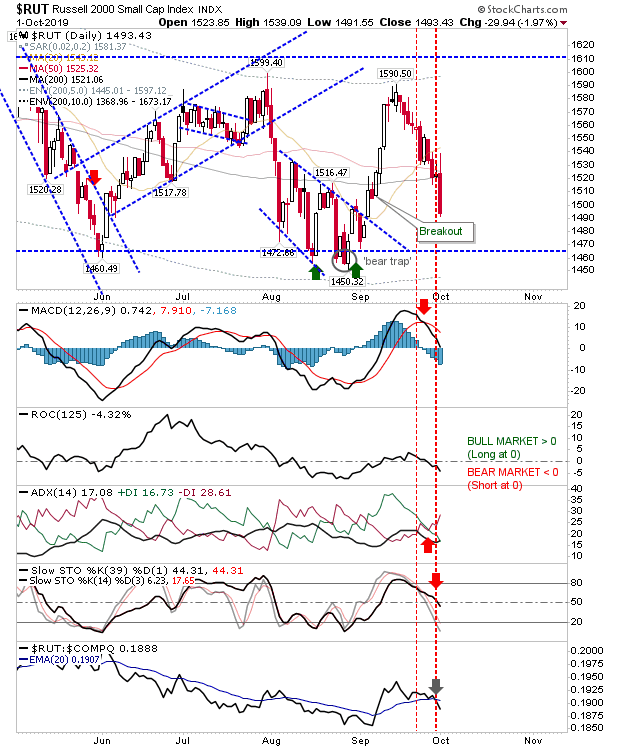

Indices Hold Up Despite Intraday Swing

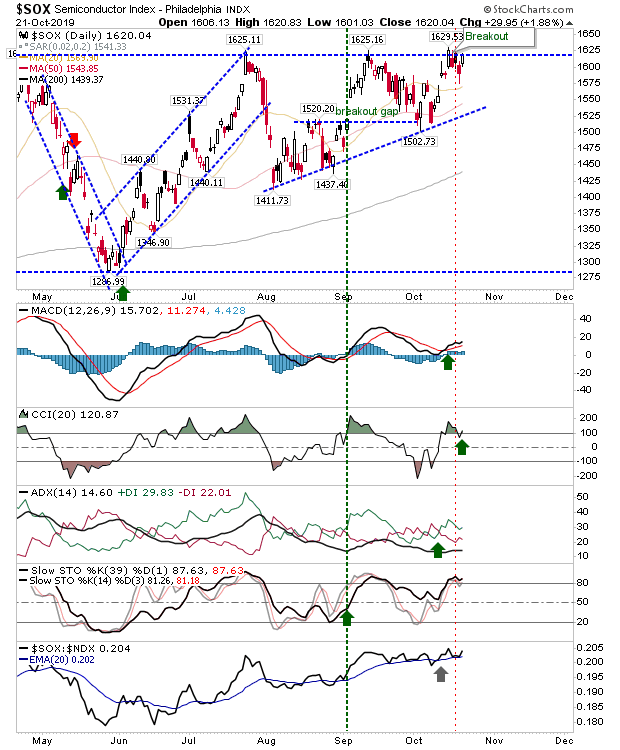

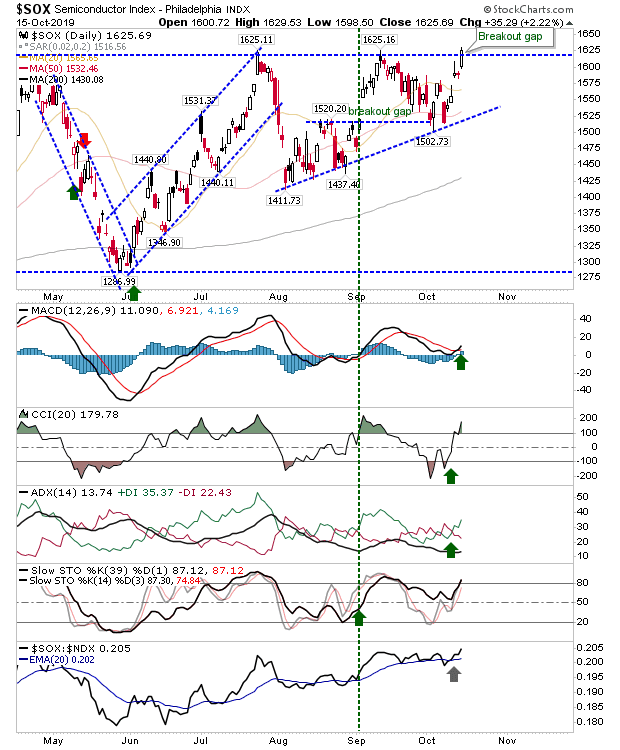

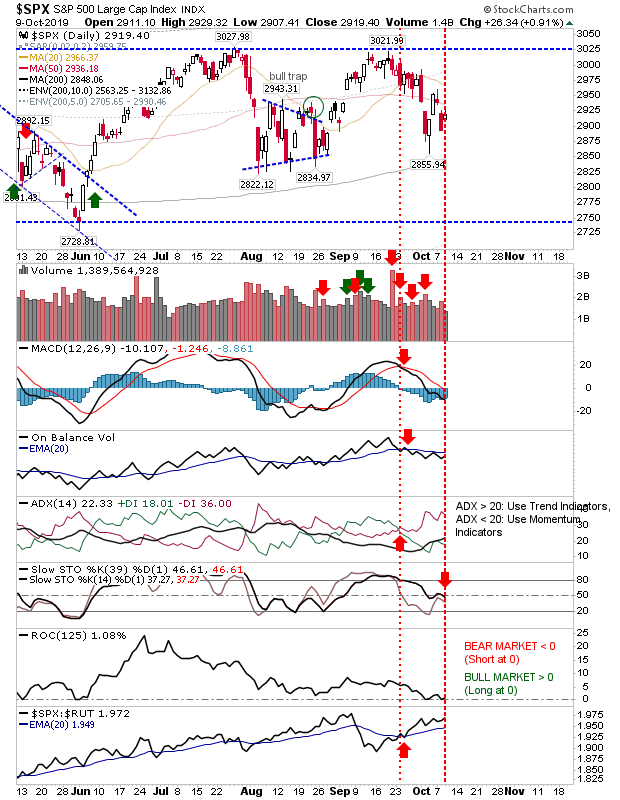

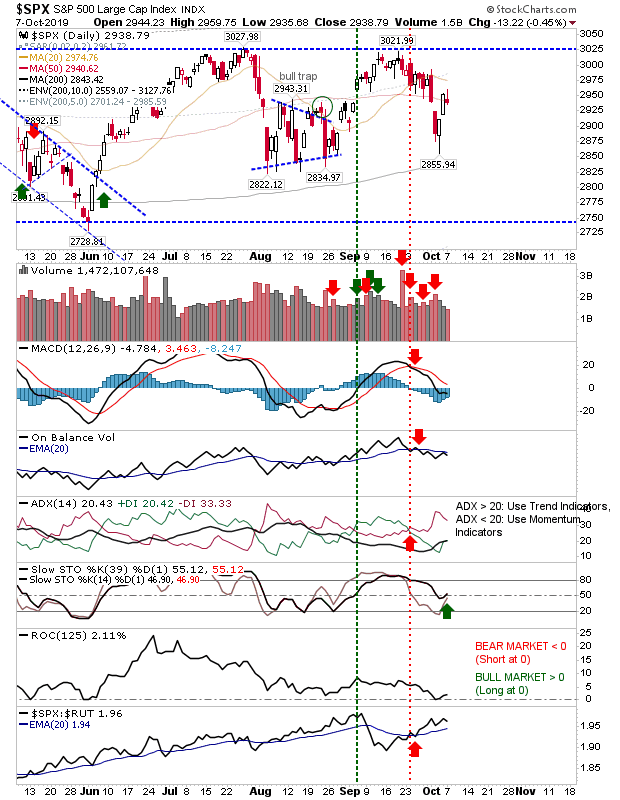

Sellers tried to reverse the breakouts in the indices but were instead undone by higher volume buying. Indices which had broken out remained above resistance, while those still waiting remain well placed to do so. The S&P tagged breakout support on higher volume accumulation. There has yet to be a supporting breakout in On-Balance-Volume to match the breakout in price but volume rose in accumulation.