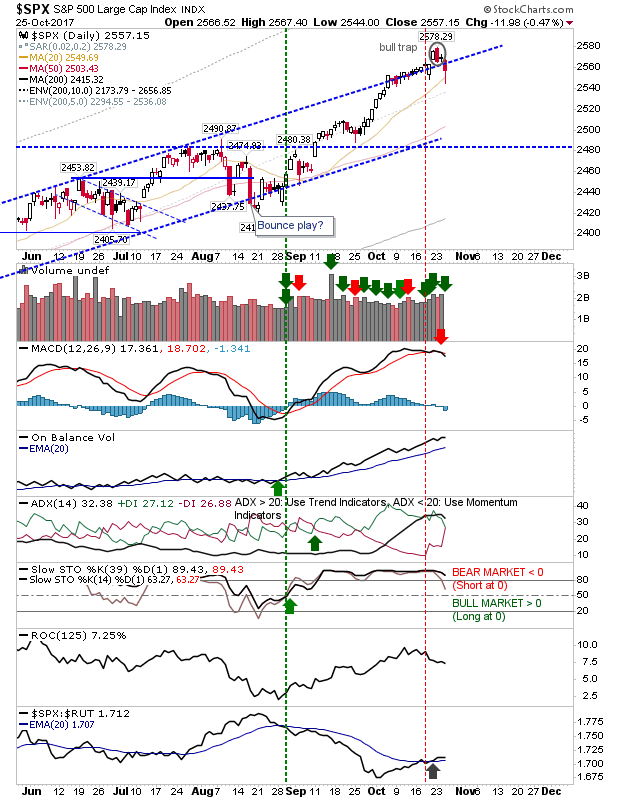

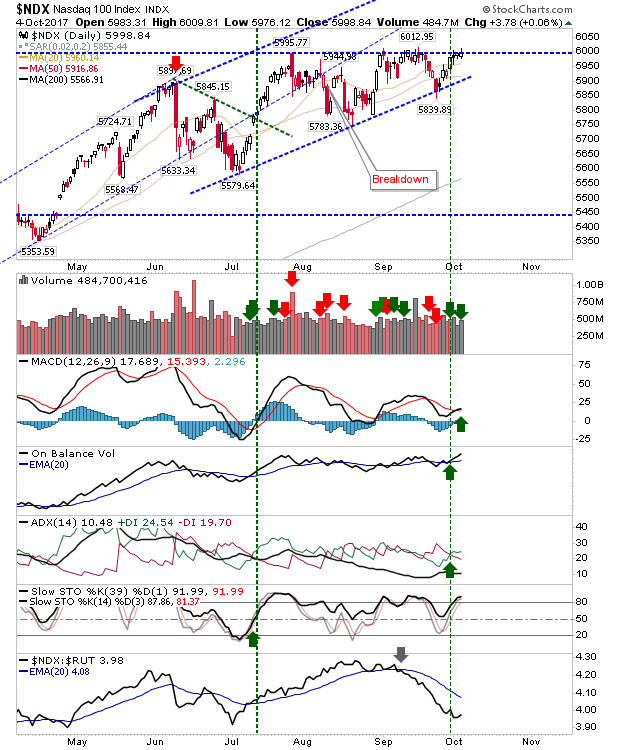

The week started with some profit taking which extended through to today. The only index to be negatively impacted by this was the S&P. Whether today's selling, which undercut former channel resistance to leave a 'bull trap', turns into anything significant to worry about remains to be seen. Recent trading volume has favoured buyers, with On-Balance-Volume showing very strong accumulation since August. The MACD has shown a 'sell' trigger but the 20-day MA has offered a point of support; a deeper pullback to the 50-day MA would still maintain the bullish trend so there is plenty of room for buyers to remain interested.