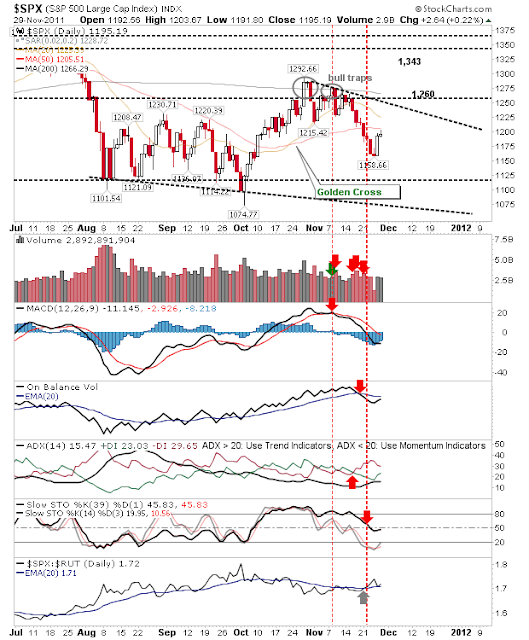

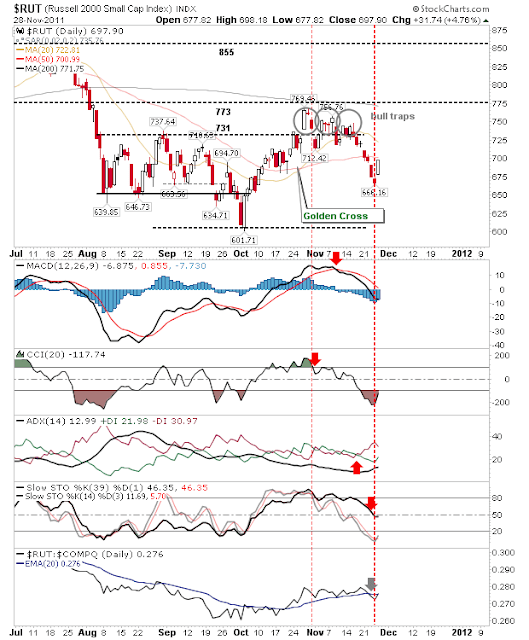

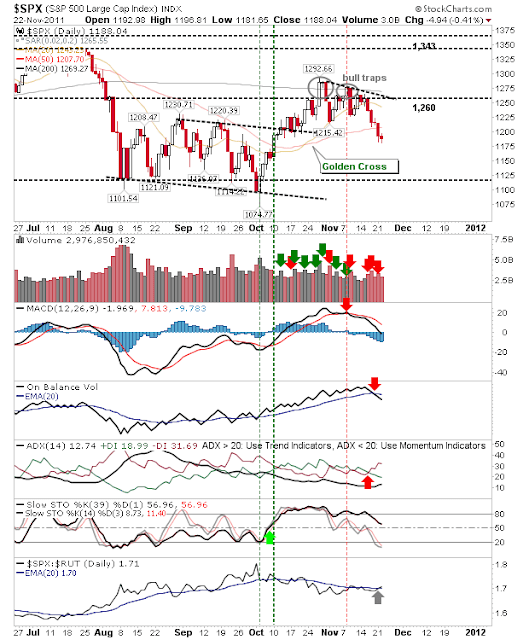

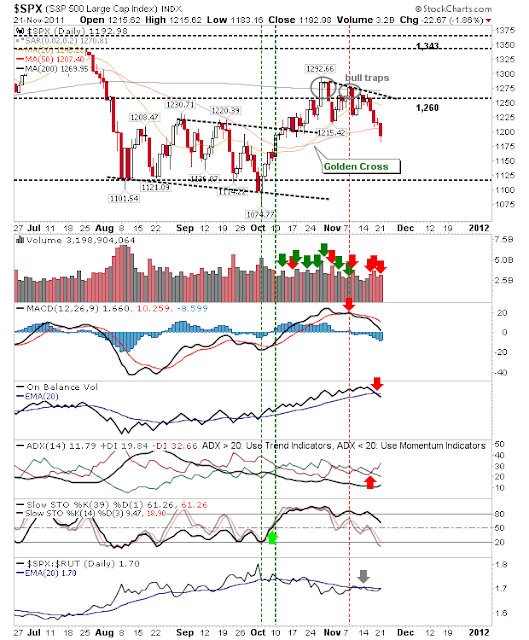

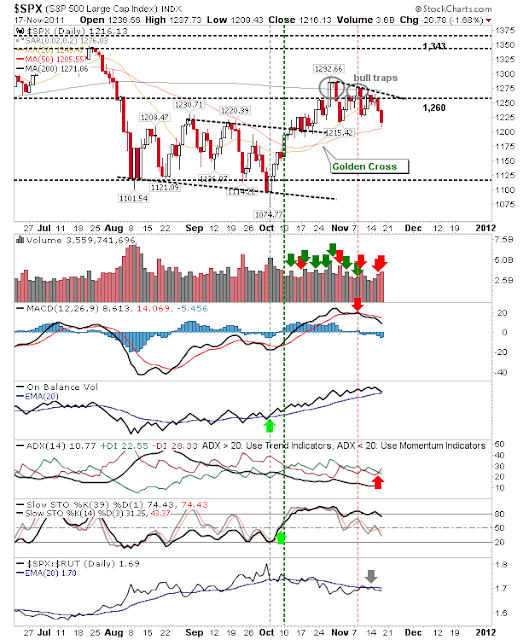

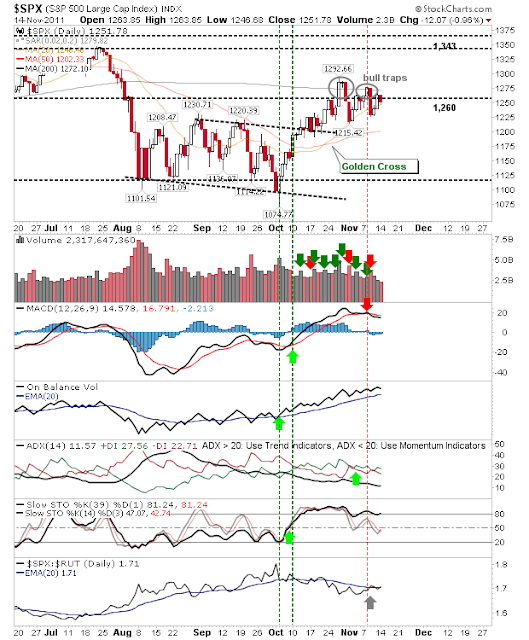

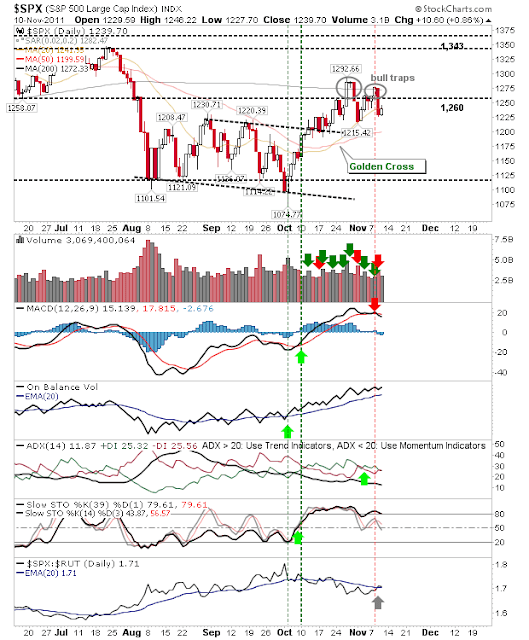

Daily Market Commentary: 'Bull Traps' Under Pressure

Today's massive rally added about a week's worth of gain in just one day. Volume surged to mark the first true accumulation day since indices broke above 200-day MAs at the end of October. In a rare sequence, it has taken only three days to reverse seven consecutive days of losses. Has Santa made an early delivery? The S&P rallied through 50-d and 20-d MAs to finish at wedge resistance. Above lurks the 'Bull Trap' divider at 1,260. Technicals have seen some significant improvement with bullish crosses of on-balance-volume, +DI to -DI and Stochastics; a great day for the index. To break out of the wedge and above 1,260 seems too much to ask for tomorrow - but it will probably happen pre-market! The Dow was another star performer. It managed to go a step further by closing above its 200-day MA and is very close to taking out the October swing high - continuing the sequence of higher highs and higher lows. Like the S&P it too saw net bullish crosses in Sto...