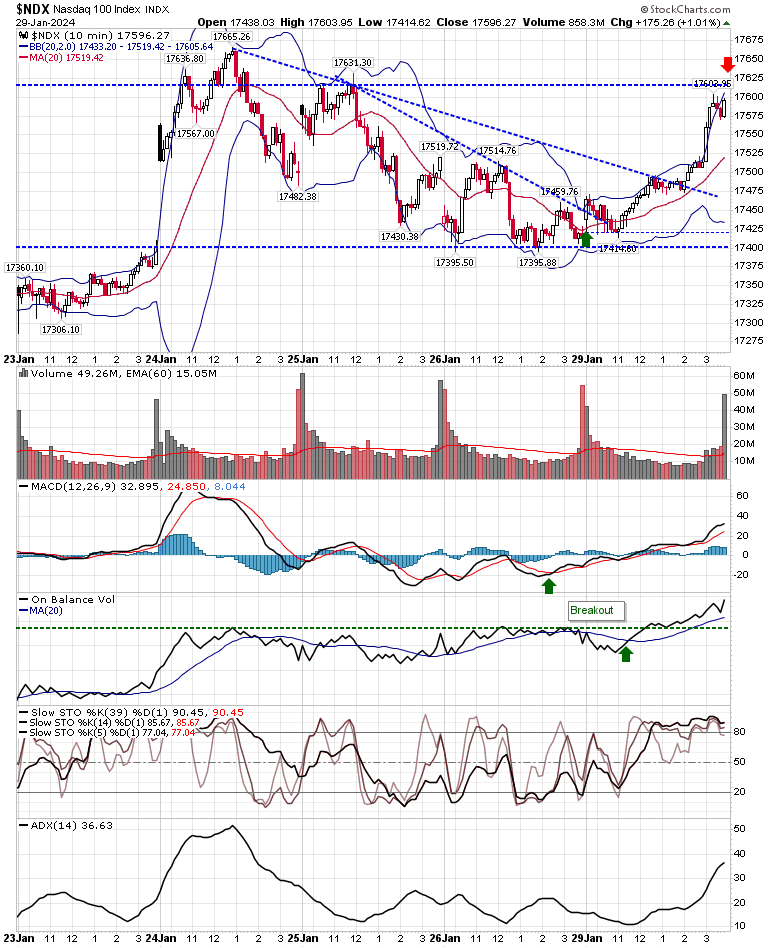

My experiment in day trading continues. Having burst out of the gates with some good success I have found myself treading water the last few weeks. Tomorrow offers an opportunity to get out of this rut. There is no significant economic data to move the needle, so action should be more technical in nature. The Nasdaq 100 ($NDX) closed the price gap from January 24th in a successful test of support, but also registered a breakout in On-Balance-Volume accumulation. Momentum is oversold and the MACD is working off an earlier 'buy' signal, although a it's a signal that triggered below the bullish zero line, so it's a "weak" buy. However, collectively, I'm optimistic for a long trade near 17,400 if you can get it with an initial target of 17,600 - although I suspect it will go higher (for a number of days).