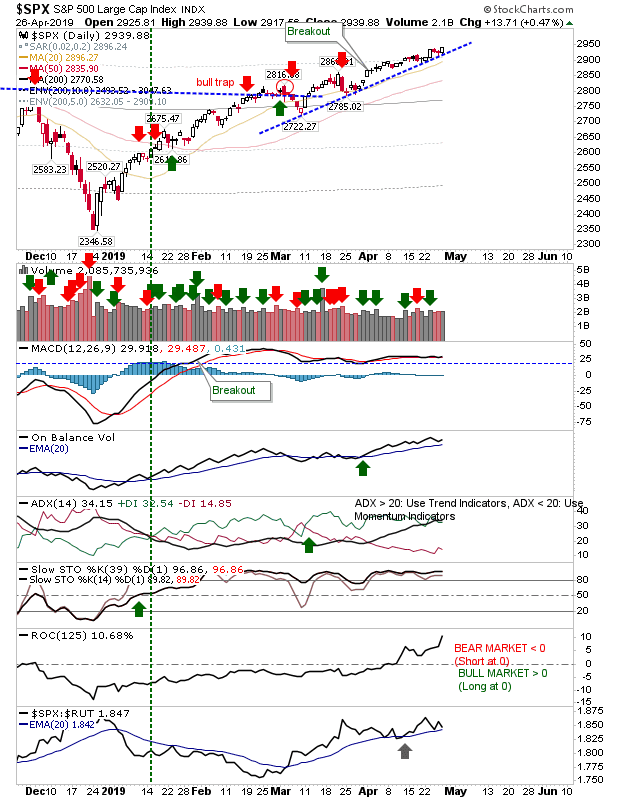

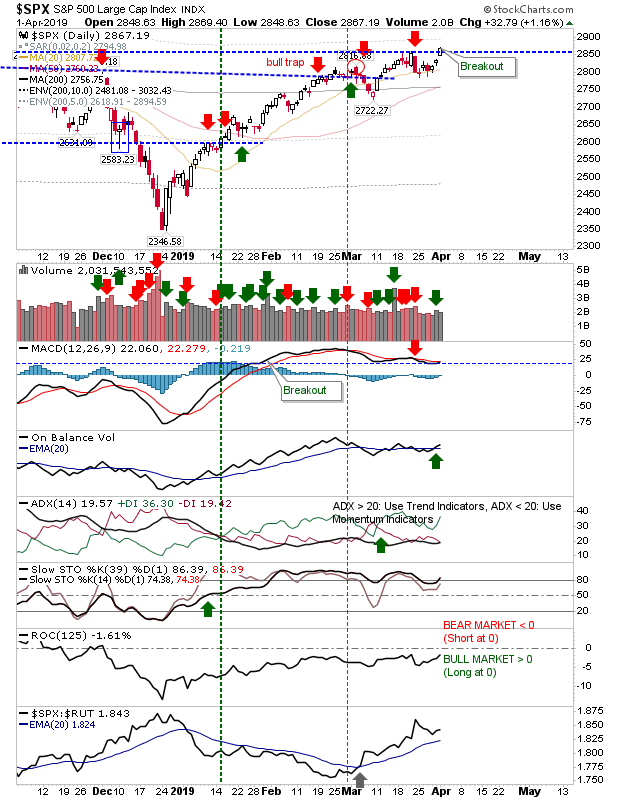

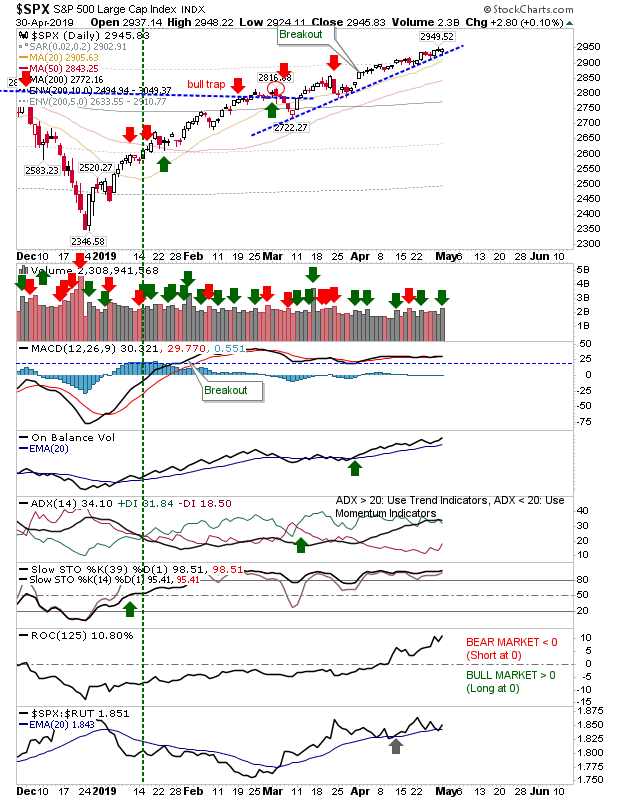

Solid finish on higher volume

There wasn't much to today's action but for what there was, it was positive - better again in the face of Google's disappointing earnings (revenue miss). The S&P barely registered a gain but with the index a couple of points shy of all-time highs it can be forgiven. Volume was sufficient to register as accumulation.