Daily Market Commentary: Tech Suffer But Small Caps Nicely Positioned For Thursday

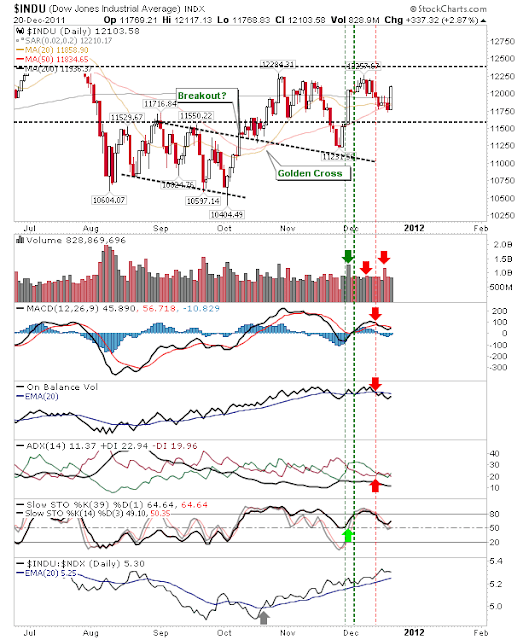

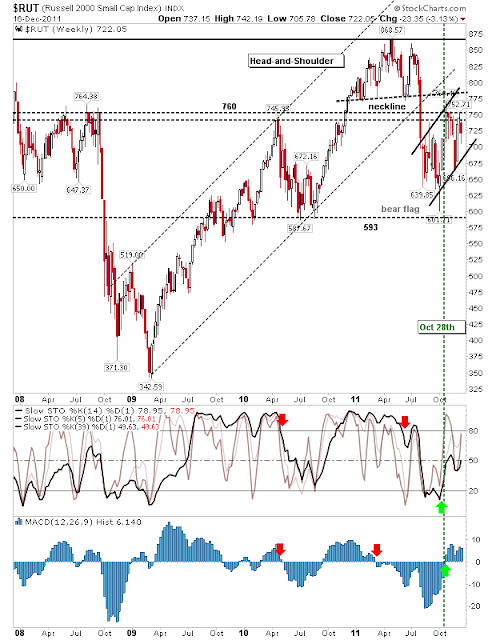

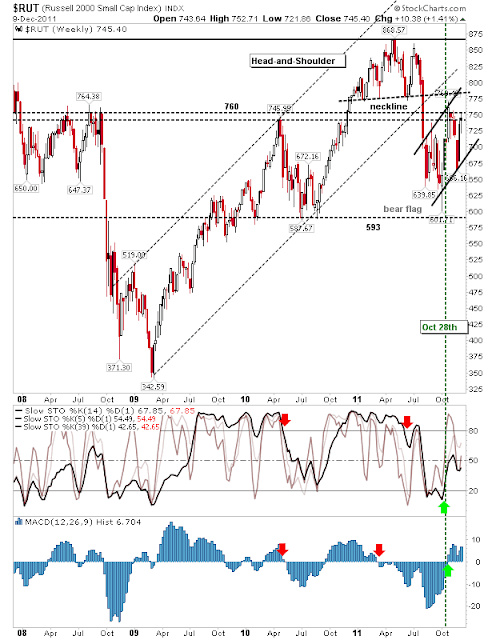

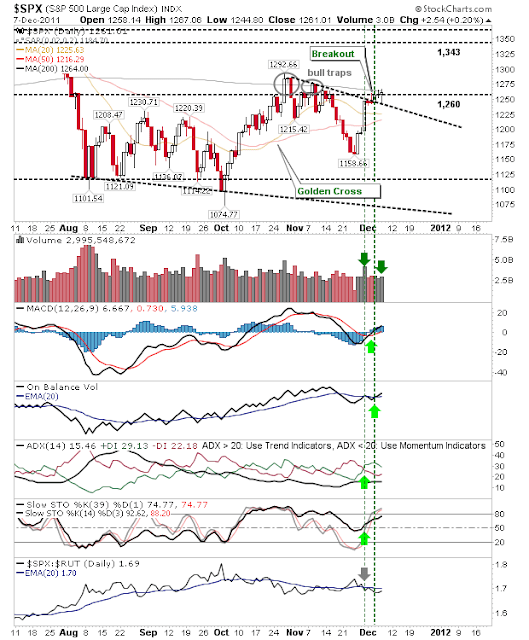

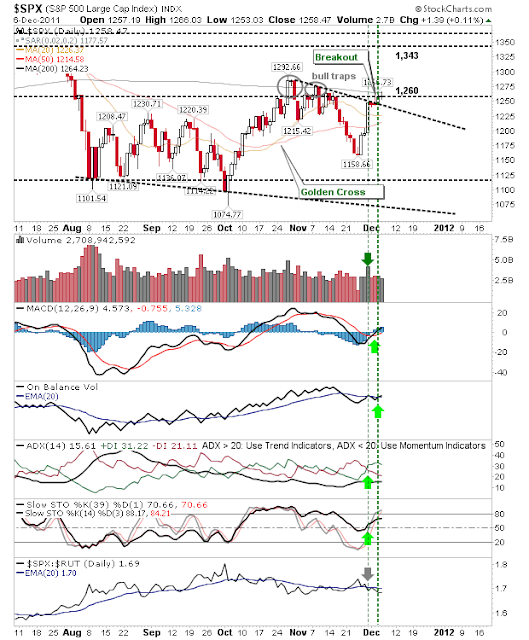

A mixed day for markets. Oracles' weak earnings split indices with the tech heavy Nasdaq and Nasdaq 100 suffering, while Large and Small Cap indices were able to retain (and add to) yesterday's gains. The S&P was able to manage a small gain with a modest improvement in technicals; enough for 'buy' triggers in On-Balance-Volume, Directional Index and Stochastics. Declining resistance may be tested tomorrow. The best play for bulls on Thursday is probably the Russell 2000. This index is nestled against declining resistance from October; the slightest gain should be enough to drive a breakout. Technicals are comfortably net bullish and relative strength runs in its favor. An opportunity for buyers? The Nasdaq was on a hiding to nothing, but a late surge of buying took the index close to its open price, holding above 20-day and 50-day MA. There is probably too much overhead supply to offer a clean break - but a move above 2,616 would be a good start . ...