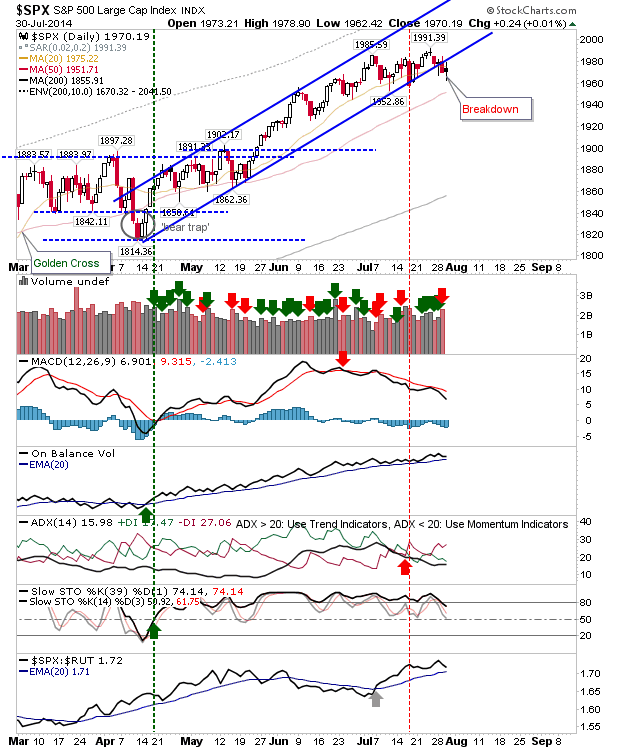

Daily Market Commentary: Bear Blitz

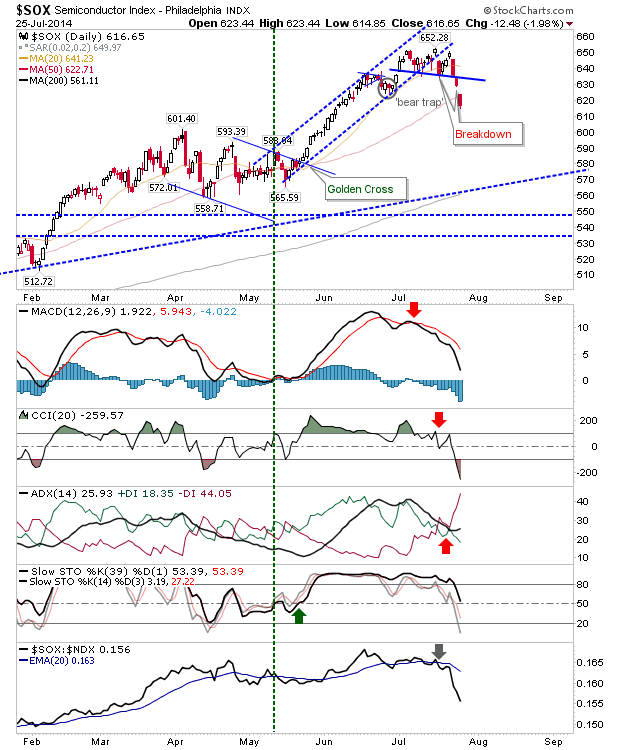

Whatever tentative bullish plays were available before the start of the day were quickly put to rest by the close of business. Where I thought the Dow might offer shorts the most reward, it was the Russell 2000 which suffered most. The Dow actually managed to close on a support level - although it probably doesn't look like it.