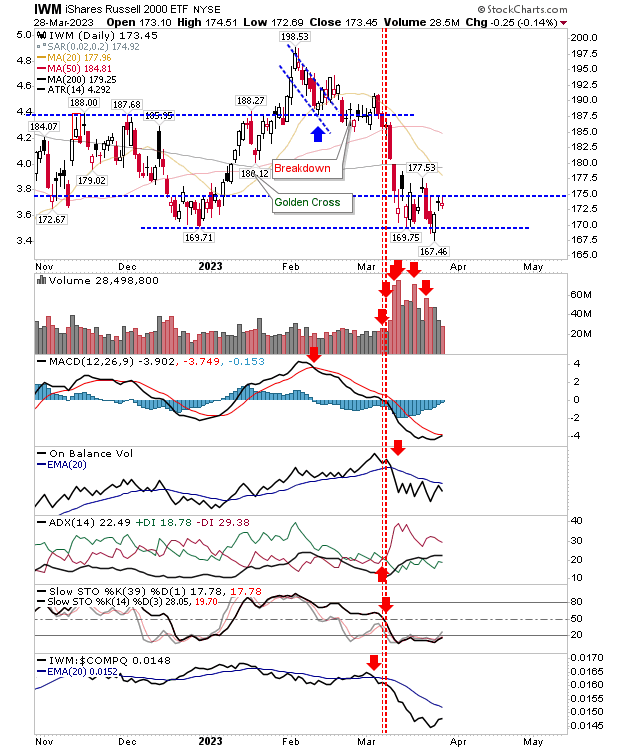

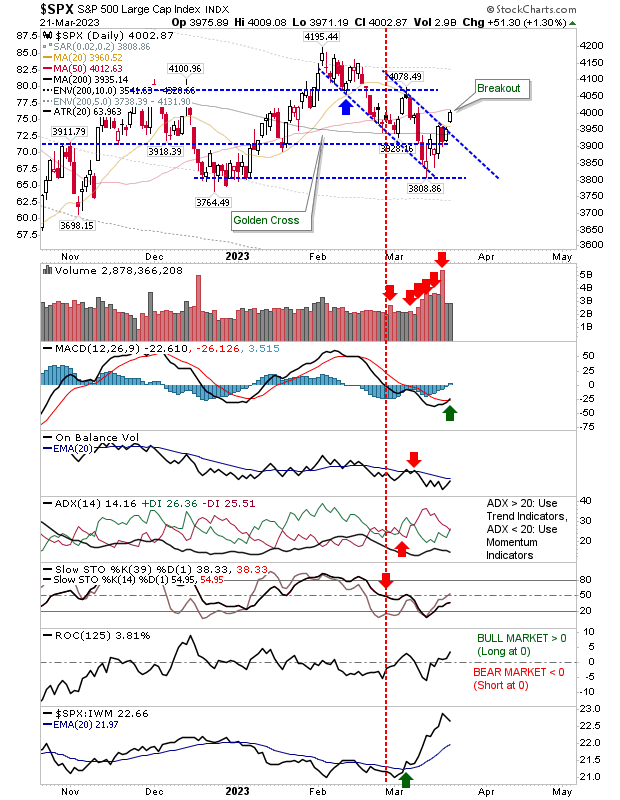

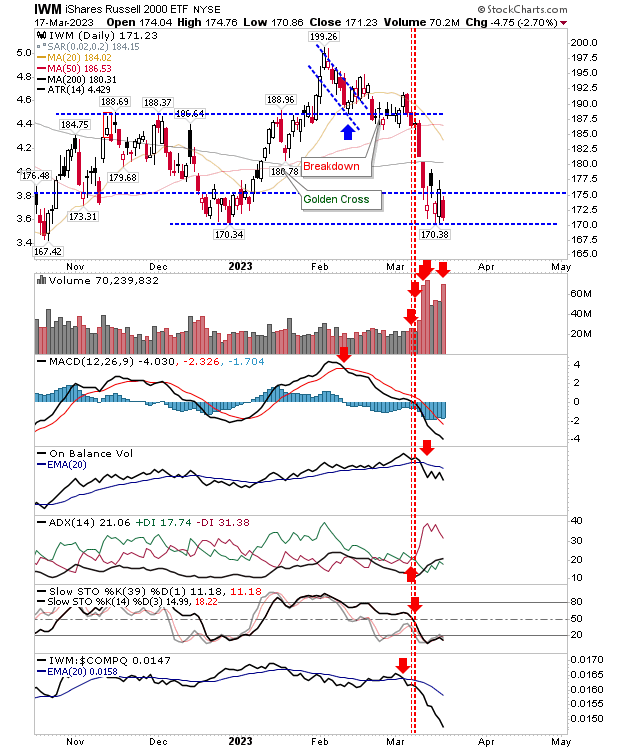

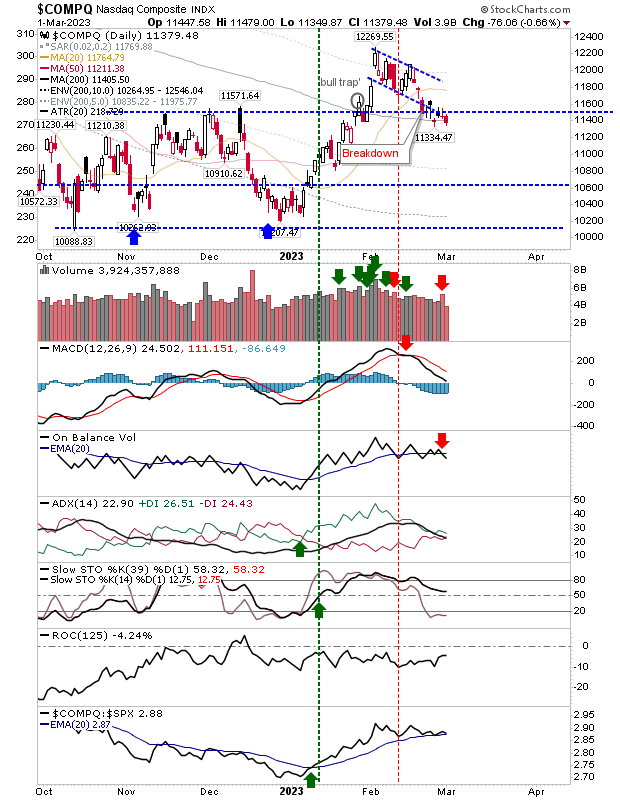

I haven't talked much about the weekly charts, although they are still part of my free stockcharts.com public list . When you are getting spun around by daily charts, it's always good to fall back on weekly charts to see the big picture. If you are an investor, then the weekly charts are all you need. I have been waiting for a confirmation of the breakout on dailies, but these just keep flipping back-and-forth on that timeframe. On the weekly chart, there is a well established break of the bearish trend, but this hasn't yet shaped the move to build the right-hand-side of a new base. In the case of the S&P, the summer high is the more important resistance level (currently at 4,325). Technicals are moving out of bearish territory, in particular, the MACD is working its way above the bullish mid-line. On-Balance-Volume is also about to turn bullish (on the weekly time frame). The caveat, as a weekly chart, it could be the end-of-the year before we even see a chal