Weekly Market Commentary: Light Volume Selling Continues

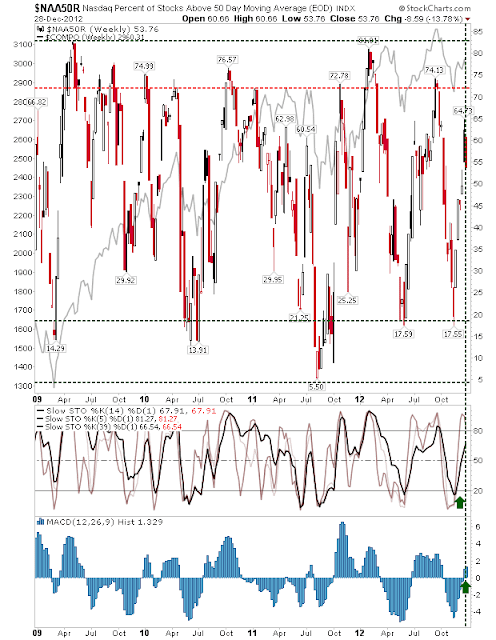

Seasonal light trading clouded what was a tumultuous week for the indices. What few traders were playing the market this week did so on a background of fear. Had selling volume been higher it would have been a troublesome end-of-week, but this may still be nothing more than a pullback. Breadth wasn't extensively damaged by the selling. The Percentage of Nasdaq Stocks above the 50-day MA remained net bullish, at 53% stocks holding above this key moving average - down from 65%. The Nasdaq Bullish Percents actually scraped another 1% gain. It too finished the week with 54% of stocks on point-n-figure 'buy' signal. The Nasdaq Summation Index turned net bullish technically, despite closing the week lower. So market breadth isn't so bearish as last week's losses suggest. The Nasdaq is in range bound territory, and could take a 100 point hit and not lose its longer based bull trend. The Russell 2000 probably has another week of losses to ...