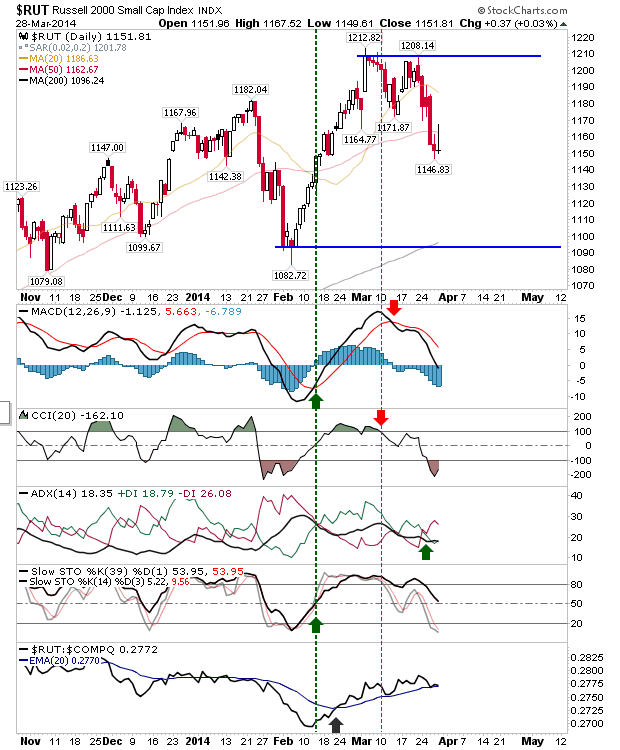

Daily Market Commentary: Failed Bounce

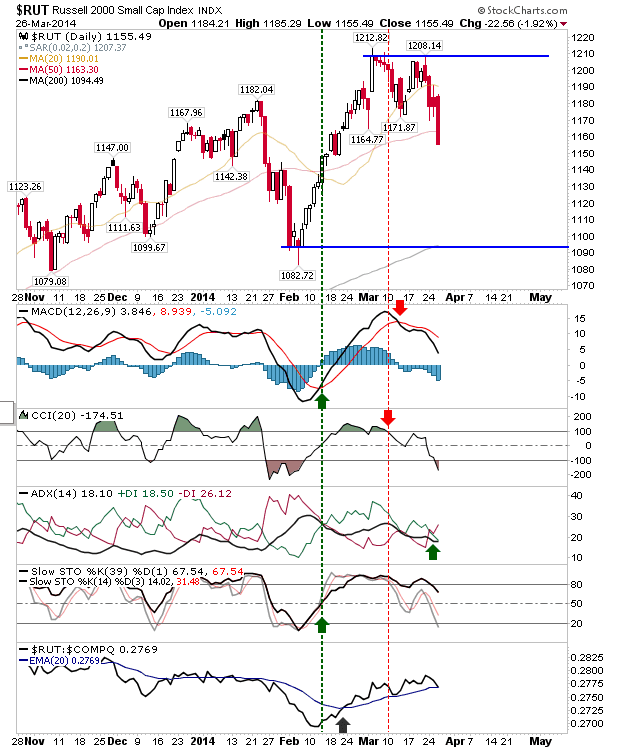

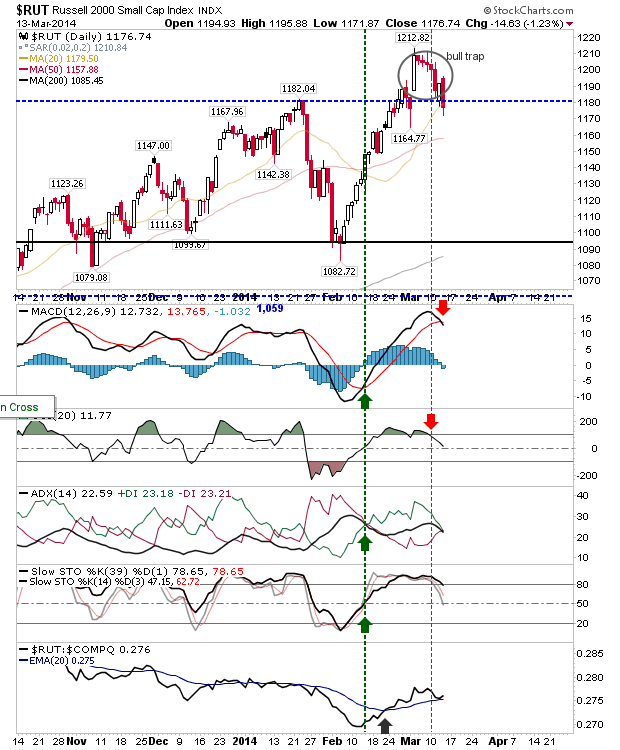

Interesting action in the markets. Five days of sharp selling in the Russell 2000 should have set up for a relief bounce, but bears were quick to sell the morning bounce bringing markets back to their open price by the close of business. Monday offers another opportunity for buyers, and while they didn't enjoy success on Friday, they may do better on a second attempt. Thursday's swing low of 1,146 looks a good place for stops. Watch for sellers again at the 50-day MA.